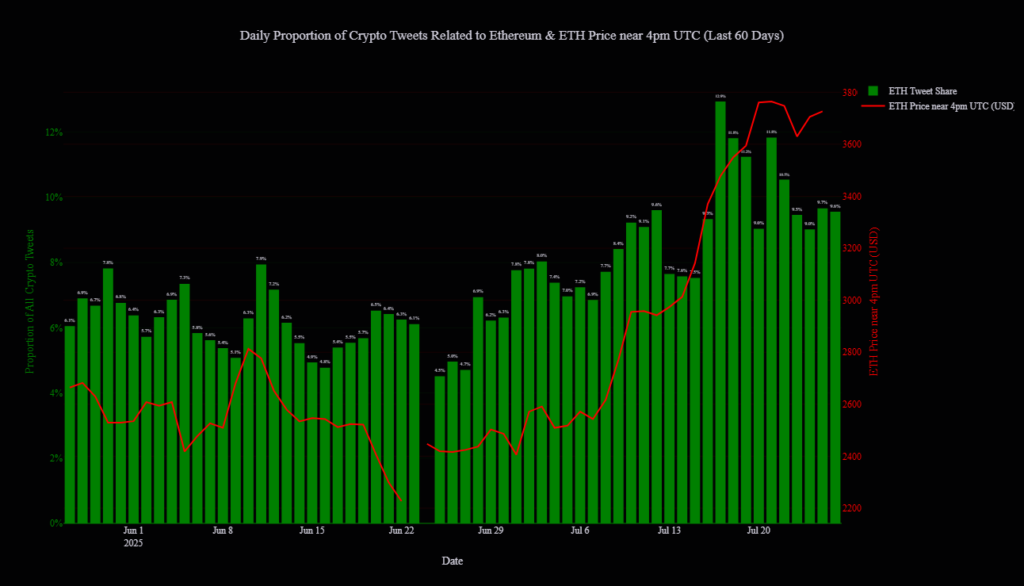

Ether’s recent surge has sparked renewed optimism in the cryptocurrency market, but rising concerns around social media hype could indicate a looming price correction. Blockchain analytics firm Santiment has flagged the rising “social dominance” of Ether as a potential warning sign that the rally may be approaching a short-term peak.

Santiment Warns of ‘Extreme Euphoria’

Ether’s price has climbed significantly in recent weeks, gaining over 50 percent in the past 30 days to trade at around $3,750, according to Nansen. However, Santiment’s latest report suggests that this sharp rise, coupled with a notable spike in social media discussions, could be a red flag.

“Social metrics are flashing warning signs,” Santiment stated. The firm noted that Ethereum’s price ratio against Bitcoin has soared by nearly 70 percent since early May, leading to what it describes as “extreme euphoria” among investors. According to the sentiment provider, when the social dominance of a cryptocurrency rises to unusually high levels, it often signals the asset is becoming overvalued.

“This suggests the asset is over-hyped and the trade is becoming crowded, increasing the risk of a price correction,” Santiment explained.

Signs the Rally May Still Continue

Despite the cautious tone, not all indicators point to an immediate pullback. Santiment highlighted that social dominance among memecoins is still relatively low, which may indicate that market-wide speculation has not yet reached its peak.

“A true marketwide top is often characterised by widespread, irrational speculation, and the absence of that could suggest this rally isn’t over,” Santiment said. In other words, the current optimism around Ether may still have room to grow before the market becomes overly saturated.

Corporate Interest Adds Momentum

Fueling the positive sentiment further is increasing institutional interest in Ether. Major firms such as SharpLink Gaming and Bitmine Immersion Technologies have made significant ETH purchases recently, sparking discussions about a growing trend of Ether adoption among corporate treasuries.

Santiment analyst Maksim Balashevich likened this shift to the “Michael Saylor for Ether” phenomenon, referencing the MicroStrategy CEO’s high-profile accumulation of Bitcoin. Balashevich believes that such adoption could be a key catalyst driving Ether to new all-time highs.

Meanwhile, Galaxy Digital CEO Michael Novogratz weighed in, saying that due to the limited supply of ETH, the asset could outperform Bitcoin over the next three to six months. His comment underscores a broader market view that Ether may offer stronger short-term upside potential than Bitcoin, especially with increasing institutional demand and limited available supply.

Bitcoin Also Showing Signs of Overheating

The concerns raised by Santiment are not limited to Ether. The firm also issued a similar cautionary note about Bitcoin, pointing out its elevated social media dominance. According to analyst Brian Quinlivan, nearly half of all crypto-related discussions online last week centred around Bitcoin, particularly as it hit a new record high of $123,100.

“As Bitcoin’s market value crept above $123.1K for the first time in its 17-plus year history, there was an equally historic social dominance spike,” Quinlivan said. He warned that such a spike could signal a local top and the potential for a short-term price retreat.

Looking Ahead

While both Ether and Bitcoin remain in strong uptrends, analysts caution that investor sentiment should not be ignored. Social media buzz can be a powerful force, but historically, extreme euphoria has often preceded corrections in the crypto market.

Traders and investors may need to stay alert and assess whether the current rally is driven more by fundamentals or hype. With Ether enjoying a strong tailwind from institutional support, it may continue to rise in the near term. However, elevated levels of social chatter could indicate that a cooling-off period is not far off.

As always in the volatile world of cryptocurrency, timing and perspective are key.

Leave a Reply