The cryptocurrency market has faced a sharp downturn, with widespread liquidations reaching an estimated $10 billion, according to Bybit CEO Ben Zhou. Major altcoins, including Ether, suffered significant losses as global economic concerns intensified following US President Donald Trump’s latest trade tariffs. Meanwhile, India is reconsidering its regulatory stance on digital assets to keep pace with evolving global policies.

Crypto Liquidations Surge to $10 Billion

A major market correction has triggered mass liquidations, potentially exceeding $10 billion, surpassing initial estimates. Bybit co-founder and CEO Ben Zhou revealed that his platform alone saw $2.1 billion in liquidations over 24 hours.

“I am afraid that today’s real total liquidation is a lot more than $2 billion. By my estimation, it should be at least around $8 billion to $10 billion,” Zhou stated in a post on X.

Data from CoinGlass indicated that over $2.24 billion was liquidated within 24 hours on 3 February. However, Zhou’s assessment suggests that the true extent of market losses is likely far greater.

The crash follows mounting macroeconomic pressures, particularly fears of a global trade war. Just days earlier, President Trump signed an executive order imposing import tariffs on goods from China, Canada, and Mexico, leading to broader uncertainty in financial markets.

Altcoins Plummet as Market Struggles

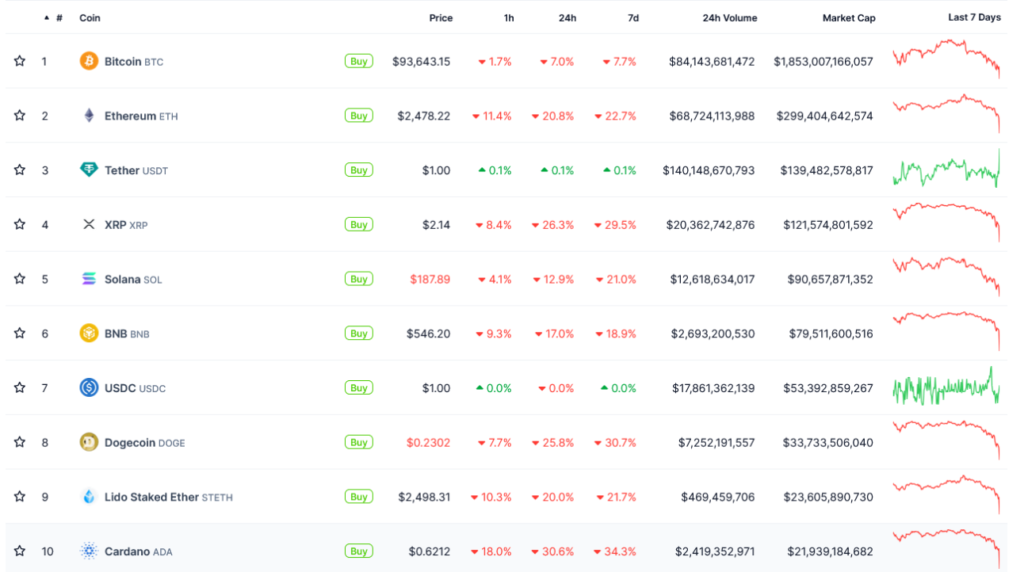

The fallout from Trump’s tariffs has led to a significant decline in major cryptocurrencies. Ether (ETH), the second-largest cryptocurrency by market capitalisation, fell 16% in just one hour, reaching $2,368 in early trading on 3 February.

Other top altcoins, including Avalanche (AVAX), XRP, Chainlink (LINK), and Dogecoin (DOGE), suffered even steeper losses, dropping over 20% in the past 24 hours. The total crypto market capitalisation shrank by 11.4% to $3.17 trillion, according to data from CoinGecko.

Markus Thielen, founder of 10x Research, attributed the steep decline to a mix of stop-loss triggers and a lack of new buyers. “The sharp drop in altcoins reflects a wave of stop-loss triggers combined with a buyer’s strike from retail investors,” he told Cointelegraph.

He also noted that trading volumes had been in decline for several weeks, signalling reduced investor confidence and waning market appetite.

India Reconsiders Crypto Stance Amid Global Regulatory Shift

As regulatory frameworks for digital assets evolve worldwide, India is reconsidering its stance on cryptocurrencies. Ajay Seth, India’s economic affairs secretary, acknowledged that digital assets operate beyond national borders, prompting the government to reassess its policies.

“Digital assets don’t believe in borders,” Seth told Reuters, hinting at a shift in India’s approach to avoid lagging behind other nations in crypto adoption and regulation.

India’s review comes shortly after President Trump’s executive order establishing the Working Group on Digital Asset Markets—a new advisory body aimed at shaping US crypto policies and exploring the potential for a strategic national crypto reserve.

With increasing global recognition of digital assets, India’s government may look to adjust its regulatory framework to align with international standards and foster innovation in the crypto sector.

Leave a Reply