Market Capitalisation Rises Amid Stock Market Gains

The cryptocurrency market experienced a strong surge on March 20, with its total market capitalisation rising by approximately 3.2% in the last 24 hours to reach $2.8 trillion. Leading the gains were Bitcoin (BTC) and Ether (ETH), which saw increases of around 3% and 4%, respectively.

The market’s upward momentum comes as the Federal Reserve decided to leave interest rates unchanged while hinting at two rate cuts later in the year.

Risk-On Sentiment Fuels Crypto Gains

The rally in the crypto market mirrored gains in US equities, which saw a positive reaction to the Fed’s decision. The S&P 500 and Nasdaq rose by 1.08% and 1.4% during late New York trading on March 19.

Crypto-related stocks also saw a boost, with Coinbase (COIN) climbing by 4.75% and MicroStrategy (MSTR) gaining nearly 7.4%.

Additionally, the US Dollar Index (DXY) remains at its lowest level since early November, dropping more than 6% from its peak of 110.17 in mid-January. A weaker dollar often makes risk assets, such as cryptocurrencies, more attractive to investors.

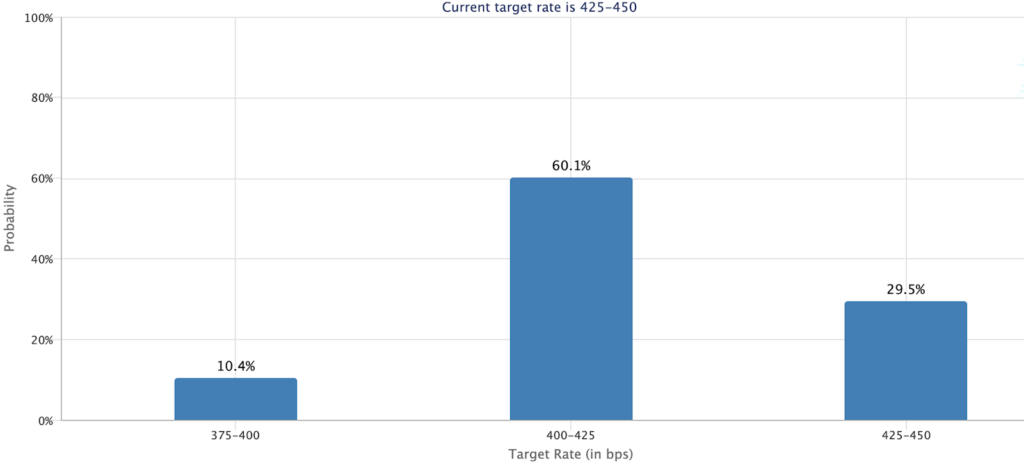

The Federal Open Market Committee (FOMC) held interest rates steady at 4.25%-4.50%, as expected. However, policymakers projected two rate cuts by the end of the year, increasing optimism among traders.

According to the CME Group’s FedWatch Tool, there is now a 16% chance of a 0.25% rate cut in May, with those odds rising to 60.1% for June. This shift in expectations has led to renewed interest in cryptocurrencies, as lower interest rates typically encourage investment in riskier assets.

Pro-Crypto Policy Speculation Adds Momentum

Adding further excitement to the market is speculation regarding upcoming US cryptocurrency policy updates.

US President Donald Trump is expected to speak at Blockworks’ Digital Asset Summit (DAS) in New York City on March 20, with rumours suggesting a potential announcement regarding his administration’s approach to crypto regulation.

Capital markets analyst The Kobeissi Letter commented on X (formerly Twitter) that this could be Trump’s first major update since March 6, when the national crypto reserve was established.

There is speculation that Trump may introduce a strategic Bitcoin reserve, reinforcing his pro-crypto stance. His previous remarks on crypto regulation sparked a wave of institutional investment, with Bitcoin ETF inflows hitting a record $3.4 billion per week. This surge helped Bitcoin surpass the $100,000 mark and set a new all-time high above $109,000.

The possibility of a more crypto-friendly regulatory environment, combined with the Fed’s dovish stance, has contributed to Bitcoin’s recovery above $85,000.

BitMEX co-founder Arthur Hayes noted that “quantitative tightening is basically over on April 1,” suggesting that markets should now focus on potential changes to banking regulations or a restart of quantitative easing. Hayes believes Bitcoin’s recent drop to $77,000 likely marked the bottom.

Technical Rebound Supports Market Growth

From a technical standpoint, the crypto market’s gains are part of a broader rebound following a multi-month low of $2.44 trillion on March 11.

The total market capitalisation, currently at $2.77 trillion, is now testing a key resistance zone between $2.8 trillion and $3 trillion, where both the 50-day and 200-day simple moving averages (SMAs) are positioned.

A breakout above this level could signal a continuation of the bullish trend, with investors eyeing all-time highs around $3.2 trillion—the level of the 100-day SMA.

Additionally, the daily Relative Strength Index (RSI) has risen from near-oversold conditions of 31 on March 11 to 47, suggesting that bullish momentum is building.

With market sentiment shifting positively, all eyes are now on upcoming economic developments and regulatory announcements that could further drive crypto prices higher.

Leave a Reply