The cryptocurrency sector witnessed a series of major developments today. Visa introduced a pilot using stablecoins to speed up cross-border payments, the US Securities and Exchange Commission (SEC) clarified its position on Decentralised Physical Infrastructure Network (DePIN) tokens, and Kazakhstan unveiled its first state-backed crypto fund in partnership with Binance.

Visa Pilots Stablecoin Payments for Real-Time Transfers

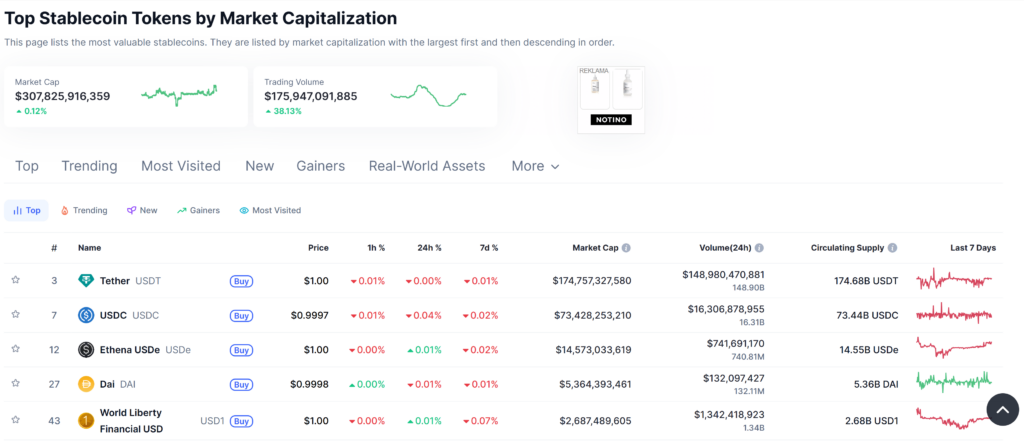

Visa has launched a pilot programme enabling financial institutions to pre-fund cross-border transactions with stablecoins. The announcement came during the SIBOS 2025 conference, highlighting Visa Direct’s integration of Circle’s USDC and EURC.

Chris Newkirk, president of commercial and money movement solutions at Visa, said outdated systems have long restricted cross-border payments. He explained the new framework allows businesses to fund transfers with stablecoins, treated as cash equivalents by Visa, to facilitate near-instant payouts.

The pilot is designed to help banks, remittance services and other financial institutions optimise liquidity. Instead of locking fiat currencies in multiple corridors, participants can use stablecoins to free up capital while reducing settlement times.

SEC Issues Rare No-Action Letter on DePIN Tokens

The SEC has provided rare regulatory clarity by stating it will not pursue enforcement action against tokens linked to DePIN projects. In a no-action letter, Michael Seaman, chief counsel of the Division of Corporation Finance, confirmed the commission would not recommend action against DoubleZero, a DePIN initiative.

Commissioner Hester Peirce explained DePIN projects differ fundamentally from capital-raising activities that fall within securities regulation. She stressed the SEC’s role is to oversee securities markets, not to govern every area of economic activity.

Austin Federa, co-founder of DoubleZero, described the decision as a milestone for both the project and the wider industry. He said the move demonstrates how innovators can work with regulators while continuing to develop infrastructure at pace.

Kazakhstan Establishes Alem Crypto Fund with Binance

Kazakhstan has taken a significant step into digital assets by launching its first state-backed crypto reserve. The Alem Crypto Fund has been set up through the Ministry of Artificial Intelligence and Digital Development and will be managed by Qazaqstan Venture Group under the Astana International Financial Centre.

The fund’s initial holdings include BNB, the utility token that underpins activity on Binance’s blockchain. Details of the amount purchased were not disclosed, and no information was provided on future portfolio expansion. The government said the fund’s purpose is to make long-term investments in digital assets while building strategic reserves.

Binance has worked closely with Kazakhstan since 2022, when a memorandum of understanding was signed with the Ministry of Digital Development to create a supportive framework for cryptocurrency regulation. The launch of the fund follows the introduction of Kazakhstan’s own stablecoin, KZTE, backed by the national currency tenge and issued on the Solana network in partnership with Mastercard, Intebix, and Eurasian Bank.

Industry Outlook

Today’s developments underline how both private enterprises and governments are shaping the future of digital finance. Visa’s pilot points to a growing acceptance of stablecoins in mainstream financial operations, while the SEC’s stance on DePIN tokens offers clarity for infrastructure-focused crypto projects. Kazakhstan’s initiative reflects a broader trend of state involvement in digital assets, signalling a potential shift towards institutional adoption at a national level.

Leave a Reply