Today’s crypto news highlights significant events shaping the landscape of decentralized finance, blockchain, and regulation. Here are the main developments:

California Court Holds DAO Members Accountable

On Nov. 18, a federal judge in California ruled that members of decentralized autonomous organizations (DAOs) could be held liable for the actions of their group under state partnership laws. Judge Vince Chhabria of the U.S. District Court for the Northern District of California determined that Lido DAO qualifies as a general partnership under California law, implying that members cannot escape responsibility for the organization’s activities.

The ruling stemmed from a lawsuit filed by Andrew Samuels, an investor who claimed losses from purchasing Lido DAO-issued tokens, alleging they were unregistered securities. The court found that Samuels’ claims were sufficient to hold Lido DAO and its partners accountable, marking a significant precedent for decentralized governance. Miles Jennings, general counsel at a16z Crypto, called this decision a substantial setback for DAOs, potentially impacting their governance and legal structure.

Lawmakers Seek Treasury’s Response on Tornado Cash

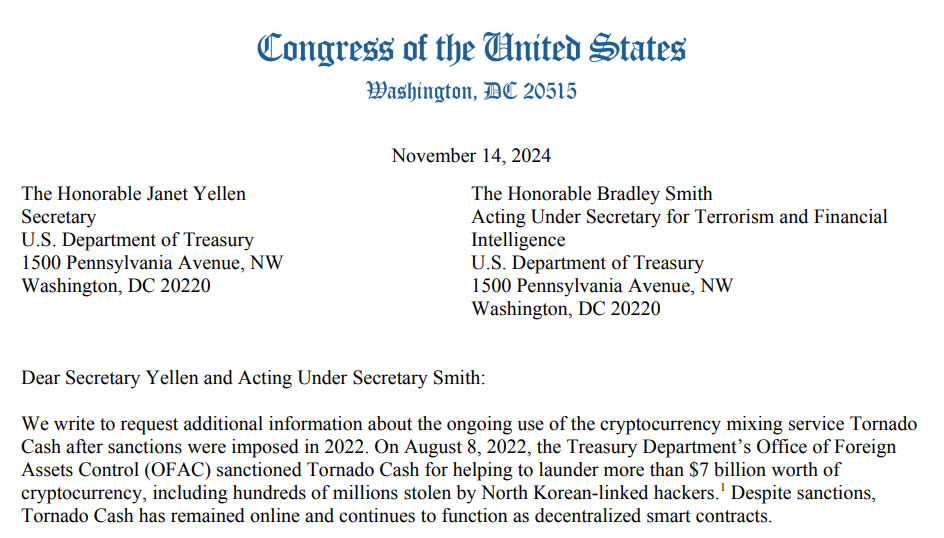

U.S. lawmakers, including Brad Sherman, are urging the Treasury Department for updates on actions related to the crypto-mixing service Tornado Cash, which faced sanctions in 2022 but remains operational. In a Nov. 14 letter, the lawmakers highlighted concerns over the mixer’s persistent use, noting that Tornado Cash processed $1.8 billion in deposits during the first half of 2024—a 45% increase over 2023.

The lawmakers stressed the urgency of addressing the continued usage of Tornado Cash, warning that the issue shows no signs of abating. This comes amid broader regulatory scrutiny of decentralized tools that can facilitate illicit transactions.

OCC Set to Launch Spot Bitcoin ETF Options

The Options Clearing Corporation (OCC) is poised to introduce spot Bitcoin ETF options, following a go-ahead from the U.S. Commodity Futures Trading Commission (CFTC). In a notice on Nov. 18, the OCC detailed its plans for managing these new ETF options. Nasdaq’s Alison Hennessy confirmed that the exchange is ready to list and trade the options as early as Nov. 19.

This launch follows the SEC’s approval of spot Bitcoin ETFs in January and spot Ether ETFs in May, indicating growing institutional interest in crypto products and advancing mainstream adoption.

Leave a Reply