Cryptocurrency spot trading volumes continued to decline in the second quarter of 2025, falling by 22% despite a strong rebound in Bitcoin’s price and growing institutional interest in crypto exchange-traded funds (ETFs), according to a new report by TokenInsight.

The report highlighted contrasting trends across different segments of the crypto market, with spot trading volumes on major centralized exchanges (CEXs) falling significantly, while derivatives markets held steady and ETFs saw record inflows.

Spot Trading on CEXs Slumps Further

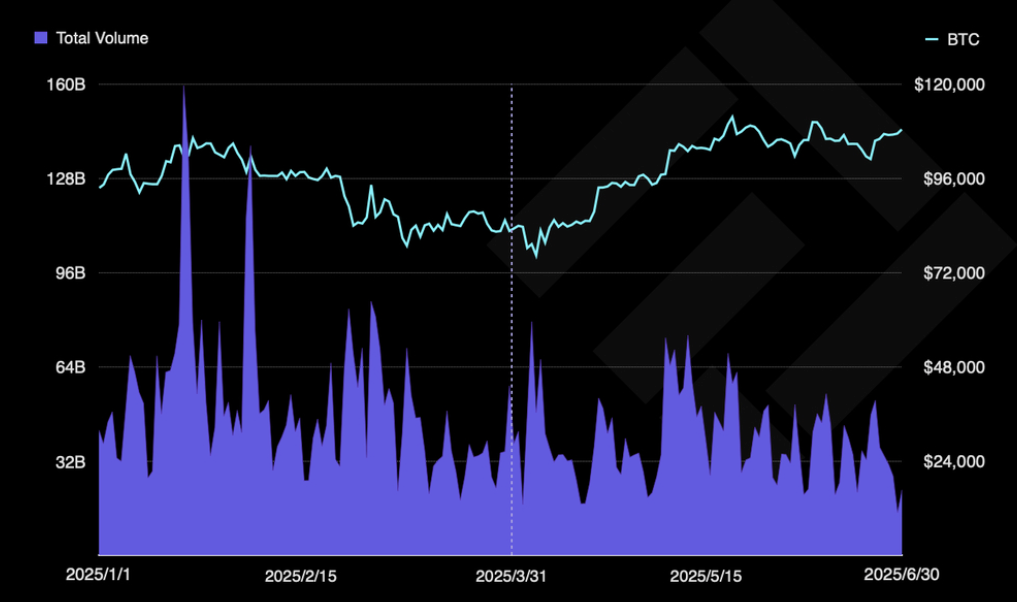

The downward trend in cryptocurrency spot trading showed no signs of reversing in Q2 2025. According to TokenInsight, spot volumes on centralized exchanges dropped from $4.6 trillion in Q1 to $3.6 trillion in Q2. This follows a previous decline from $5.3 trillion in Q4 2024, suggesting a prolonged slump in retail and altcoin trading activity.

Daily spot trading volumes also declined, averaging $40 billion in Q2 compared to $52 billion in the previous quarter. The report attributed this to a sharp drop in liquidity and interest in the altcoin market. TokenInsight analysts noted that the persistent market uncertainty led traders to shift their focus from spot to derivatives trading.

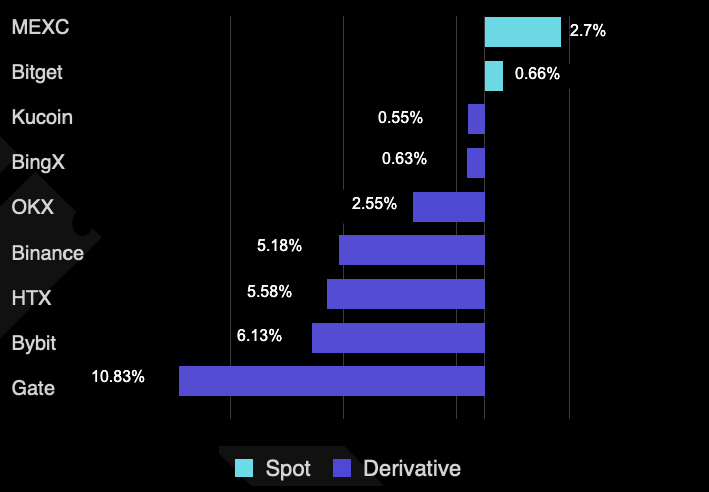

MEXC and Bitget Defy the Trend

Despite the broader downturn, a few exchanges managed to buck the trend. MEXC recorded a 2.7% increase in spot trading volume in Q2, making it the best-performing exchange in this segment. Bitget also posted marginal growth of around 0.7%. However, these gains were exceptions in a quarter largely marked by declining activity.

The report projected that spot market volumes would likely remain weak in Q3, estimating that overall activity would fluctuate between $3 trillion and $3.5 trillion due to continued economic uncertainty and reduced altcoin liquidity.

Derivatives Market Holds Steady

While spot markets struggled, crypto derivatives trading showed resilience in Q2. Derivatives volume dipped slightly by 3.6% to $20.2 trillion from $20.9 trillion in Q1, indicating sustained interest among traders looking to hedge or leverage market movements.

TokenInsight highlighted that many investors opted for high-frequency derivatives trading amid a volatile macroeconomic backdrop. Although market sentiment received a brief boost in April when the US Federal Reserve paused interest rate hikes, concerns over a global economic slowdown and geopolitical tensions kept risk appetite in check.

Bitcoin ETFs See Explosive Growth

In stark contrast to falling CEX volumes, crypto ETFs experienced significant inflows during the quarter. BlackRock led the way with a 370% surge in ETF inflows compared to the previous quarter. Data from CoinShares shows that global crypto exchange-traded products (ETPs) attracted $17.8 billion in the first half of 2025, with nearly $15 billion coming from BlackRock alone.

This wave of institutional interest helped fuel a 25% rebound in Bitcoin’s price in Q2, reversing a 12% drop in Q1, according to CoinGecko. Rising inflows into Bitcoin funds and increasing corporate adoption were cited as key drivers of the price recovery.

Outlook Remains Mixed for Exchange Tokens

While Bitcoin benefited from institutional momentum, exchange platform tokens remained closely tied to the underperforming altcoin market. TokenInsight noted that reduced trading activity and liquidity in altcoins further weakened support for exchange tokens.

Looking ahead to Q3, the report suggested that the performance of exchange tokens would likely diverge based on individual platform strategies and market conditions. The overall crypto market, especially spot trading, is expected to remain cautious until broader economic indicators show signs of improvement.

Leave a Reply