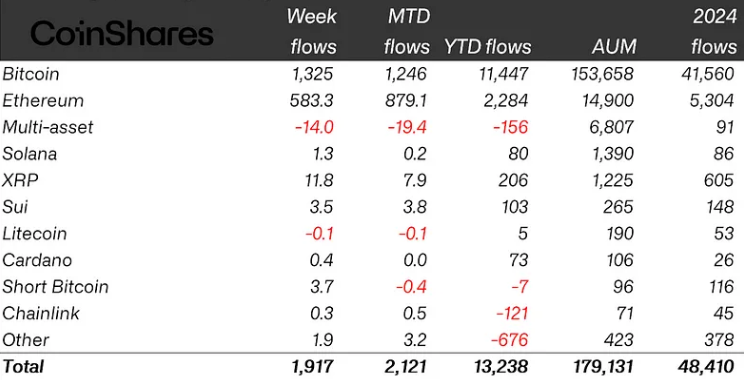

Cryptocurrency exchange-traded products (ETPs) recorded a substantial $1.9 billion in inflows last week, pushing year-to-date (YTD) totals to a record $13.2 billion, according to a report by CoinShares. The data highlights growing investor confidence amid recent market volatility, driven largely by a rebound in Bitcoin and strengthening momentum in Ether.

This marks the ninth consecutive week of net inflows, with total assets under management (AUM) in crypto ETPs rising from $175.9 billion to $179 billion. According to James Butterfill, head of research at CoinShares, the persistent inflows suggest that investor interest remains strong despite broader geopolitical and macroeconomic concerns.

Bitcoin Reclaims Top Spot with $1.3B in Weekly Inflow

After two weeks of mild outflows, Bitcoin ETPs rebounded in commanding fashion, registering $1.3 billion in inflows, once again leading all digital asset products. Short-Bitcoin funds also saw modest interest with $3.7 million in inflows, though total AUM remains low at just $96 million.

Bitcoin’s recovery comes after a turbulent week where it briefly fell from highs of $110,000 to lows of $103,000 amid rising geopolitical tensions, including Israel’s military strike on Iran’s nuclear program. Despite the volatility, BTC managed to regain ground, closing the week around $106,000 and starting the new week trading at $107,171, according to CoinGecko.

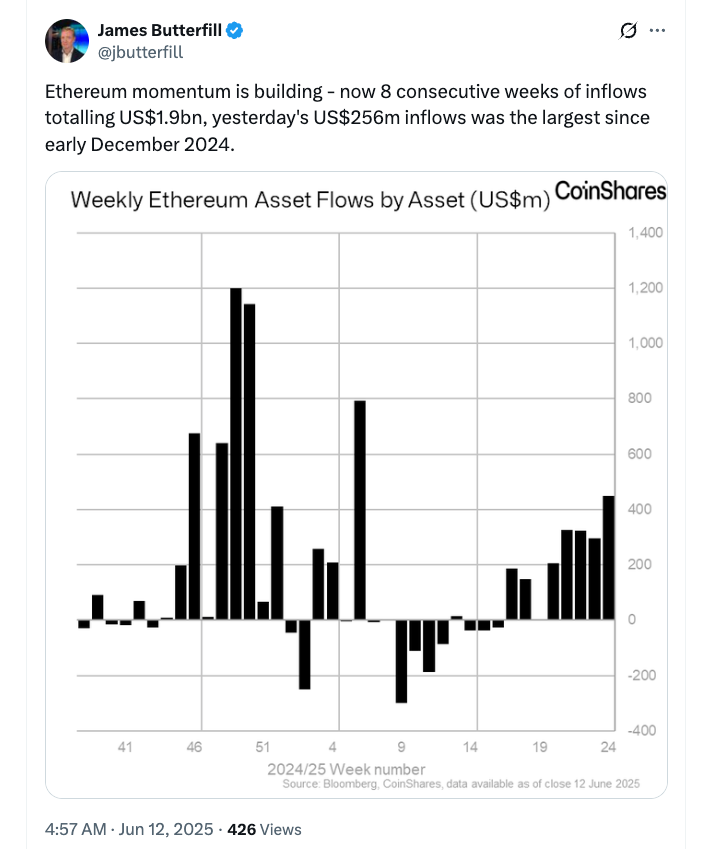

Ether Sees Biggest Inflows Since February

Ethereum ETPs continued their strong streak, attracting $583 million in inflows last week. This marks the highest weekly inflow since February and includes the strongest single-day inflow of $256 million recorded last Wednesday. The ETH products have now registered eight consecutive weeks of inflows totalling $1.9 billion.

Ether’s price reflected the positive sentiment, despite a midweek dip from $2,869 to $2,473 following global market anxiety. By the end of the week, ETH recovered to $2,628, underscoring its resilience amid market stress. Analysts suggest Ethereum’s steady inflow trend could be signalling a shift in investor preference toward the asset ahead of potential network upgrades and long-term ecosystem developments.

Mixed Fortunes for Altcoins and Issuers

Among altcoins, XRP ETPs recorded $11.8 million in inflows, snapping a three-week outflow streak. Sui-based products also saw a minor boost, pulling in $3.5 million. While not as dominant as Bitcoin or Ether, these altcoins are showing renewed investor interest as the broader market improves.

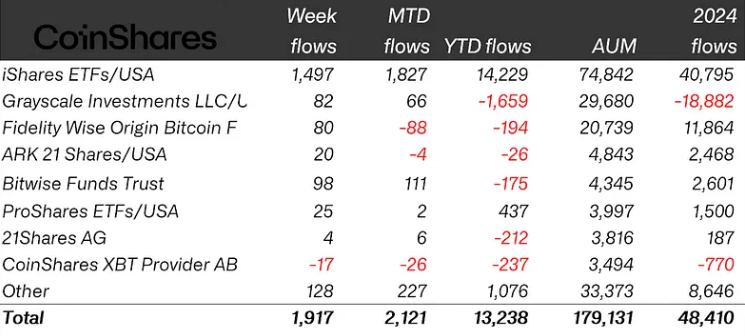

BlackRock’s iShares crypto ETFs led fund-specific inflows with a weekly surge of $1.5 billion, taking its YTD total past $14.2 billion. Other US-based crypto ETFs added a combined $95 million, while Europe’s CoinShares XBT Provider reported minor outflows of $17 million.

Despite the bullish trend, most issuers still face negative YTD flows. Grayscale continues to lead the outflow tally with over $1.6 billion in net withdrawals. In contrast, ProShares is the only major issuer with net YTD inflows, currently standing at $437 million.

Macro Environment Fuels Safe-Haven Shift

Investor sentiment last week was also influenced by broader market conditions, particularly the escalation of the Israel-Iran conflict. This geopolitical tension drove increased demand for traditional safe-haven assets, with gold prices jumping to $3,448, its highest since early May.

Yet, the crypto market’s strong recovery suggests resilience, with Bitcoin and Ether both starting the new week in a positive zone. Market analysts believe that if macro uncertainty stabilises, crypto ETPs could continue to attract inflows, potentially setting the stage for a breakout quarter.

Crypto Funds on Strong Footing

With nine straight weeks of inflows and record-setting YTD gains, crypto ETPs are showing robust institutional interest. Bitcoin and Ether continue to lead the charge, benefiting from renewed investor confidence and macro-driven volatility.

If current trends persist, crypto funds may see even greater momentum in the second half of 2025, potentially ushering in a new era of mainstream adoption and investment.

Leave a Reply