Coinbase Becomes Ethereum’s Largest Node Operator

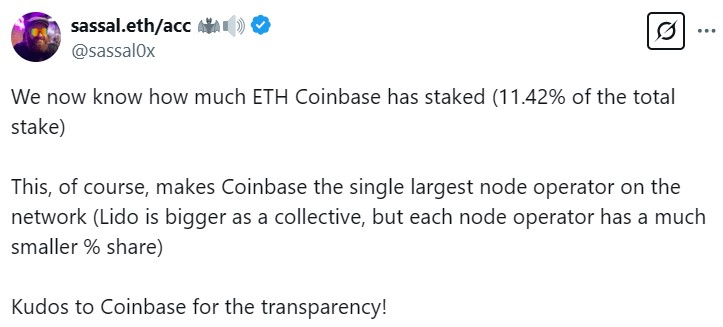

Coinbase has emerged as the largest node operator on the Ethereum network, now controlling 11.42% of the total staked Ether, according to the company’s latest performance report.

The crypto exchange revealed it has staked 3.84 million Ether (ETH), valued at approximately $6.8 billion, with its validators. As of 3 March, this stake accounts for 11.42% of the total staked ETH on the network.

Coinbase also reported that it exceeded its target for validator uptime, a measure of how consistently its validators remain operational. The company’s growing dominance in Ethereum staking highlights the increasing influence of centralised exchanges in blockchain networks.

Solana CEO Responds to Backlash Over Controversial Advertisement

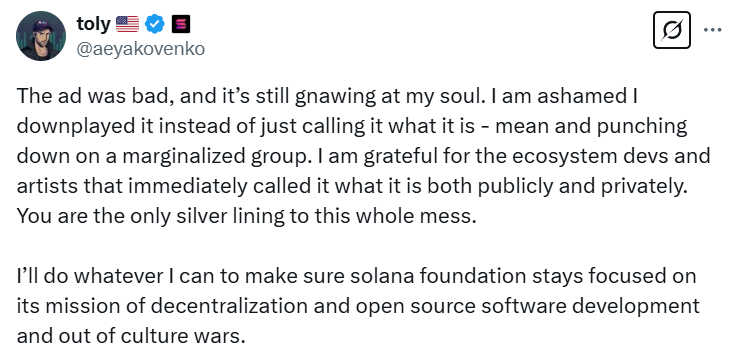

Solana Labs CEO Anatoly Yakovenko has publicly addressed criticism over a recent advertisement that blended themes of American patriotism and technological innovation with controversial political messaging on gender identity.

“The ad was bad, and it’s still gnawing at my soul,” Yakovenko admitted in a post on X (formerly Twitter) on 19 March. He expressed regret for initially downplaying the controversy, acknowledging that the advertisement was “mean and punching down on a marginalised group.”

Yakovenko praised members of the Solana community who spoke out against the advert, which had gained around 1.2 million views and received 1,300 comments before it was deleted roughly nine hours after being posted.

Going forward, the Solana CEO vowed to keep the company focused on open-source software development and decentralisation, stating that he intends to keep the project out of divisive cultural debates.

SEC’s Case Against Ripple Collapses, Strengthening XRP’s Status

The long-running battle between the U.S. Securities and Exchange Commission (SEC) and Ripple has taken a decisive turn, with crypto lawyer John Deaton declaring that the SEC’s case against XRP as a security is now effectively over.

In an interview, Deaton stated that XRP is a digital commodity rather than a security. With the SEC abandoning its case against Ripple, the blockchain firm now has the opportunity to renegotiate the $125 million judgment initially imposed on it.

“Everything’s turned,” Deaton said, pointing to shifts in political leadership and regulatory attitudes toward the crypto industry. “The election’s turned, the industry turned, the SEC [has] completely done a 180 as it relates to the industry. Why should we pay $125 million?”

Ripple CEO Brad Garlinghouse echoed this sentiment earlier in the day, calling the regulator’s reversal on XRP a “victory for the industry and the beginning of a new chapter.”

This latest development is being seen as a major win for the broader cryptocurrency industry, potentially setting a precedent for how digital assets are classified and regulated in the future.

Leave a Reply