Ethereum (ETH) recently soared to a new all-time high (ATH) of $4,953, sparking excitement across the crypto market. Traders and investors were quick to eye the much-anticipated $5,000 milestone. However, after briefly touching its ATH, ETH slipped below $4,700.

At first glance, this retreat might appear as a sign of weakness. Yet, technical patterns, on-chain data, and whale activity suggest the move is more of a healthy pause than a breakdown. With bullish momentum building, Ethereum could soon attempt another breakout above resistance.

A Strong Rally After a Key Breakout

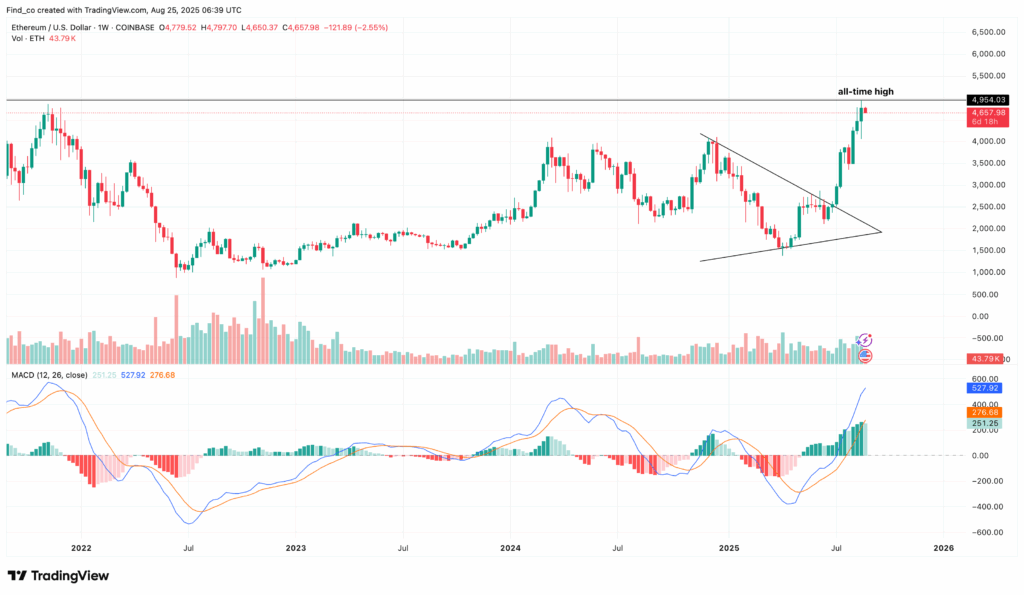

Ethereum’s record high followed a decisive breakout from a symmetrical triangle pattern on the weekly chart. This technical formation typically indicates consolidation, where price action compresses between lower highs and higher lows before an explosive move in either direction.

In this case, ETH broke through the upper trendline, confirming bullish momentum. The rally was further supported by the Moving Average Convergence Divergence (MACD) indicator. The 12-day Exponential Moving Average (EMA) recently crossed above the 26-day EMA, creating a bullish crossover.

This type of crossover is widely seen as a strong buy signal, and if sustained, it suggests Ethereum has room to challenge overhead resistance and push higher.

