Ethereum is stealing the spotlight from Bitcoin this week, as surging capital inflows into Ethereum-backed exchange-traded funds (ETFs) push the leading altcoin ahead of the world’s largest cryptocurrency. Institutional appetite for ETH appears to be strengthening, setting the stage for potential price gains if momentum continues.

Ethereum ETF Inflows Outpace Bitcoin by a Wide Margin

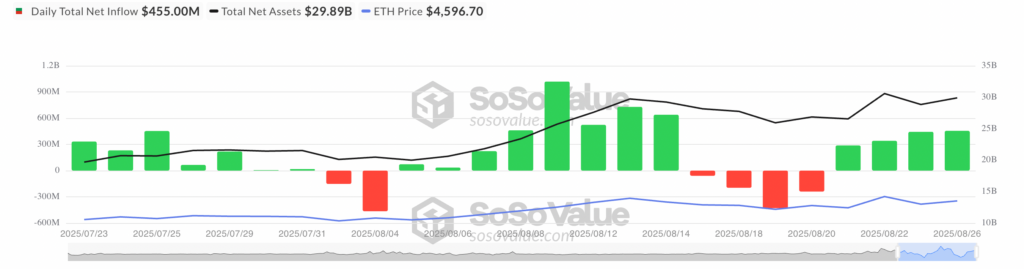

According to data from SosoValue, Ethereum ETFs have seen inflows of more than $1.8 billion since 21 August, far outstripping Bitcoin’s inflows of $388.45 million over the same period. This marks a significant shift in institutional interest, as large investors tilt capital flows towards ETH at the expense of BTC.

Ethereum’s ETF inflows have been consistently robust throughout the week, peaking at $455 million on 26 August. In contrast, Bitcoin has struggled to maintain positive inflows, with several days of net outflows dragging sentiment. On 21 August alone, BTC ETFs recorded nearly $200 million in withdrawals, highlighting waning demand relative to Ethereum.

This surge in ETH demand has directly translated into stronger price performance. Over the past week, ETH has climbed 7%, while BTC has slipped 0.32% in value, underlining the divergent momentum between the two top cryptocurrencies.

Derivatives Market Signals Growing Bullishness

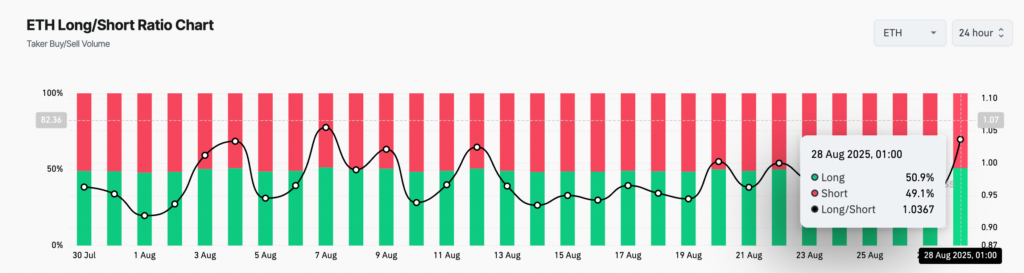

The optimism around ETH is not limited to spot markets and ETFs. Derivatives data also suggests traders are increasingly betting on further gains. According to CoinGlass, Ethereum’s long/short ratio currently stands at 1.03, meaning long positions slightly outweigh shorts.

A long/short ratio above 1 signals that more traders expect prices to rise than fall. For ETH, this indicates that the ETF-driven momentum is being reinforced by speculative positioning in futures and options markets. By contrast, Bitcoin’s sentiment has been more subdued, reflecting the weaker inflow dynamics seen in ETF markets.

This bullish tilt could provide ETH with the fuel for a potential upside breakout if momentum persists.

Technical Indicators Support Uptrend

Market indicators further validate Ethereum’s bullish outlook. The Parabolic Stop and Reverse (SAR) indicator on the ETH/USD daily chart currently places its dots below the price at $4,225, offering a level of dynamic support.

The Parabolic SAR is a widely used momentum indicator that tracks potential trend reversals. When its dots are positioned beneath an asset’s price, it typically indicates the market is in an uptrend. For ETH, this technical signal suggests that buyers remain in control, and the rally could continue if demand holds.

If the ETF inflow momentum sustains, analysts project that Ethereum’s price could advance toward $4,957. Conversely, if buying pressure fades and inflows slow, ETH risks retracing towards support near $4,221.

Institutional Shift Marks a Turning Point

The sharp divergence in ETF flows highlights a potential turning point in institutional sentiment. For years, Bitcoin has been the default gateway for institutional investors into digital assets, thanks to its status as the largest and most established cryptocurrency. However, Ethereum’s ecosystem with its smart contracts, decentralised applications, and staking mechanisms is increasingly seen as a cornerstone of blockchain’s real-world utility.

The fact that ETH ETFs have not only attracted billions but also outpaced BTC ETFs by such a margin in a short span underscores a growing conviction that Ethereum may hold greater near-term upside potential. Should this trend persist, Ethereum could consolidate its position as the leading alternative to Bitcoin and perhaps even rival it in terms of institutional dominance.

ETH Eyes $5K as Momentum Builds

Ethereum’s combination of surging ETF inflows, bullish derivatives positioning, and supportive technical signals sets a positive backdrop for price action in the weeks ahead. If institutional buying pressure remains consistent, ETH could realistically test the $5,000 level in the near term.

However, the outlook is not without risks. A slowdown in ETF inflows or broader weakness in crypto markets could put ETH under pressure, with the $4,221 support zone acting as the key level to watch on the downside.

For now, though, Ethereum’s outperformance is clear. By outpacing Bitcoin both in capital flows and in weekly returns, the altcoin has reasserted its strength and traders are increasingly betting that this rally may just be getting started.

Leave a Reply