DeAgentAI (AIA) has stunned the crypto community with an extraordinary 862% surge in the past 24 hours, positioning it as one of the fastest-growing altcoins of the week. The sudden rally follows the project’s strategic partnership with Piverse, a blockchain-based social platform that will now enable invoice payments using Binance Wallet through AIA tokens.

The collaboration has fuelled optimism around DeAgentAI’s real-world adoption potential, as investors interpret the move as a step toward mainstream crypto integration. Market sentiment shifted sharply positive, with speculative traders rushing to secure early positions.

However, analysts caution that while AIA’s explosive growth signals strong enthusiasm, it may also indicate an overheated market lacking solid liquidity support.

Independent Rally Amid Bitcoin Slump

Interestingly, AIA’s meteoric rise occurred independently of Bitcoin’s price action, a rare feat in the current volatile market. Data shows AIA’s correlation with Bitcoin stands at -0.60, meaning its trajectory has diverged sharply from the broader crypto trend.

While Bitcoin has been struggling with market-wide uncertainty and declining trading volumes, DeAgentAI has outperformed the market by a wide margin, suggesting that investor interest in smaller-cap AI-driven tokens remains strong.

This independence offers short-term upside potential but also heightens volatility risks, as the token lacks the stabilising effect typically provided by Bitcoin’s deep liquidity cycles.

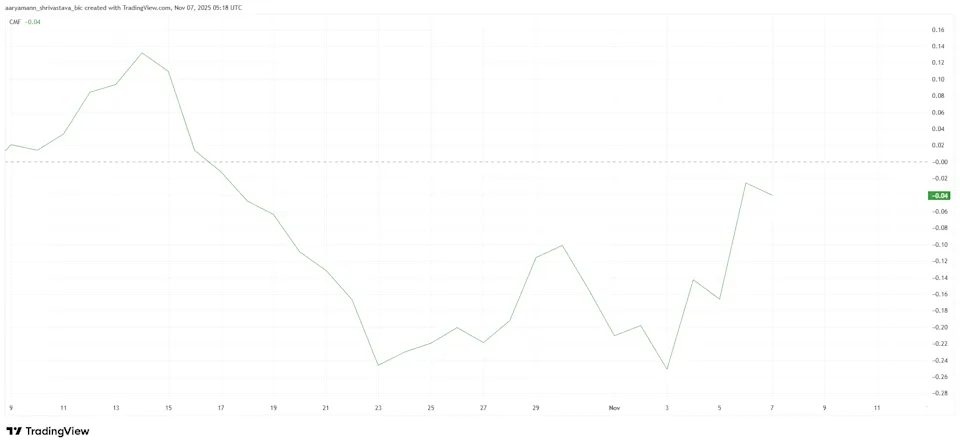

Investor Sentiment and CMF Signals

Technical indicators reflect a mixed picture for AIA’s sustainability. The Chaikin Money Flow (CMF) metric, which measures buying and selling pressure, shows a slowdown in capital outflows, implying that trader sentiment is improving.

Yet, despite the price explosion, on-chain inflows remain moderate, indicating that much of the recent rally is driven by speculative momentum rather than sustained accumulation.

Such scenarios are common in parabolic rallies, where rapid gains attract short-term traders, potentially leading to volatile corrections once profit-taking begins. Analysts say that AIA must now demonstrate consistent network activity and liquidity depth to justify its current valuation levels.

AIA Price Action and Key Levels

At the time of writing, AIA trades near $16.26, marking an eightfold increase from its previous day’s price. The token is now testing the key resistance zone around $20.00, a critical psychological barrier that could determine the next phase of movement.

If AIA manages to hold above this level with strong buying pressure, the next targets could be $25.00 and $30.00. However, if bullish momentum fades, a correction appears likely. Technical charts suggest potential retracements to $10.00, $8.58, and possibly $5.00, where traders may seek fresh support.

Market analysts emphasise that profit-taking typically follows extreme rallies, particularly when underlying trading volume fails to match price expansion.

What Lies Ahead for DeAgentAI

DeAgentAI’s core proposition, integrating AI-driven automation tools with decentralised payments, continues to attract attention in the rapidly growing AI-crypto sector. The Piverse integration strengthens its utility case, offering practical applications beyond speculative trading.

However, sustainability remains the key question. Without robust user adoption and steady liquidity, the current rally could lose steam, echoing patterns seen in previous short-lived altcoin surges.

For now, AIA stands as a symbol of renewed retail enthusiasm in an otherwise cautious market. But as experts note, “when an altcoin rises nearly 900% overnight, gravity eventually plays its part.”

Leave a Reply