After a period of muted trading, Dogecoin (DOGE) has re-emerged as one of the most closely watched cryptocurrencies. Over the past week, the memecoin has jumped 25%, briefly testing $0.30 before retracing to around $0.28. This latest rally has not only pushed price higher but also triggered a spike in derivatives activity, raising questions about whether DOGE is preparing for an extended bull run.

Derivatives Market Shows Explosive Growth

One of the most striking developments has been the surge in Dogecoin’s open interest (OI). At press time, OI has climbed to $2.28 billion, its highest level since December 2024.

In derivatives markets, rising OI indicates that more capital is flowing in as traders open new positions instead of closing old ones. When OI grows alongside price, it is typically seen as confirmation of strong bullish momentum, since more market participants are backing the uptrend.

However, higher OI also means greater leverage is at play, which can amplify volatility. If sentiment suddenly shifts, a wave of liquidations could trigger sharp swings in price. Despite this risk, the fact that DOGE’s OI appears set to hold above $2 billion suggests strong market conviction. If sustained, Dogecoin could soon retest the $0.30 level, with room for further upside in the coming weeks.

MVRV Ratio Suggests Room to Run

Beyond derivatives, on-chain data also reinforces the bullish narrative. Dogecoin’s Market Value to Realised Value (MVRV) ratio currently stands at 1.35. This metric compares DOGE’s market capitalisation to the average price at which current holders acquired their coins.

A reading above 1 signals that investors, on average, are sitting on profits. Historically, however, market tops for DOGE have occurred when MVRV enters the 3.11 to 4.53 range. At just 1.35, the memecoin still appears far from overheated territory, leaving room for additional upside before heavy profit-taking becomes a risk.

In other words, while investors are in profit, the data suggests that Dogecoin’s rally is still in its earlier stages compared to previous bull cycles.

Technical Indicators Remain Bullish

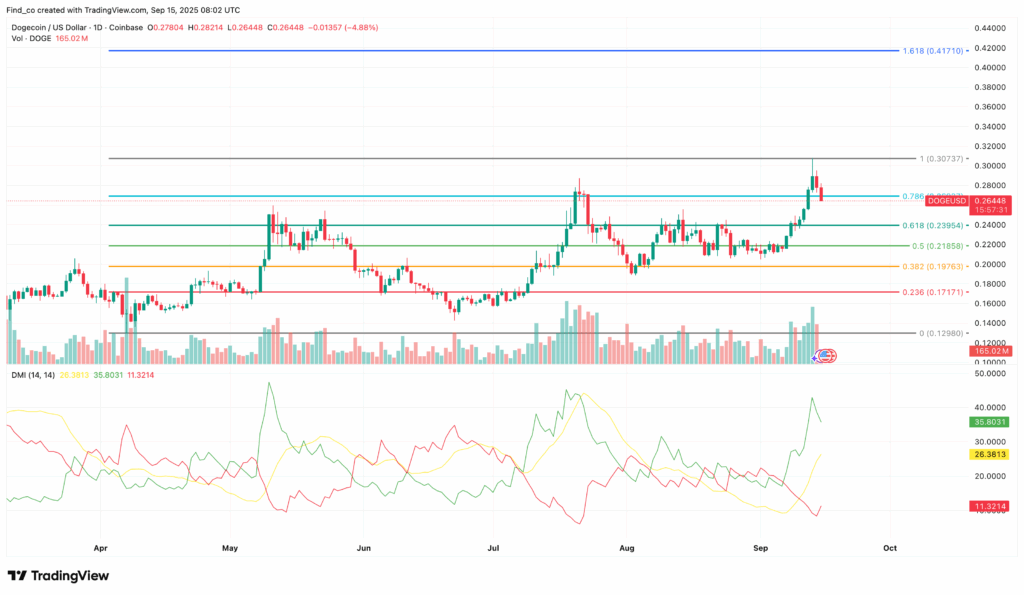

From a technical perspective, Dogecoin’s daily chart continues to paint an encouraging picture. The price structure shows higher lows, a classic sign of an uptrend. Recently, two consecutive red histogram bars hinted at a brief slowdown in momentum, but this does not appear to have derailed the bullish structure.

The Directional Movement Index (DMI) supports this view. The +DMI currently stands at 36.24, well above the –DMI at 10.24, confirming that buyers remain firmly in control. Meanwhile, the Average Directional Index (ADX) is at 26.67, suggesting that the current uptrend is not only intact but also strengthening.

Should this momentum hold, DOGE could first retest $0.30 and in a more optimistic scenario, climb towards $0.42.

Key Levels to Watch

While sentiment is clearly bullish, risks remain. The sharp rise in OI means any sudden drop in demand could spark volatility. If DOGE fails to hold current levels, the price could fall back towards $0.24.

For now, though, the balance of evidence points to continued strength. With derivatives activity at multi-year highs, on-chain metrics showing room for further growth and technical indicators aligned in favour of bulls, Dogecoin appears well-positioned for a potential extended rally.

Investors and traders will be closely watching whether the memecoin can build on its momentum, retesting resistance at $0.30 and possibly eyeing a run towards $0.42 in the weeks ahead.

Leave a Reply