Crypto venture capitalists are shifting gears in 2025, moving away from speculative trend-chasing toward more measured, data-driven investments. According to Bullish Capital Management director Sylvia To, the industry has entered a new phase of restraint, where “throwing money at the next big thing” is no longer the norm.

A More Careful Approach to Crypto Investments

Speaking at Token2049 in Singapore, To explained that crypto VCs are no longer chasing narratives or rushing to back every new blockchain project promising revolutionary potential.

“VCs are a lot more careful now. It’s not just a narrative play. Before, you could throw a cheque and say, ‘Oh, there’s another L1, but it’s going to be an Ethereum killer,’” she said.

The previous cycle saw an explosion of new layer-1 blockchains and infrastructure projects, many of which ultimately failed to attract real users or sustain activity. To noted that the market became “too fragmented,” with large sums of capital flowing into ideas that were not commercially viable.

Asking the Right Questions

To believes that the current market demands a shift from hype-driven investing to practical evaluation. “We’re at a phase where you don’t have the luxury to just bet on new narratives,” she said. “You really have to start thinking, there’s all this infrastructure being built — but who has been using it? Are there enough transactions? Is there enough volume coming through these chains to justify all the money being raised?”

She added that in 2025, many crypto projects continue to raise funds at inflated valuations, banking heavily on future growth projections rather than concrete performance. “The potential revenue and the pipeline they’ve got aren’t solidified,” she said, calling it “a slow year” for the sector.

Market Maturity Forces Selectivity

Echoing similar sentiments, Eva Oberholzer, chief investment officer at Ajna Capital, said that venture firms have become increasingly selective when choosing which crypto startups to back. In an interview on 1 September, she observed that the industry has matured significantly, leading investors to focus on sustainable business models rather than speculative ones.

“It’s more about predictable revenue models, institutional dependency, and irreversible adoption,” Oberholzer explained. This signals a decisive shift from the 2020–2022 period, when venture firms poured billions into experimental projects with uncertain paths to profitability.

Crypto VC Funding Declines in 2025

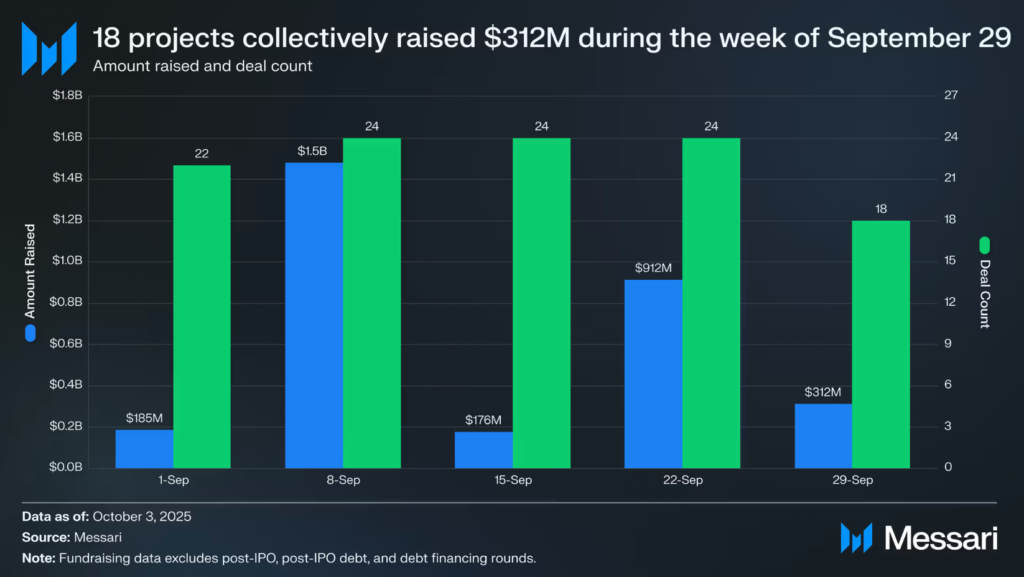

The cautious outlook is reflected in recent data. Galaxy Research reported that crypto and blockchain startups raised $1.97 billion across 378 deals in the second quarter of 2025. This marks a 59% drop in funding and a 15% fall in deal count compared with the previous quarter.

Overall, the total venture capital investment in crypto reached $10.03 billion over the three months ending in June, a stark contrast to the peak funding periods seen during the 2021 bull market.

Analysts suggest this funding slowdown reflects both global macroeconomic uncertainty and the industry’s own need to recalibrate after years of exuberant spending. Startups are now expected to show tangible user growth, stable revenue generation, and long-term market fit before attracting investment.

Selective Optimism Remains

Despite the overall pullback, not all capital has dried up. Some funds continue to place large, targeted bets on established players or high-conviction strategies. Strive Funds, an asset management firm founded by American entrepreneur and politician Vivek Ramaswamy, raised $750 million in May to pursue “alpha-generating” strategies centred on Bitcoin-related investments.

Such moves indicate that while speculative funding is waning, institutional interest in crypto remains strong, particularly in areas backed by clear fundamentals and regulatory momentum.

To concluded that the industry is entering a more disciplined era. “You can’t rely on buzzwords anymore. The investors who’ll win from here are the ones asking hard questions, not just following trends.”

Leave a Reply