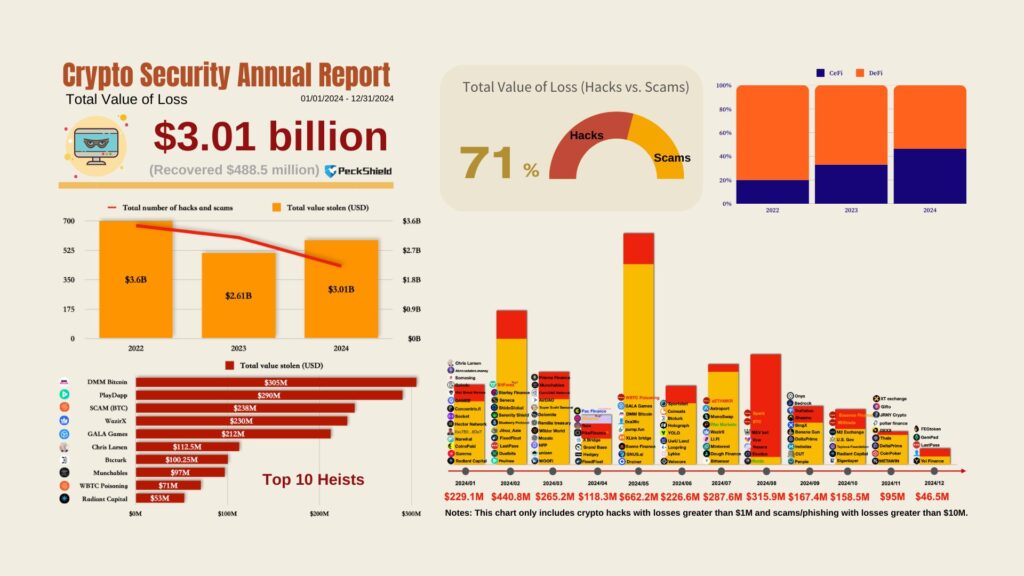

The cryptocurrency industry suffered significant setbacks in 2024 as losses from hacks and scams surged to $3.01 billion, marking a 15% increase from the $2.61 billion recorded in 2023, according to data from blockchain forensic firm PeckShield. Decentralized finance (DeFi) protocols remained the primary targets, while security vulnerabilities in both DeFi and centralized platforms were heavily exploited.

A Year of Rising Losses

PeckShield’s report revealed that hacks were responsible for 70% of the total losses, amounting to $2.15 billion, while scams contributed $834.5 million. Despite the grim figures, approximately $488.5 million of stolen funds were recovered during the year.

May was the most catastrophic month, with losses reaching $662.2 million. July and August followed with over $280 million in damages each, though December brought a semblance of relief, recording the lowest losses at $46.5 million.

Major Heists of 2024

Among the largest incidents was the $305 million hack of Japanese crypto exchange DMM Bitcoin. Other significant breaches included:

- PlayDapp: $290 million lost.

- BTC Scam: $238 million siphoned off.

- WazirX (India): $230 million stolen.

- Gala Games: $212 million breach.

These high-profile attacks underscored the persistent vulnerabilities in the sector, with DeFi platforms remaining the most attractive targets due to their open-access architecture.

Access Control Exploits Dominate

Security firm Hacken highlighted that 78% of the year’s losses stemmed from access control vulnerabilities. These flaws allowed attackers to bypass critical security measures, affecting various sectors, including gaming/metaverse platforms, centralized finance (CeFi), and DeFi protocols.

The growing sophistication of attackers has amplified the urgency for more robust security measures across blockchain platforms. Analysts warn that without immediate intervention, the industry’s reputation and investor confidence could face further erosion.

Calls for Better Safeguards

As losses continue to mount, experts are urging crypto platforms to prioritize security enhancements. Improved access controls, regular audits, and stricter compliance measures are critical to mitigating risks.

The surge in crypto crimes highlights the need for collaboration among industry stakeholders, regulators, and security firms to build a more resilient ecosystem. For now, crypto investors are advised to exercise caution and remain vigilant against scams and potential vulnerabilities in their chosen platforms.

The $3 billion figure in 2024 serves as a stark reminder of the ongoing challenges in crypto security. As the industry evolves, its ability to address these risks will play a decisive role in shaping the future of digital finance.

Leave a Reply