Corporate cryptocurrency treasuries have collectively surpassed $100 billion in digital asset holdings, according to a new report by Galaxy Research. This marks a pivotal moment in institutional adoption, as publicly traded firms increasingly use crypto assets, primarily Bitcoin and Ether as part of their financial strategies.

The bulk of the holdings comes from Bitcoin, with over 791,662 BTC, worth approximately $93 billion, now held by corporate entities. This represents nearly 4% of Bitcoin’s circulating supply. However, attention is swiftly shifting toward Ether (ETH), with corporate treasuries holding around 1.3 million ETH, currently valued at over $4 billion.

These developments position corporate treasuries as a new and influential category within the crypto ecosystem, offering fresh liquidity and validating digital assets as institutional-grade instruments.

Ether Gaining Ground with Institutions

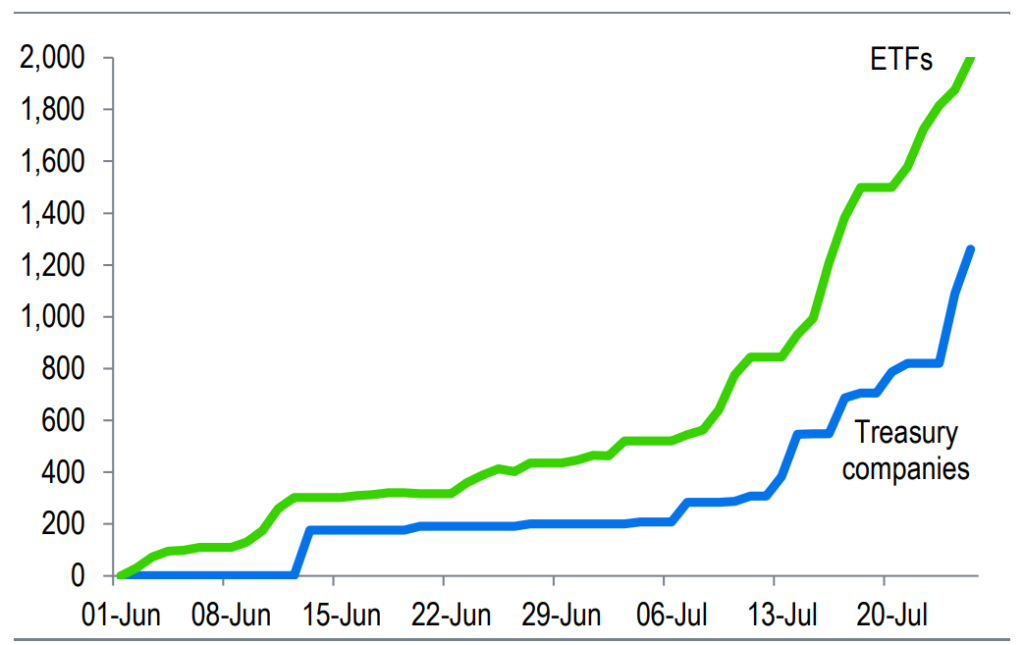

Although Bitcoin remains the dominant crypto treasury asset, Ether is increasingly being recognised as a legitimate store of value and strategic holding. Recent data shows a sharp uptick in corporate interest in ETH, fueled by both direct treasury acquisitions and exchange-traded fund (ETF) investments.

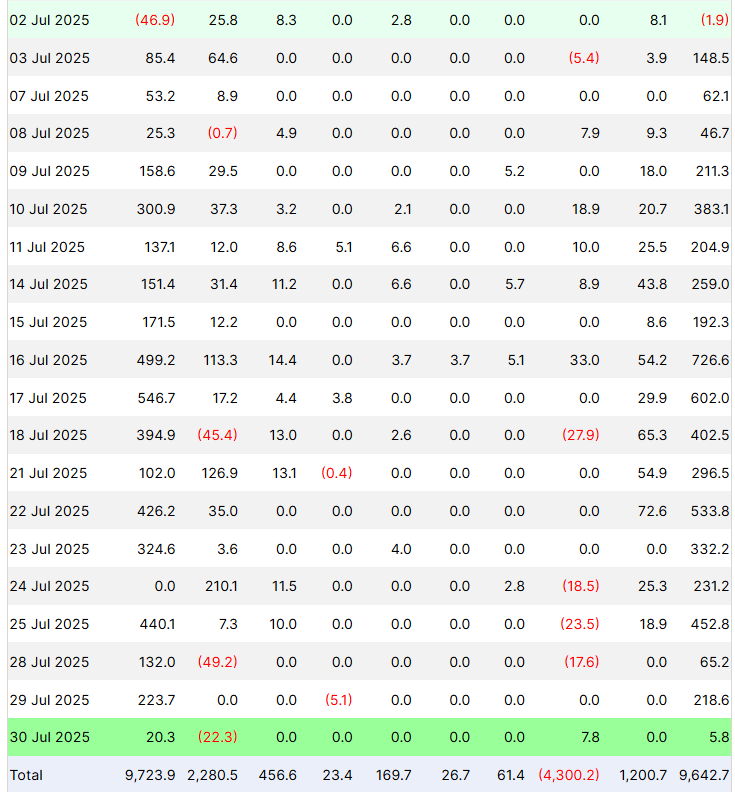

According to Farside Investors, U.S. spot ETH ETFs have recorded 19 consecutive days of net inflows, accumulating $5.3 billion worth of Ether since 3 July. This sets a record streak for the newly launched funds and reflects a growing appetite for Ether exposure among both corporations and retail investors.

Standard Chartered’s latest forecast pins a year-end price target of $4,000 for Ether, underpinned by increasing institutional accumulation and positive ETF momentum. The bank further anticipates that corporate buyers could eventually hold up to 10% of Ether’s total supply, a tenfold increase from current levels.

Beyond Holding: Active Use of Ether

Unlike Bitcoin, which is primarily used as a passive store of value, Ether offers corporations the added benefit of staking yields and decentralised finance (DeFi) utility. According to Enmanuel Cardozo, a market analyst at tokenisation platform Brickken, companies are not merely sitting on ETH; they are staking it, leveraging it, and integrating it into broader financial operations.

“This shift is happening faster than it did with Bitcoin,” Cardozo noted. “Ether’s programmability and yield-generating potential make it more dynamic and attractive for treasury strategies.”

The increased use of staking allows firms to earn passive income while holding the asset, strengthening Ether’s case as a long-term treasury tool, particularly in an era where yield and capital efficiency are increasingly critical.

The Road to $4,000 and Beyond

Despite these bullish indicators, Ether is still trading 21% below its all-time high of $4,890, recorded in November 2021. Analysts believe that reclaiming this level in the near term would require ideal market conditions, including sustained ETF inflows, macroeconomic stability, and positive regulatory developments.

While the next all-time high might not materialise until late 2025, current trends point to a broader revaluation of Ether. The growing role of corporate treasuries and ETFs is laying the groundwork for this potential breakout.

“Corporate crypto treasury companies have become a global phenomenon,” said Cardozo. “We’re witnessing the early stages of institutional redefinition in the digital asset space, particularly around Ether.”

The rise of corporate crypto treasuries marks a key milestone in the integration of blockchain assets into mainstream finance. With over $100 billion now held across Bitcoin and Ether, and Ether rapidly gaining traction due to its yield-generating capabilities, the stage is set for deeper institutional involvement in crypto.

As companies shift from passive holding to active engagement with Ether, and ETF inflows remain steady, the asset is poised for a long-term revaluation, one that could reshape treasury strategies across industries.

Leave a Reply