Ethereum has reached a major milestone, surpassing Bitcoin’s monthly trading volume for the first time in seven years. The development, recorded in August, highlights Ethereum’s growing dominance as both institutional and retail investors flock to the asset. But with ETH’s price now cooling after touching new highs, the question remains: can Ethereum sustain its momentum?

Ethereum Breaks Bitcoin’s Streak

According to CCN’s analysis, Ethereum’s trading volume on centralised exchanges hit $480 billion in August, eclipsing Bitcoin’s $401 billion. This marks the first time since 2017 that ETH has overtaken BTC in monthly trading activity.

The significance of this flip cannot be understated. Bitcoin has long been the market leader in trading volume and liquidity. Ethereum’s surge represents a shift in investor focus, particularly as ETH rallied more than 50% in August compared with Bitcoin’s modest 10% rise.

The surge in Ethereum’s volume coincided with its climb to a fresh all-time high before retracing to $4,344. The move suggests traders and institutions are increasingly treating Ethereum as more than a secondary digital asset.

ETFs and Institutional Demand Fuel ETH

One of the key drivers behind Ethereum’s dominance in August was institutional inflows into ETH exchange-traded funds (ETFs). Market watchers point to demand from institutional players, including firms like SharpLink, which added to the buying pressure.

ETFs have opened the door for traditional investors to gain exposure to Ethereum without directly holding the token. As a result, inflows have boosted spot market liquidity and overall trading volume, contributing to ETH’s outsized gains compared with Bitcoin.

Despite the momentum, ETH is now facing resistance at the $4,500 mark. Meanwhile, Bitcoin is struggling to reclaim its psychological barrier at $110,000. Both assets have cooled off, raising uncertainty about whether the August rally can extend deeper into September.

ETH/BTC Signals Bullish Momentum

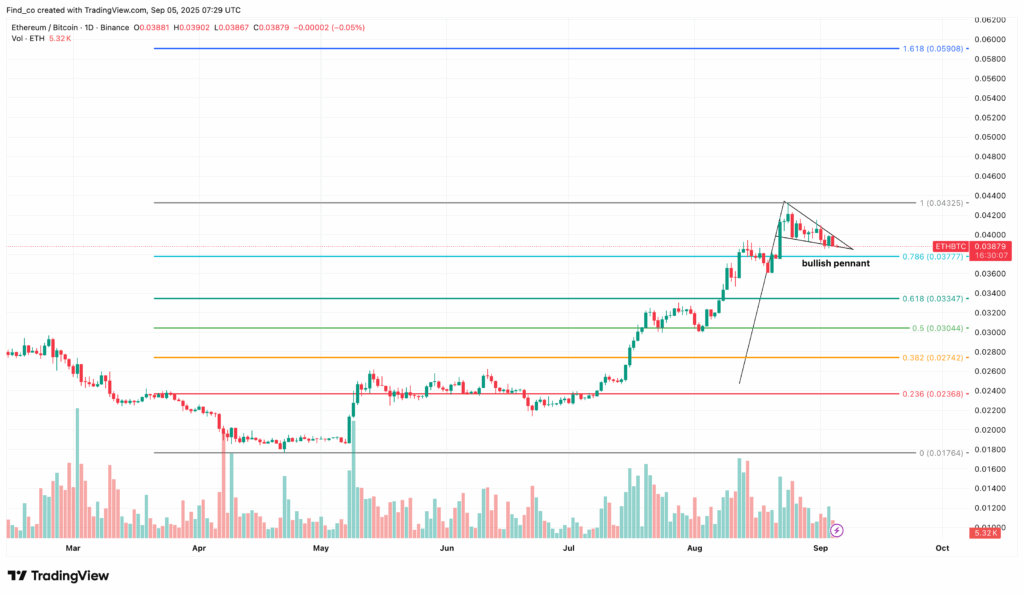

Technical analysis of the ETH/BTC pair suggests Ethereum may continue to strengthen against Bitcoin. On the daily chart, ETH/BTC has formed a bullish pennant, a pattern that typically appears after a sharp upward move.

