Ethereum is experiencing its largest validator exit in history, with over $5 billion worth of Ether (ETH) now waiting to be withdrawn from staking. The development has raised questions about potential selling pressure, even as analysts highlight strong institutional demand that could balance the market.

Record Validator Exodus

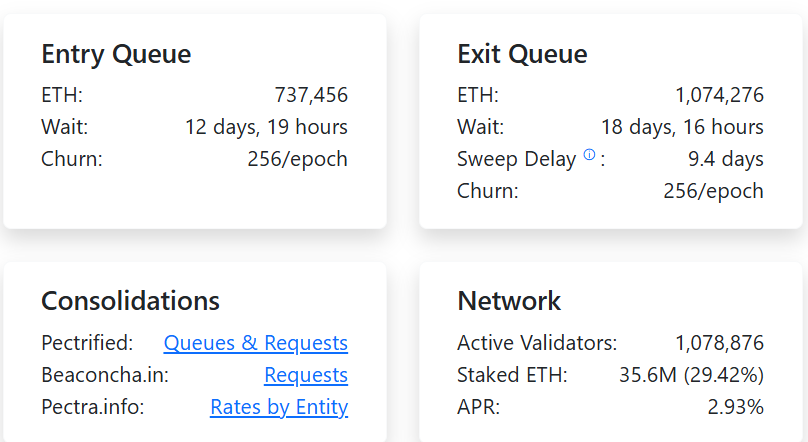

On Thursday, Ethereum’s exit queue crossed the milestone of 1 million ETH, valued at around $4.96 billion. Validators, who are crucial to the network by verifying transactions and adding new blocks in Ethereum’s proof-of-stake (PoS) system, have been exiting at an unprecedented rate.

This surge has extended the exit queue to a record 18 days and 16 hours, according to blockchain data provider ValidatorQueue. While not every validator is expected to sell their withdrawn Ether, a portion may choose to lock in profits after Ether’s 72% rally over the past three months.

Analysts Stress Market Stability

Despite fears of mass selling, experts believe the situation reflects natural market dynamics rather than instability.

“The exit queue hitting 1 million ETH reflects healthy market dynamics rather than a cause for concern,” said Marcin Kazmierczak, co-founder of RedStone, a blockchain oracle firm.

He emphasised that institutional capital continues to flow into Ethereum, with public investment vehicles such as treasury firms and exchange-traded funds showing strong appetite. This “unprecedented demand” is expected to easily absorb any validator sales.

Ether Seen as a Liquidity Magnet

Analysts continue to view Ether as the “liquidity magnet” of the crypto market. Open interest in Ether futures is approaching $33 billion, a sign of consistent institutional interest, according to Iliya Kalchev, dispatch analyst at digital asset platform Nexo.

“Standard Chartered reiterated that ETH and ETH-treasury firms remain undervalued even at these levels, projecting a $7,500 year-end target,” Kalchev noted. He also highlighted that prediction market Polymarket is currently pricing a 26% chance of ETH reaching $5,000 before the end of the month.

Ethereum, he added, looks “primed to test $5,000,” with investor sentiment likely to be influenced by key US economic data, including jobless claims and the Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditure Price Index (PCE).

Entry Queue Highlights Ongoing Staking Activity

While withdrawals have surged, staking activity remains significant. Data shows that 737,000 Ether are waiting in the entry queue to be staked, with an average waiting period of 12 days and 19 hours.

Ethereum’s network continues to display strong fundamentals, with over 1 million active validators and more than 35.6 million Ether staked, representing about 29.4% of total supply.

Outlook

The validator exit marks a historic moment for Ethereum, yet experts argue that strong institutional demand is more than capable of offsetting potential selling pressure. With Ether trading at $4,507 and analysts pointing to targets as high as $7,500, the cryptocurrency’s role as a cornerstone of the digital asset market appears secure.

Leave a Reply