Ethereum Leads the Way in ETP Inflows

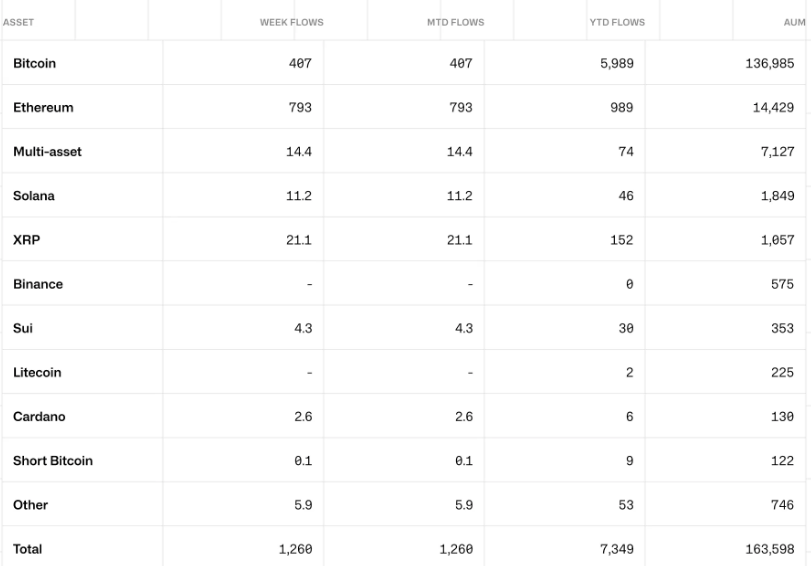

Ethereum-based exchange-traded products (ETPs) have outpaced Bitcoin ETPs in inflows for the first time in 2025, according to data from CoinShares. The cryptocurrency market saw its fifth consecutive week of inflows, with a total of $1.3 billion invested in crypto ETPs.

Ether (ETH) ETPs saw an impressive $793 million in inflows over the past trading week, marking a 95% increase over Bitcoin (BTC) ETPs. This surge came as ETH dropped below $2,700 on 6 February, triggering significant “buying-on-weakness,” CoinShares research director James Butterfill noted.

This marks a rare occurrence where Ethereum ETPs have outperformed Bitcoin in inflows, with the last such instances seen in late 2024.

Bitcoin Still Leads Year-to-Date Inflows

Despite Ether’s weekly dominance, Bitcoin remains the overall leader in year-to-date (YTD) inflows. Over the past trading week, Bitcoin ETPs saw inflows of $407 million, representing a 19% decline from the previous week.

However, Bitcoin ETPs have accumulated nearly $6 billion in inflows so far in 2025, standing 505% higher than Ethereum’s YTD total.

Altcoins Experience Surge in Inflows

Beyond Bitcoin and Ethereum, other altcoins also experienced notable increases in inflows. XRP ETPs rose by 45% week-over-week, increasing from $14.5 million to $21 million. Meanwhile, Solana ETPs recorded an impressive 148% surge, attracting $11.2 million in inflows.

Total Crypto ETP AUM Declines Despite Positive Inflows

Despite the continued investment in crypto ETPs, the total assets under management (AUM) in these products declined to $163 billion last week. This figure represents a 4% drop from the previous week and an 11% decline from the all-time high of $181 billion recorded in late January.

CoinShares’ Butterfill attributed the AUM decline to recent price fluctuations in the market, which have impacted the valuation of crypto assets.

BlackRock and Fidelity Funds See Contrasting Trends

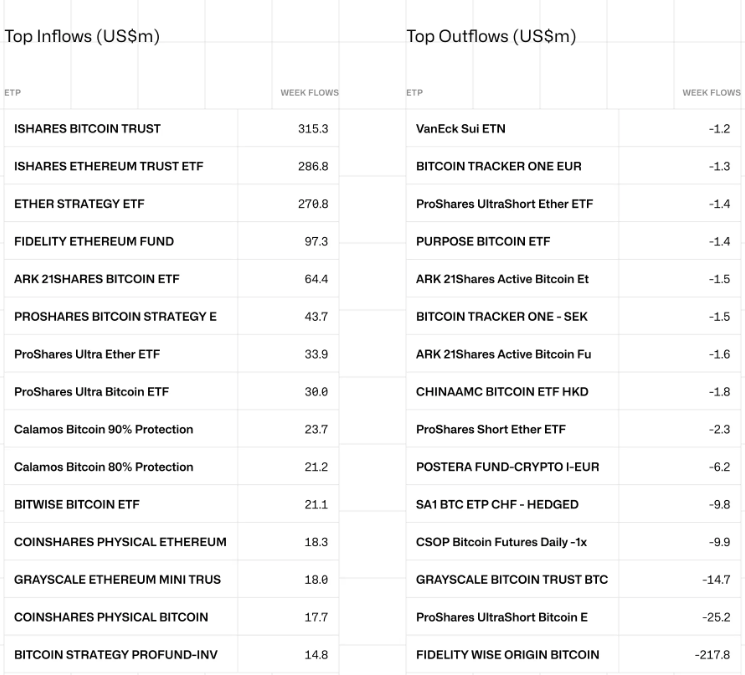

Among individual ETPs, BlackRock’s spot Bitcoin exchange-traded fund (ETF), iShares Bitcoin Trust (IBIT), led the way with $315 million in inflows last week.

Conversely, Fidelity’s Wise Origin Bitcoin Fund experienced the highest outflows, losing $217 million over the same period. This divergence highlights the shifting investor sentiment within the crypto ETP landscape.

With Ethereum making significant strides in inflows and altcoins gaining traction, the market continues to see dynamic shifts, indicating growing investor interest beyond Bitcoin.

Leave a Reply