Aster, a newly launched decentralised perpetual exchange token, has stunned the crypto market with an explosive rally. Backed by YZi Labs (formerly Binance Labs) and PancakeSwap and endorsed by Binance’s former CEO Changpeng Zhao (CZ), the token surged more than 400% within 24 hours of launch, taking its market capitalisation beyond $1 billion and generating over $500 million in trading volume.

The rally, which followed a large-scale airdrop and a 1:1 token swap with APX Finance, has positioned Aster as one of the most talked-about decentralised exchange (DEX) tokens of 2025.

From Astherus and APX Merger to Aster DEX

Aster is the product of a merger between Astherus and APX Finance, designed as a multi-chain DEX for spot and perpetual trading. Built on chains like BNB Chain, Ethereum and Solana, Aster offers unique features including ultra-low trading fees (0.03%), hidden orders and extreme leverage up to 1001x.

Its standout offering is stock perpetual contracts such as Tesla and NVIDIA, which has drawn the attention of traders seeking exposure to traditional equities in a decentralised environment. This positioning places Aster in direct competition with platforms like Hyperliquid, which currently holds a $19 billion valuation.

CZ’s Shoutout and the APX Swap Drive Momentum

The rally began after CZ congratulated the Aster team in a post on X, encouraging them to “keep building.” The endorsement coincided with the announcement of a 1:1 swap from APX tokens to ASTER, set to close on 1 October 2025.

Speculators quickly piled into APX before the swap deadline, with APX itself jumping 50–100% in anticipation. This created strong buy pressure for ASTER as traders rushed to secure allocations. Community speculation about a potential Binance listing, historically a powerful catalyst for price rallies added another layer of excitement.

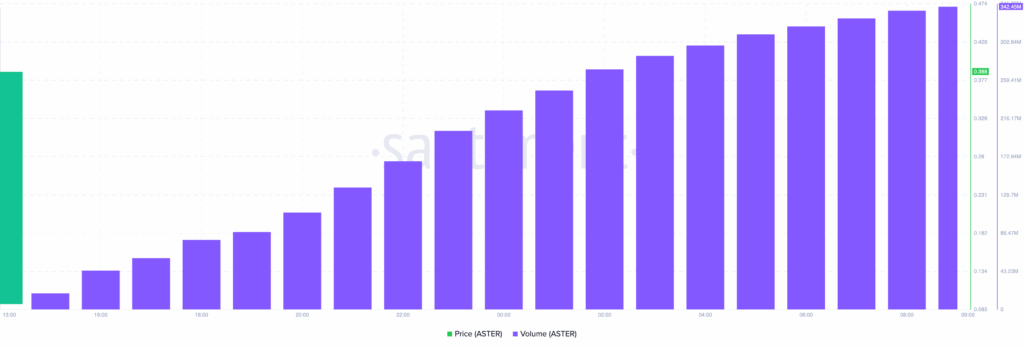

Unlike many projects that see heavy sell-offs after large airdrops, Aster defied expectations. Out of a circulating supply of 1.65 billion, 704 million tokens were unlocked via the airdrop. Instead of collapsing, ASTER’s price rocketed from $0.0089 at launch to above $0.60, proving demand was strong enough to absorb selling pressure.

User Growth, Adoption and Market Conditions

Adoption figures reinforced the price surge. Within just six hours of launch, Aster DEX reported 400,000 new users, $356 million in total value locked (TVL) and $33 billion in monthly trading volume.

This explosive growth comes amid favourable market conditions. The Altcoin Season Index rose nearly 58% over the past month, while Bitcoin’s dominance slipped, creating room for altcoin rallies. With a relatively modest market cap compared to Hyperliquid, many traders see ASTER as a “catch-up” play.

The neutral reading on the Fear & Greed Index (51) further reduced systemic risk aversion, encouraging rotation into smaller-cap tokens. Liquidity on Aster surged particularly during US market hours, largely due to interest in stock perpetual contracts, showing the platform’s appeal extends beyond crypto-native users.

Technical Analysis: Bullish but Overheated

The ASTER/USDT pair has broken above key resistance zones and is trading well above its 20, 50, 100 and 200-day exponential moving averages (EMA), a clear sign of bullish momentum.

- RSI: At 76, the token is entering overbought territory, which suggests strong momentum but raises the risk of a pullback.

- Upside target: Analysts suggest $0.90–$0.95 as the next resistance range if the momentum continues.

- Support zone: On the downside, key support lies between $0.047–$0.049, where EMA clusters converge.

With volatility expected to increase around the APX swap deadline in October, short-term traders may look for quick gains, while long-term holders will focus on adoption metrics, liquidity growth and whether Aster can sustain its initial hype.

Investment Outlook: Hype Meets Risk

Aster’s tokenomics are designed to scale with platform usage, with ASTER serving as both a governance and utility token, offering trading fee discounts and participation rights. The platform’s early traction, high-profile backers and CZ’s public endorsement have placed it in the spotlight.

Yet, challenges remain. The token supply is concentrated in a limited number of addresses, raising concerns about potential sell pressure. The use of extreme leverage, while attractive to risk-seeking traders is a double-edged sword that could amplify both gains and losses.

Market participants are also watching whether Aster can sustain user activity once the initial hype fades. Much of the rally is currently driven by speculation around a Binance listing and the upcoming APX swap deadline is expected to inject further volatility.

The Bottom Line

Aster has emerged as one of the most explosive new tokens of 2025, fuelled by big-name backing, aggressive adoption and CZ’s influential endorsement. Its ability to defy the typical post-airdrop dump and capture more than 400,000 users in its first week shows that the project has tapped into strong market demand.

However, with high leverage offerings, concentrated token supply and speculative frenzy around the APX swap, caution is warranted. Aster may well grow into a serious competitor to Hyperliquid and other perpetual DEX giants — but in the short term, its path will likely remain volatile.

For now, ASTER sits firmly on the list of tokens to watch, as its journey will test whether it can move from hype-fuelled surges to long-term sustainability.

Leave a Reply