A sharp decline in Nvidia shares sent shockwaves through global markets late Tuesday, dragging down both equities and cryptocurrencies. A fresh $5.5 billion write-down—linked to a U.S. ban on Nvidia’s H20 chip sales to China—has sparked renewed fears over trade tensions and recession risks, souring investor sentiment across risk assets.

Bitcoin Drops After Hitting Two-Week High

Bitcoin fell to $83,600, reversing gains after hitting a two-week peak of $86,440 earlier in the day, according to CoinDesk. The drop followed a sharp decline in Nvidia shares, which plunged 8% to $89.10 in after-hours trading.

Altcoins mirrored Bitcoin’s slide:

- XRP slipped over 2% to $2.08

- Cardano (ADA) dropped 4% to $0.61

- The CoinDesk 20 Index, tracking major digital assets, fell more than 2%

Tokens linked to artificial intelligence—previously buoyed by Nvidia’s tech leadership—fared worse, reflecting shaken confidence after the chipmaker’s dismal outlook.

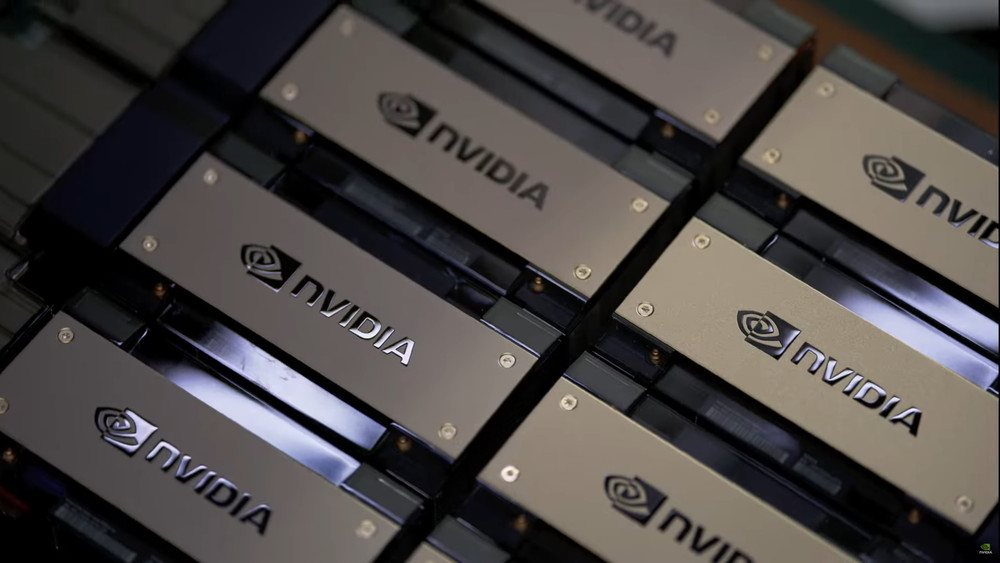

Nvidia’s $5.5B Write-Down Fuels Risk-Off Mood

Nvidia’s massive charge stems from the Trump-era ban on exports of its H20 chips to China, now enforced more strictly. The blow is seen as part of escalating trade tensions, with knock-on effects rippling across tech and crypto markets.

Adding to the unease was unusual activity in Nvidia put options on Monday, suggesting that some traders anticipated a downturn.

The Nasdaq futures dropped over 1%, setting the tone for a broader risk-off sentiment in global markets.

Eyes on U.S. Retail Data and Powell’s Speech

Markets now await two major cues on Wednesday:

- The U.S. retail sales report for March, expected to show a 1.2% monthly rise, up from February’s 0.2%

- A speech by Fed Chair Jerome Powell at the Economic Club of Chicago, where traders hope for clarity on interest rate policy

While strong retail numbers may ease some recession concerns, analysts caution that they may be seen as outdated, given the rapid deterioration in trade dynamics this month.

Trade War Adds Pressure on the Fed

The crypto and equities markets are also closely tracking signals from the Federal Reserve, particularly in light of renewed trade tensions. Fed Governor Christopher Waller warned that escalating tariffs could force the central bank to issue a series of “bad news” rate cuts.

President Trump’s April 2 tariff announcement on 180 countries—later paused for most, except China—has added fresh uncertainty to an already fragile global outlook.

Disinflationary signals, such as falling inflation breakevens, may give the Fed room to cut rates, but investors are still looking for clearer direction from Powell.

Leave a Reply