Exchange Outflows and Whale Accumulation

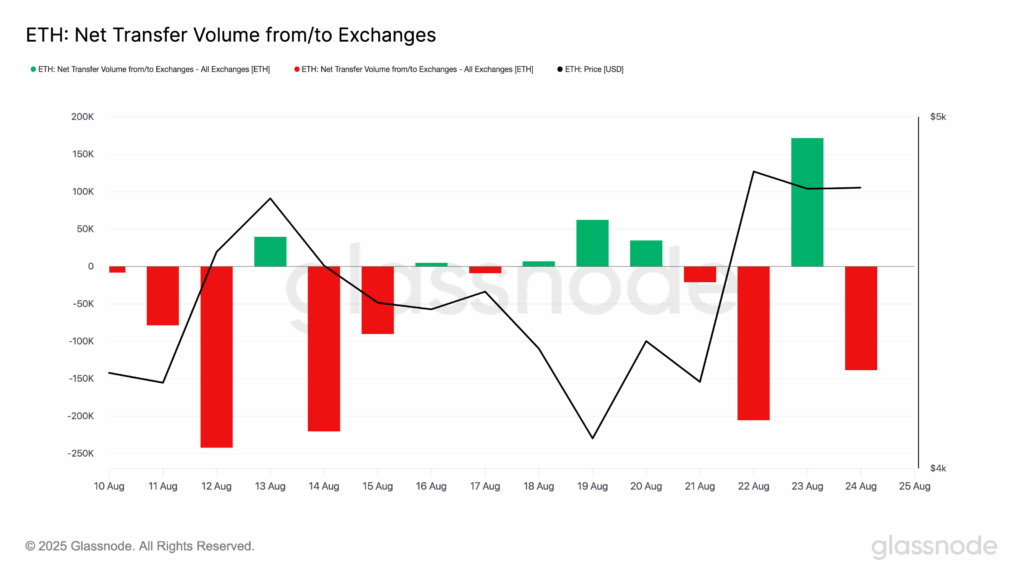

Beyond technical signals, on-chain data shows declining selling pressure, which played a key role in driving Ethereum to its new ATH. According to Glassnode, the net ETH transfer volume to exchanges dropped sharply, with a negative flow of -138,656 recorded.

A negative exchange flow means more ETH is leaving exchanges than entering. This reduces the available supply for immediate selling, often leading to stronger upward price movements. So far, there has been no sharp increase in inflows, meaning selling pressure remains low.

Adding further strength to the bullish outlook, whales on Binance have been actively accumulating ETH. Large-scale buying by whales signals strong confidence in Ethereum’s long-term potential and reduces available liquidity in the market. As whales add to their positions, it creates speculation that ETH could break the $5,000 barrier sooner than expected.

Crypto analyst Darkfost highlighted this trend, noting that whales typically prefer to enter after a trend reversal has been confirmed. This strong accumulation not only supports Ethereum’s uptrend but could provide the momentum needed to surpass resistance.

Bullish Continuation Patterns on Lower Timeframes

On the 4-hour chart, Ethereum’s pullback appears to have formed a bull flag, a classic bullish continuation setup. Such patterns usually emerge after a strong rally and signal the potential for another upward move once the consolidation phase ends.

Additional indicators also support the bullish outlook. The Supertrend indicator has flipped green, providing a buy signal, while the Chaikin Money Flow (CMF) has climbed above zero, reflecting strong capital inflows and rising buying pressure.

If these conditions persist, Ethereum is well-positioned to break its $4,950 resistance and move beyond $5,000 in the short term.

Price Outlook: What Comes Next for ETH?

Looking ahead, Ethereum remains in a strong uptrend, and the recent retreat seems more like a pause than a reversal. If bullish momentum continues, analysts suggest ETH could rally to new highs beyond $5,000, with the next significant target around $6,708 before the current cycle concludes.

Institutional participation could also play a key role in driving prices higher. Reports suggest that major institutions such as BlackRock and SharpLink Gaming may continue buying ETH, further fuelling long-term demand.

However, risks remain. If selling pressure rises and demand weakens, Ethereum could face a pullback towards $4,321, a key support level. Traders should therefore keep an eye on both exchange flows and whale activity as these remain critical indicators of ETH’s next move.

Ethereum’s retreat from its all-time high should not be mistaken for weakness. The breakout from a symmetrical triangle, positive MACD crossover, exchange outflows, and whale accumulation all point to sustained bullish momentum.

With technical and on-chain data aligned, Ethereum appears ready to challenge the $5,000 psychological barrier in the near term. Whether it reaches higher targets like $6,708 will depend on market sentiment and continued institutional interest. For now, the uptrend remains intact, and ETH looks set for another attempt at uncharted territory.

Leave a Reply