Ethereum is under increasing pressure after failing to breach the long-anticipated $5,000 mark earlier this month. The world’s second-largest cryptocurrency by market capitalisation is now struggling to maintain its footing above $4,500, with selling activity intensifying and technical indicators flashing red.

Profit-Taking Picks Up Pace

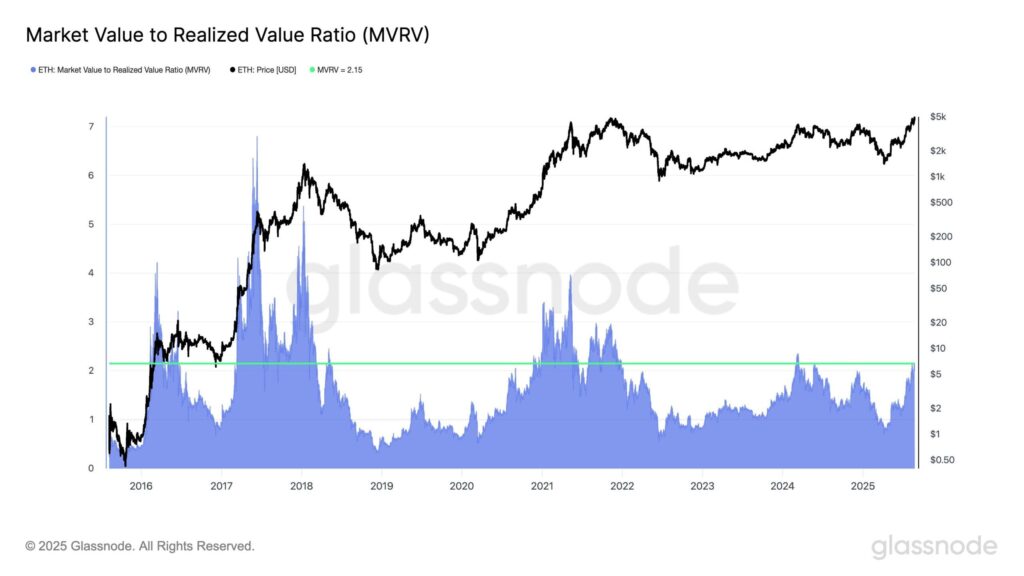

Recent on-chain metrics highlight a sharp rise in profit-taking among Ethereum holders. The Market Value to Realised Value (MVRV) ratio for ETH currently stands at 2.15, suggesting that investors, on average, are sitting on more than double their initial capital as unrealised gains. Historically, similar levels have coincided with waves of selling, as witnessed in March 2024 and December 2020, both periods followed by increased volatility and sizeable corrections.

The timing of this MVRV peak is telling. Investors appear keen to lock in profits before momentum stalls, a trend that has often triggered market pullbacks in the past. In line with this, exchange data points to rising sell-side pressure.

