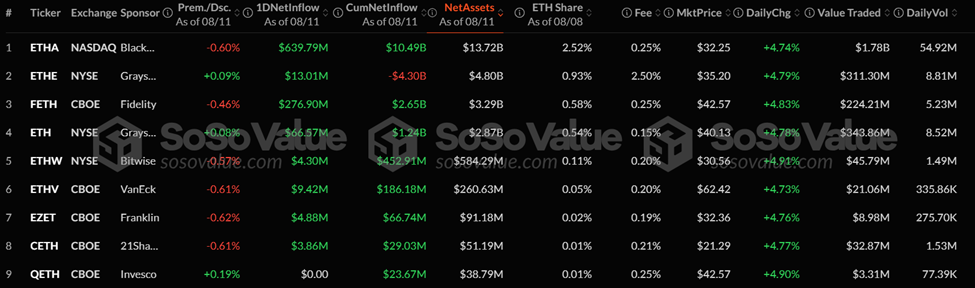

On 11 August, US spot Ethereum ETFs recorded a combined net inflow of $1.019 billion, the largest single-day intake since these products launched. BlackRock’s iShares Ethereum Trust (ETHA) led the surge with about $640 million in net inflows.

Fidelity’s Ethereum ETF also reached new highs the same day. By comparison, spot Bitcoin ETFs took in $178 million on 11 August, with BlackRock’s IBIT contributing $138 million of that total.

Why this is a milestone

This marks the first time Ethereum ETFs have passed the $1 billion daily inflow threshold. The size and speed of the move show that professional and institutional investors are moving from initial curiosity to confident allocation. Many in traditional finance took longer to grasp Ethereum’s case because, unlike Bitcoin’s simple “digital gold” story, Ethereum is a multifunctional blockchain that supports decentralised finance (DeFi), tokenisation, smart contracts and Web3 applications.

Industry voices point to a changing narrative. Nate Geraci, president of the ETF Store, said investors are beginning to hear a clearer story about Ethereum: not just a speculative asset, but “the backbone of future financial markets.” On social channels, commentators including Crypto Patel have warned of strong short-squeeze potential if price action remains firm saying that continued demand from spot ETFs, coupled with derivatives and tight supply, could create rapid upside moves.

Market dynamics behind the inflows

Several supply-and-demand factors are tightening Ethereum’s available float. Roughly 30% of the total ETH supply is now staked, reducing the amount available to trade. Exchange reserves are near record lows, which leaves fewer tokens sitting on exchanges ready to be sold. At the same time, derivatives activity has picked up: open interest in Binance ETH futures reportedly climbed to about $10 billion, up 46% over the prior month, while short positions have reportedly risen 500% year-on-year. These dynamics increase the potential for higher volatility and sharper moves in price.

Price reaction and technical context

Ethereum’s market price moved past $4,300 around the same time as the ETF flows, putting it close to its all-time high of $4,868 recorded on 8 November 2021.

Analysts note that sustained trading above key levels such as $4,400 could force short positions to cover, accelerating upward momentum. But rapid moves can also reverse quickly; the same supply compression that helps push prices higher can amplify downside if sentiment shifts.

Institutional interest and industry changes

The inflows come amid structural changes in the ETF industry and growing Wall Street engagement with crypto products. Big asset managers launching or supporting spot Ethereum ETFs have made exposure easier for pension funds, family offices and wealth managers. As these traditional investors learn Ethereum’s broader use cases, allocations that were once tentative are becoming more decisive.

What it means for the wider market

If the current trend continues, Ethereum ETFs could become a meaningful driver of demand for ETH and a catalyst for increased liquidity across the crypto market. Greater institutional participation tends to bring deeper order books and potentially lower volatility over time, but the combination of spot demand, active derivatives markets and limited supply creates a short-term environment ripe for sharp moves in either direction.

The $1.019 billion inflow day is an important signal: institutional investors are now treating Ethereum as more than an experimental asset. That shift does not remove risks, volatility, regulatory changes and derivatives-driven squeezes remain real, but it does mark a clear step towards mainstream adoption. For investors and observers, the next questions are whether ETF-driven demand will persist and how it will interact with staking, exchange reserves and derivative positions in the weeks and months ahead.

Leave a Reply