Ethereum has climbed back above a crucial long-term trendline, reviving optimism that the recent correction has ended and a major price rally could be underway. The move comes as whales resume heavy accumulation and spot Ethereum exchange traded funds record their strongest inflows in weeks.

ETH Reclaims 50 Week Moving Average

Ether rose seven percent in the past day to trade near three thousand three hundred and twenty three dollars. The recovery pushed the price above its 50 week moving average just above three thousand three hundred dollars. Historically, this level has acted as a launch point for strong upside moves.

Previous breakouts above the same trendline resulted in gains of ninety seven percent in the third quarter of twenty twenty five and one hundred forty seven percent between October twenty twenty three and March twenty twenty four.

Recent price action also shows ETH bouncing from support near two thousand eight hundred dollars before rising twenty percent to current levels.

Analysts Eye Four Thousand Dollars Next

Market analysts say Ethereum must now hold the 50 week moving average to maintain the bullish setup. Investor StockTrader Max stated that a decisive break above the 200 day moving average at three thousand five hundred dollars would strengthen the case for a move toward the previous all time high around five thousand dollars.

Analyst CyrilXBT echoed that the reclaimed trendline is now a key zone for bulls. Ethereum recently ended a five month downtrend against Bitcoin, opening the possibility of gains of up to one hundred seventy percent toward zero point zero nine BTC in the coming months.

Whales Increase Accumulation

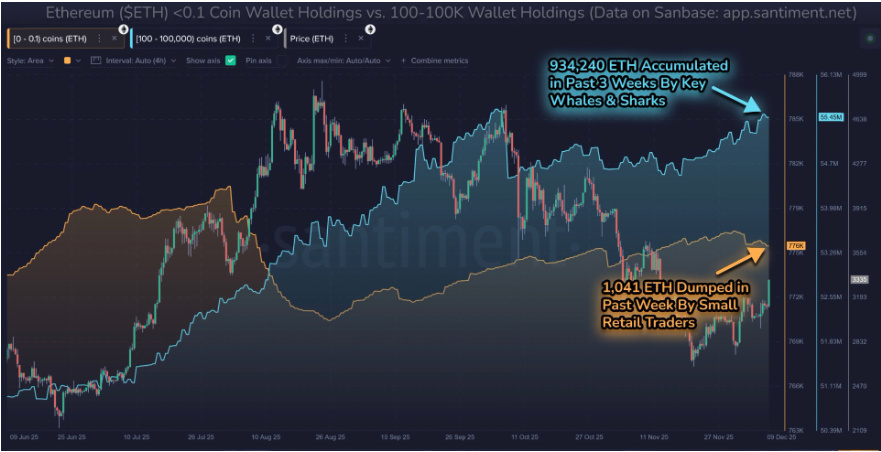

Large holders have quietly been building their positions over the past three weeks. Data from Santiment shows whales and sharks accumulated about nine hundred thirty four thousand ETH worth more than three point one billion dollars at current prices. During the same period, smaller retail wallets sold around one thousand forty one ETH.

Santiment described the setup as ideal for further upside since accumulation by major addresses often precedes extended rallies.

Institutional Interest Picks Up Again

Fresh demand from institutions is adding to the bullish picture. CryptoQuant reports that wallets holding between ten thousand and one hundred thousand ETH have reached record balances. Holdings in addresses owning more than one hundred thousand ETH have also risen, indicating renewed interest from larger investors and funds.

Spot Ethereum ETF products recorded one hundred seventy seven million dollars in inflows on Tuesday, the strongest in more than a month according to SoSoValue. At the same time, the ETH Coinbase Premium Index stayed positive for a full week after spending nearly a month in negative territory. The shift suggests US based investors have returned to buying, providing further support to price momentum.

Outlook

Ethereum’s climb back above the 50 week moving average combined with whale accumulation and renewed ETF inflows has strengthened confidence that the market may have set a local bottom near two thousand eight hundred dollars. If ETH can flip three thousand five hundred dollars into support, analysts believe a significant rally toward four thousand dollars and beyond could follow.

With trader sentiment improving and institutional demand returning, Ethereum is now positioned for a potentially powerful move in the weeks ahead.

Leave a Reply