Billions in ETH Flow to Exchanges

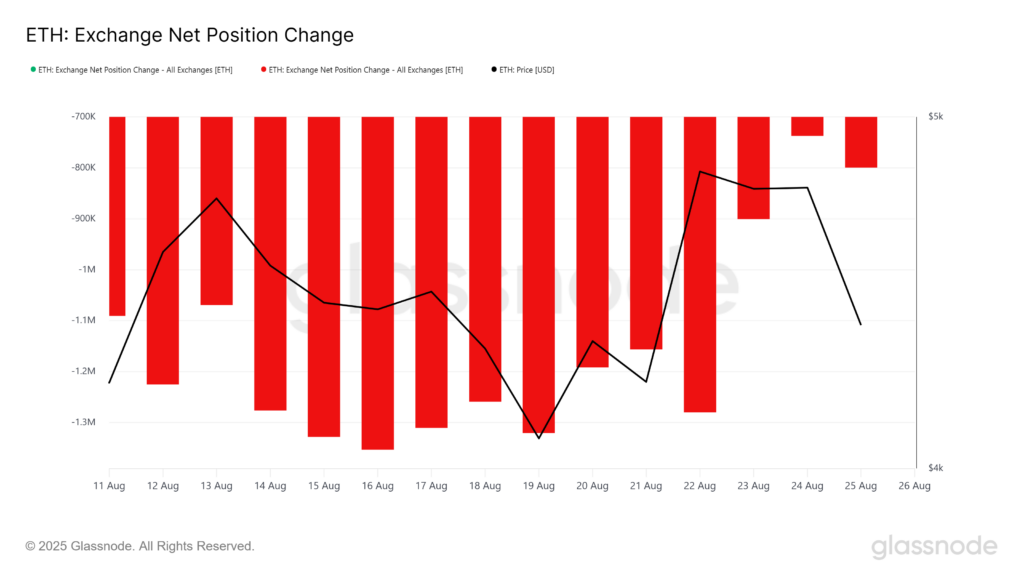

Ethereum has seen a significant shift from accumulation to distribution over the past week. More than 521,000 ETH worth in excess of $2.3 billion has been transferred to centralised exchanges. Such large inflows typically indicate that investors are preparing to offload assets, rather than store them securely.

This move represents widespread profit-taking across the Ethereum market, further weakening bullish momentum. Combined with the elevated MVRV ratio, these exchange flows amplify the risk of a near-term downturn. Analysts warn that the correlation between current behaviour and past market cycles suggests Ethereum may be entering a phase of extended correction.

Key Levels Under Threat

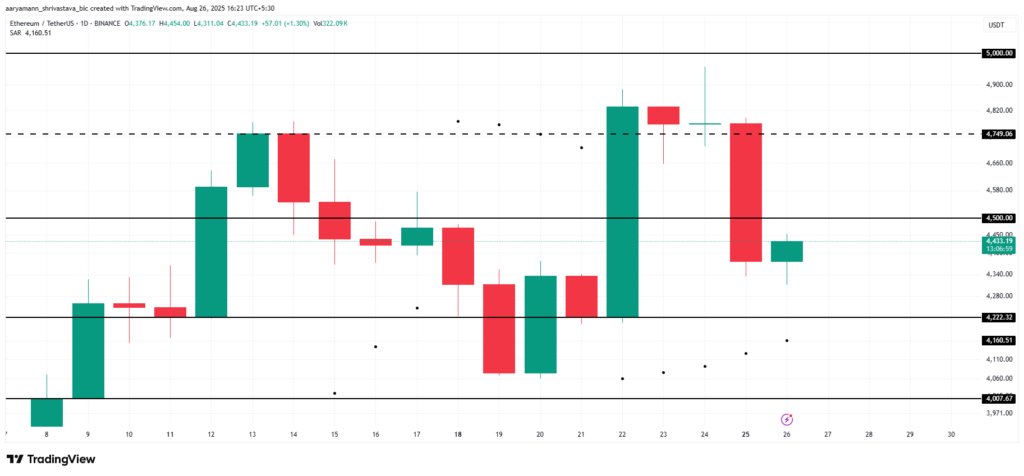

At the time of writing, Ethereum is trading at $4,433, sitting just below the $4,500 resistance level. The failure to reclaim this level as firm support highlights fragility in Ethereum’s price structure. Without renewed buying pressure, ETH risks testing lower ranges.

The immediate support lies at $4,222. A decisive break below this threshold could pave the way for a drop towards $4,007 a level that, if breached, would confirm broader selling trends. Such a move would align closely with the on-chain indicators suggesting that profit-taking is overwhelming bullish sentiment.

On the flip side, if selling pressure eases, Ethereum could attempt a rebound. A successful bounce from $4,222 might allow the asset to reclaim $4,500, and if momentum strengthens further, the next upside target sits near $4,749. This recovery, however, would require fresh buying enthusiasm to counter the current wave of distribution.

Market Outlook Remains Fragile

Ethereum’s near-term trajectory remains uncertain, but the outlook is clouded by rising sell-side activity. With billions worth of ETH flowing into exchanges and investors eager to lock in gains, the likelihood of continued downward pressure remains high.

The MVRV ratio, coupled with historical precedents, indicates that Ethereum may not yet have fully shaken off profit-taking cycles. While long-term fundamentals for the altcoin king remain intact driven by its pivotal role in decentralised finance and broader blockchain adoption, short-term price action appears vulnerable to sharper corrections.

For now, the $4,222 support stands as the key battleground. A hold above this level could help stabilise price action, but a breakdown may open the door for Ethereum’s slide toward $4,000, a level that traders and investors alike will be watching closely.

Leave a Reply