The pennant formation indicates consolidation within narrowing trendlines before a possible breakout. If ETH/BTC breaks to the upside, it would confirm buyers are firmly in control, potentially driving ETH to outperform Bitcoin in the broader market.

Historically, such moves have led to significant rallies in ETH’s dollar value. Analysts suggest that if validated, the pair could retest 0.043 in the near term and possibly climb to 0.059 if bullish market conditions return.

This signals not only relative strength against Bitcoin but also the potential for ETH/USD to extend its recent recovery.

Ethereum’s Price Outlook: Bull Flag and Breakout Potential

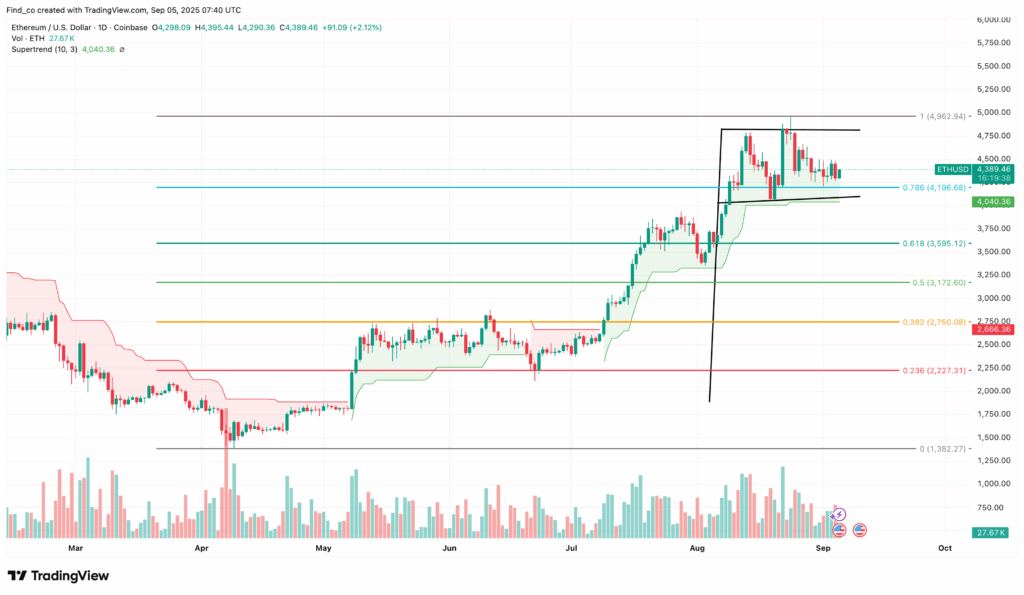

Ethereum’s daily price chart offers further reasons for optimism. The Supertrend indicator remains below the current price, reinforcing the prevailing bullish bias. At the same time, ETH has formed a bull flag pattern, which often precedes another strong upward leg.

If ETH’s trading volume continues to exceed Bitcoin’s in September, these technical structures suggest the rally could continue. A breakout from the bull flag may push ETH back to $4,962, with some analysts eyeing a move above $5,500 before the month closes.

However, downside risks remain. Should demand weaken, ETH could slide back to $4,196 or even test lower support near $3,595. Market sentiment around Bitcoin’s performance and macroeconomic conditions will also play a role in shaping Ethereum’s trajectory.

The Bigger Picture

ETH overtaking Bitcoin in trading volume underscores its rising prominence in the crypto ecosystem. While Bitcoin remains the benchmark digital asset, Ethereum’s expanding use cases from decentralised finance to ETFs are fuelling a broader shift in investor behaviour.

Whether ETH can sustain this lead will depend on continued institutional support, favourable technical patterns and the ability to break through resistance levels. If successful, ETH may not only extend its dominance over Bitcoin in trading activity but also solidify its role as a central player in the next phase of the crypto bull cycle.

Leave a Reply