The United States economy added 256,000 jobs in December, far exceeding economists’ forecast of 160,000, according to the Bureau of Labor Statistics. This uptick marks a significant rise from November’s revised 212,000 figure. The unemployment rate also unexpectedly dipped to 4.1%, below the anticipated 4.2%, signaling a robust labor market.

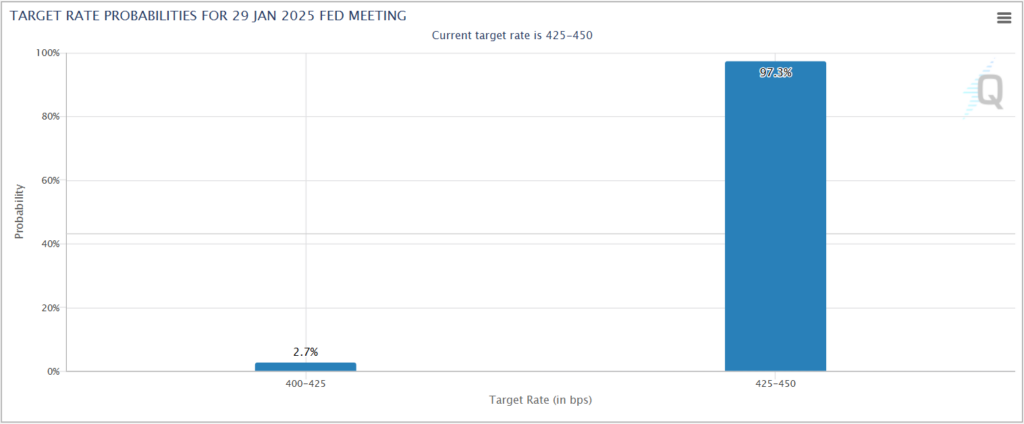

These strong figures challenge the notion of a cooling economy and suggest the Federal Reserve may pause its anticipated easing of monetary policy in 2025.

Crypto Markets React Negatively

Bitcoin (BTC) and other cryptocurrencies faced sharp declines in the wake of the jobs report. Bitcoin, which had already been under pressure earlier in the week, fell by over 2% following the announcement, dropping to $92,800.

The flagship cryptocurrency started the week near $103,000 but slid below $92,000 on Thursday amid broader market uncertainty. Altcoins faced even steeper percentage losses, as risk-averse sentiment weighed heavily on the digital asset market.

Broader Market Impact

The repercussions of the jobs data extended beyond crypto markets. U.S. stock index futures dropped roughly 1%, while the bond market saw a sharp reaction with the 10-year Treasury yield jumping nine basis points to 4.78%. The dollar index climbed 0.6%, reflecting stronger investor demand, while gold edged slightly lower to just under $2,700 per ounce.

The data also caused traders to rethink the likelihood of future Federal Reserve rate cuts. CME FedWatch data revealed that the probability of a March rate cut fell to 28% from 41% prior to the report. Similarly, expectations for a May rate cut declined to 34% from 44%.

Earnings Data Offers Mixed Signals

Average hourly earnings in December rose by 0.3%, aligning with forecasts but marking a slight dip from November’s 0.4% increase. On an annual basis, earnings were up 3.9%, marginally below November’s 4% year-over-year growth.

While the earnings data suggests some moderation in wage inflation, the overall strength of the labor market overshadowed these figures, fueling concerns that the Fed might delay or even halt rate cuts altogether.

Outlook for Crypto Markets

The crypto market’s reaction underscores its sensitivity to macroeconomic developments, particularly interest rate expectations. Higher rates tend to increase the appeal of traditional assets like bonds and the U.S. dollar while reducing the attractiveness of riskier investments such as cryptocurrencies.

For now, the strong job market has reignited fears of prolonged monetary tightening, leaving crypto markets vulnerable to further downside in the near term. Traders will closely monitor upcoming economic data and Federal Reserve commentary for clearer direction.

Leave a Reply