Ethereum (ETH) experienced a sharp decline on 19 May, dropping over 5% to trade around $2,380 as bearish momentum gripped the broader cryptocurrency market. The fall, which saw ETH touch an intraday low of $2,353 after a high of $2,587 the previous day, came amid a wave of long liquidations and economic uncertainty sparked by a major US credit rating downgrade.

Ethereum Leads Crypto Market Decline

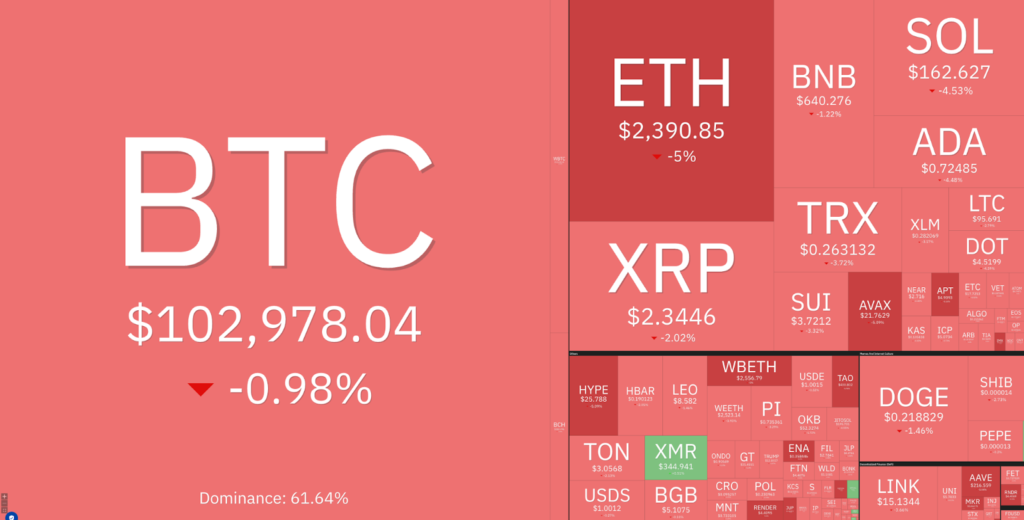

The downturn in ETH mirrors similar moves across the digital asset market. Total crypto market capitalisation fell by roughly 1.4% to $3.25 trillion. Bitcoin (BTC) saw a modest 1% dip, trading above $102,900, while other altcoins such as XRP and Solana fell by 2.3% and 4.5% respectively.

The market’s bearish tilt followed Moody’s Ratings decision on 17 May to downgrade the United States’ sovereign credit rating from Aaa to Aa1. The downgrade, the first from Moody’s since 1919, was driven by mounting concerns over the country’s $36 trillion national debt, persistent fiscal deficits, and growing interest expenses.

US Credit Downgrade Spurs ‘Risk-Off’ Sentiment

Moody’s downgrade rattled financial markets, pushing US Treasury yields higher and prompting investors to exit riskier assets, including cryptocurrencies.

“The downgrade reflects higher economic uncertainty,” noted capital markets analyst The Kobeissi Letter. “Trade deals, recession worries, lower inflation, and slowing GDP all can’t get lower yields.”

With the Federal Reserve showing no intention of cutting interest rates soon, markets are now only pricing in two possible rate cuts in 2025, adding to the cautious sentiment. Higher yields increase borrowing costs and often trigger broader sell-offs in speculative sectors such as crypto.

Long Liquidations Deepen Ethereum’s Decline

Ethereum’s fall was further intensified by a significant wave of long liquidations. In the past 24 hours, over $255 million in ETH positions were liquidated, with 78% of them being longs.

These forced sell-offs occur when traders using leverage fail to meet margin requirements, prompting exchanges to automatically liquidate positions to recover losses. The broader crypto market saw $665 million in liquidations, including $430 million within just 12 hours—signalling a major deleveraging event.

ETH Falls Below Key Technical Support

Ethereum breached critical support zones on 18 May, falling below its 50-day simple moving average (SMA) at $2,530 and the $2,400 psychological level. Analysts had previously identified the $2,400 mark as essential for maintaining upward momentum.

The Relative Strength Index (RSI) dropped to 38 on 19 May, falling sharply from overbought levels of 86 on 9 May. This shift signals growing bearish pressure and increased profit-taking.

If ETH fails to hold the next support range between $2,330 and $2,274 (the latter reached on 9 May), the price could slide further towards the $2,250 level, coinciding with the 100-day SMA.

Analysts Remain Cautiously Optimistic

Despite the recent downturn, some analysts see the current drop as a potential buy-the-dip opportunity. Renowned crypto analyst Michael van de Poppe suggested ETH’s fall below $2,400 represents “a steal,” expecting a rebound and potential rally toward new all-time highs in the longer term.

Daily trading volume for ETH surged by 110% over the last 24 hours to $30.4 billion, reflecting intense market activity and heightened investor interest in the asset’s next move.

Leave a Reply