Ether (ETH) is edging closer to its all-time high amid a wave of bullish signals, with traders forecasting the cryptocurrency could climb to as much as $13,000 in the coming months. Strong inflows into spot Ethereum exchange-traded funds (ETFs), increased institutional accumulation, and a surge in network activity are fuelling optimism for a sustained rally.

ETH Breaks Above $4,600 as Rally Intensifies

On Wednesday, ETH rose above $4,600, marking an 8% gain in the past 24 hours. The cryptocurrency reached an intraday high of $4,715, just shy of its record of $4,867 set in November 2021, according to TradingView data. Onchain data provider Glassnode noted that Ethereum has “served as a bellwether for broader altcoin performance”, with its recent momentum sparking speculation of further upside.

Billions Flow into Spot Ethereum ETFs

Investor confidence has been underscored by significant capital inflows into spot Ethereum ETFs, which have seen a six-day streak totalling $2.3 billion. Monday recorded a record $1 billion in net inflows, while NovaDius president Nate Geraci highlighted that spot ETH ETFs have attracted nearly $1.5 billion more than spot Bitcoin ETFs since the start of July. Institutional interest is also on the rise, with treasury holdings of ETH now exceeding $16.5 billion. BitMine Immersion Technologies leads the list with 1.2 million ETH (worth $5.33 billion), followed by SharpLink Gaming with 598,800 ETH — a 177% increase in the past month — and The Ether Machine with 345,400 ETH. Over 30% of ETH supply is staked, reducing immediate selling pressure and potentially supporting further price appreciation.

Ethereum Network Sees Record Activity

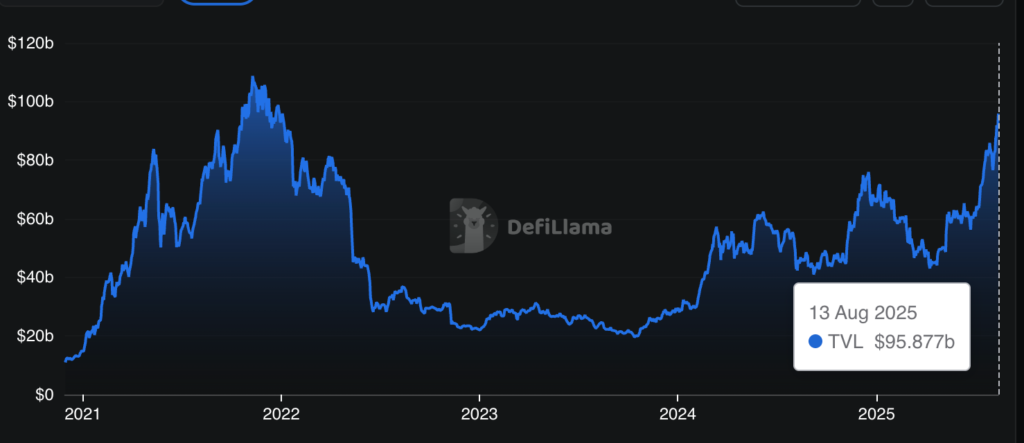

Ethereum’s network activity is approaching historic highs, with daily transactions surpassing 1.87 million on Tuesday. July 2025 recorded roughly 50 million transactions — the highest in over a year. Decentralised finance (DeFi) activity remains robust, with the total value locked (TVL) in DeFi protocols nearing $95 billion and Ethereum maintaining a dominant 61% market share. This combination of high transaction volume and strong DeFi adoption underscores growing demand and utility for the network.

Key Resistance Levels and Breakout Potential

Analysts have identified the $4,700–$4,750 range as a critical resistance zone. Glassnode’s latest report noted that $4,700 is the +1 standard deviation level of Ether’s active realised price, where selling pressure often emerges. A break above $4,750, particularly alongside strong transaction momentum, could trigger a “price discovery phase”, according to Cryptoquant analyst CryptoOnchain.

Price Targets Range from $7,000 to $13,000

Market analysts are increasingly optimistic about ETH’s prospects beyond the current rally. Analyst Jelle pointed to ETH trading above a bullish megaphone pattern, suggesting potential upside targets between $7,000 and $13,000. Crypto investor and YouTuber DivXMaN maintained a $7,500 target but noted that based on historical bull market patterns and diminishing returns, the rally could extend to $13,000. Other forecasts have been even more ambitious, with some suggesting that ETH could reach $20,000 in the ongoing bull cycle if momentum continues.

Leave a Reply