Global Tariff Concerns Weigh on Markets

Cryptocurrency and traditional financial markets are expected to remain under pressure until at least early April due to ongoing global trade tensions, according to analysts at Nansen.

Bitcoin (BTC) has dropped over 17% since US President Donald Trump announced new import tariffs on Chinese goods on 20 January, the first day after his inauguration. Despite positive developments within the crypto sector, broader economic uncertainties continue to dominate market sentiment.

Speaking on the Chainreaction Daily X show on 21 March, Nansen research analyst Nicolai Sondergaard highlighted the impact of tariffs on investor confidence.

“I’m looking forward to seeing what happens with the tariffs from 2 April onwards. Maybe we’ll see some of them dropped, but it depends if all countries can agree. That’s the biggest driver at this moment,” Sondergaard said.

The uncertainty is expected to keep risk assets, including cryptocurrencies, lacking clear direction until a resolution is reached. A breakthrough between April and July could serve as a key market catalyst, potentially driving a recovery.

President Trump’s reciprocal tariff rates are scheduled to take effect on 2 April, despite previous indications from Treasury Secretary Scott Bessent that their activation could be delayed.

Federal Reserve Policies Add to Market Volatility

Beyond trade concerns, high interest rates set by the US Federal Reserve are also weighing on investor sentiment. Sondergaard noted that markets are awaiting clear signs of economic deterioration before the Fed considers rate cuts.

“We’re waiting for the Fed to see proper ‘bad news’ before they will really start cutting rates,” he explained.

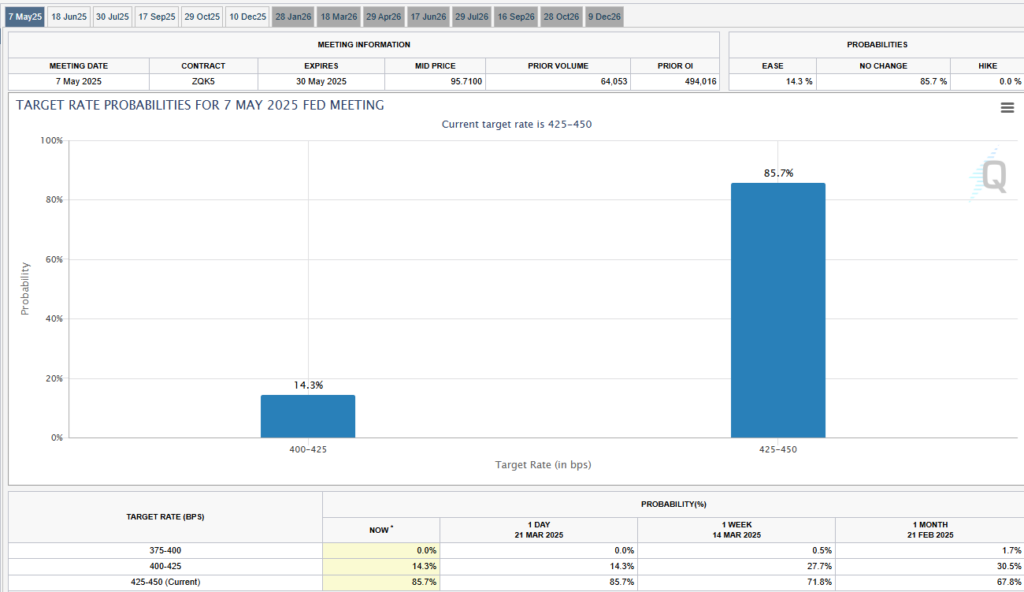

According to CME Group’s FedWatch tool, there is an 85% probability that the Federal Open Market Committee (FOMC) will keep interest rates unchanged at its next meeting on 7 May. While inflation remains a key concern, the Federal Reserve has maintained that the impact of tariffs and recession risks may be temporary.

Economic Indicators to Watch

Despite ongoing uncertainty, some analysts believe stabilising economic conditions could improve investor confidence in the coming months. Iliya Kalchev, a dispatch analyst at Nexo digital asset investment platform, suggested that cooling inflation and steady economic data might help boost appetite for Bitcoin and other digital assets.

“Markets may now expect upcoming economic data with greater confidence,” Kalchev said.

He advised investors to monitor key reports, including Consumer Confidence, Q4 GDP figures, jobless claims, and next week’s crucial PCE inflation release, as these indicators could influence the likelihood of future Fed rate cuts.

While the crypto market remains under pressure, analysts suggest that a resolution to trade disputes and clearer signals from the Federal Reserve could provide the next major catalyst for market movement.

Leave a Reply