Ether (ETH) has surged past the $4,000 mark for the first time since December 2024, signalling renewed bullish momentum for the second-largest cryptocurrency and adding fuel to the ongoing altseason narrative.

Data from TradingView showed ETH/USD hitting $4,012 on Bitstamp on Friday, gaining around 1.7% over the day. This milestone puts Ether less than $900 away from its all-time high, achieved during the peak of the 2021 bull run.

The move comes as Bitcoin’s dominance over the wider cryptocurrency market continues to weaken, with analysts predicting an inevitable longer-term decline in its share.

Reaccumulation Zone Fuels Bullish Sentiment

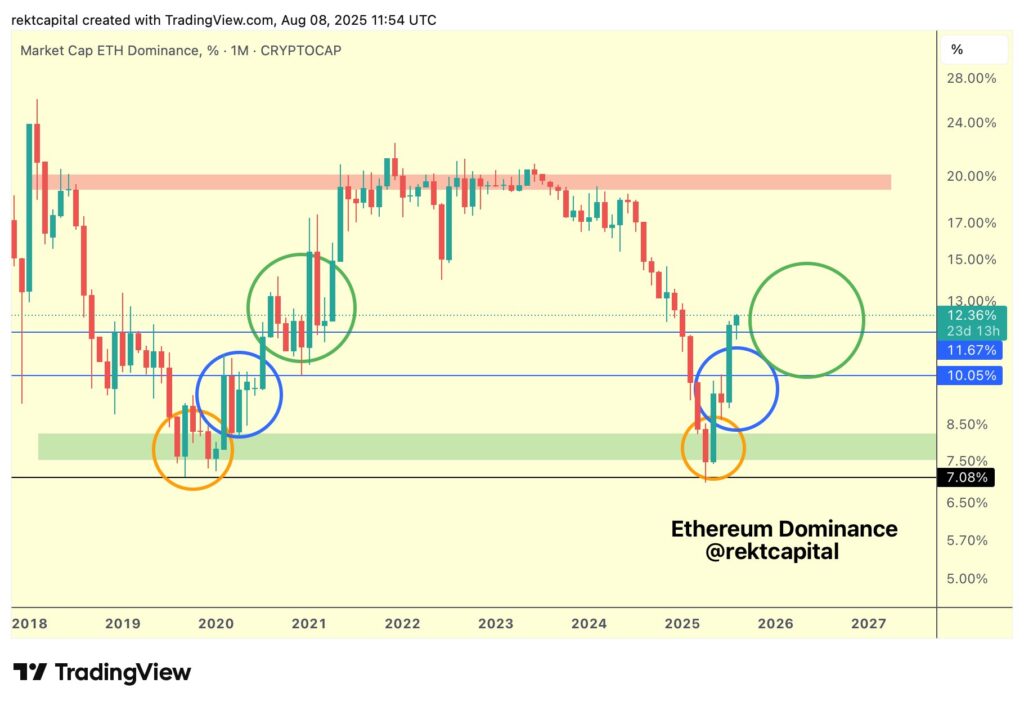

Market analysts were quick to interpret Ether’s move above the key $4,000 psychological threshold as a sign of continued bullish momentum. Popular trader and analyst Rekt Capital noted that Ethereum’s market dominance is already around “50–60% of the way” through its macro uptrend.

His accompanying chart drew comparisons to ETH’s performance during its explosive 2021 bull cycle, hinting that the current rally could mirror those historic gains.

Meanwhile, trader Cas Abbe highlighted a clear trend of large-scale ETH purchases by investors, pointing to strong demand from whales looking to accumulate ahead of potential further price appreciation.

On-chain analytics platform Lookonchain confirmed the activity, tracking multiple whale transactions that appeared designed to leverage Ether’s growing strength relative to Bitcoin.

Liquidation Clusters Hint at Further Price Upside

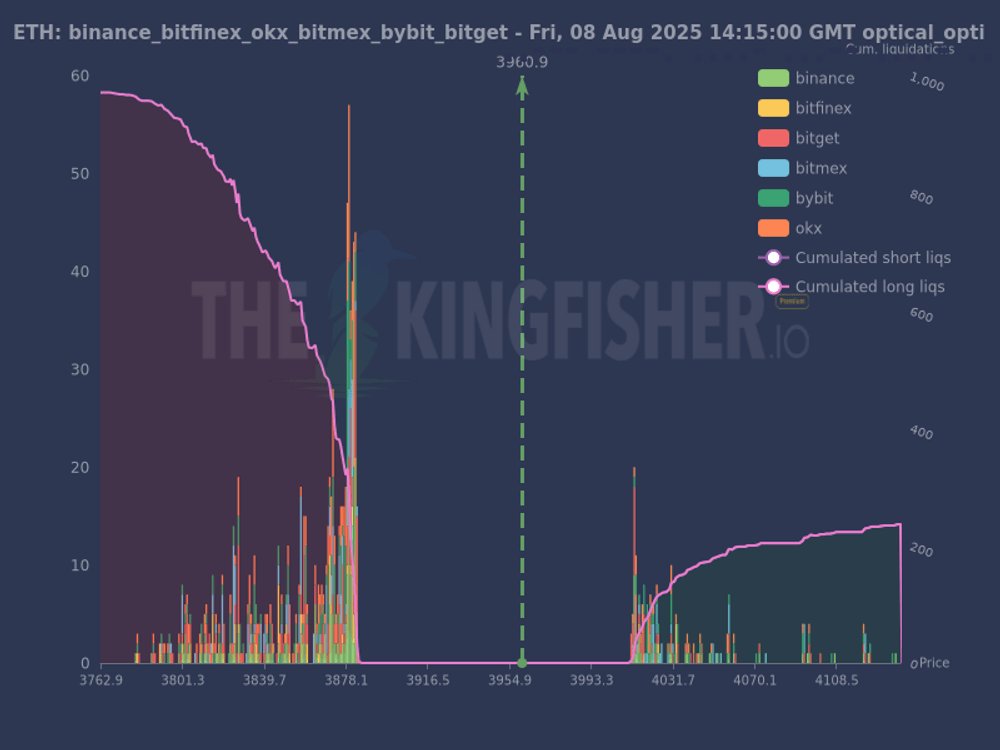

Exchange order book data also points towards additional upside potential. Data shared by the X account TheKingfisher revealed a “massive wall of long liquidations” positioned just below the $3,960 level.

“This is what smart money hunts,” TheKingfisher commented, adding that while most traders may perceive such dips as a sell-off trigger, experienced market participants see them as reaccumulation opportunities.

In essence, heavy liquidations can flush out weak hands, clearing the way for renewed buying pressure and potentially accelerating price gains. This dynamic, combined with robust whale accumulation, could strengthen ETH’s foothold above $4,000 in the near term.

Bitcoin Dominance Weakens Amid Altcoin Rally

While Ether enjoys fresh highs, Bitcoin’s market share has continued to slide. On Friday, Bitcoin’s dominance fell to around 60.7%, flirting with a crucial technical support level.

Rekt Capital suggested that while a short-term rebound in dominance to historic highs near 70% remains possible, the longer-term trajectory is likely downwards.

“And once that long-term technical uptrend is lost,” he explained, “BTC dominance will transition into a long-term technical downtrend. The long-term downside target would be a crash into the low 40%, maybe high 30% region.”

Such a decline in dominance would represent a dramatic shift in the crypto landscape, opening the door for altcoins like ETH to capture a significantly larger share of the overall market capitalisation.

ETH Bulls Eye All-Time Highs

With Ether now comfortably above $4,000, the next major target lies at its all-time high of just under $4,900. The combination of bullish technical setups, whale accumulation, and weakening Bitcoin dominance provides fertile ground for further gains.

However, analysts caution that profit-taking, macroeconomic factors, and sudden shifts in sentiment could introduce volatility. Still, the broader outlook remains optimistic, particularly as Ethereum continues to benefit from its central role in decentralised finance, NFTs, and the growing layer-2 scaling ecosystem.

For now, ETH’s resurgence marks a symbolic victory for altcoins in their battle for market share and with altseason sentiment heating up, the crypto market’s balance of power could be set for its most dramatic shift in years.

Leave a Reply