Ethereum is once again finding it difficult to maintain momentum above the $4,000 level, with fading futures demand and cooling onchain activity pointing toward potential downside risks. The world’s second-largest cryptocurrency has hovered around this key level for two weeks, following a sharp dip below $3,500 earlier this month. Despite a recent recovery attempt, data suggests traders remain unconvinced about a sustained bullish move.

Lack of conviction above $4,000

Ether has traded in a tight range near $4,000 since bouncing back from its October 11 flash crash. The move followed the U.S. Federal Reserve’s 0.25% interest rate cut and the confirmation that quantitative tightening will end soon. While these developments initially sparked optimism, the broader crypto market has yet to respond with strong buying pressure.

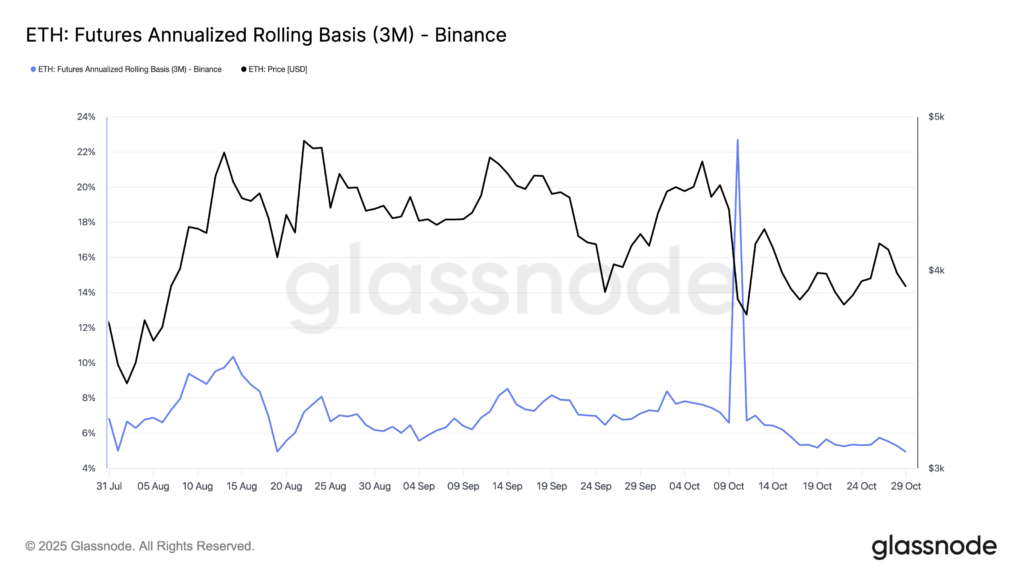

Analysts say Ethereum’s struggle to stay above $4,000 reflects weak sentiment. The asset’s futures currently trade at just a 5% premium to spot prices—typically the lower bound of a neutral market. Futures premiums usually range between 5% and 10%, but the recent rally to $4,250 failed to trigger the kind of enthusiasm seen earlier this year.

ETF flows and network activity weaken outlook

Weak demand in the futures market coincides with persistent outflows from U.S.-listed Ethereum exchange-traded funds (ETFs). Even after a brief $380 million influx earlier in the week, inflows have not been strong enough to offset the broader trend of declining investor interest. The fading ETF activity has added to the uncertainty around whether Ethereum can realistically aim for the much-discussed $10,000 price target in this cycle.

Onchain data tells a similar story. Ethereum network fees dropped 16% in the past week to $5 million, signaling lower transaction activity. Active addresses on the base layer fell 4%, while competitors like Tron saw a sharp 100% jump in activity during the same period. Analysts note that while declining fees affect most major chains, Ethereum’s slowdown has amplified concerns about waning onchain demand.

Key support levels in focus

Ether’s daily chart shows a third consecutive red candle, reflecting continued selling pressure. Multiple recovery attempts have failed near the $4,000 resistance zone, reinforcing it as a major hurdle for bulls. Market analyst Ted Pillows highlighted the disconnect between macroeconomic tailwinds and Ethereum’s muted response.

“$ETH has lost its $4,000 support level again,” Pillows wrote on X. “Even with the Fed’s rate cut, the end of QT, and progress in U.S.-China talks, Ethereum remains weak.”

According to Pillows, the next key level to watch is $3,800. A breakdown below it could trigger further losses toward the $3,500–$3,700 range and potentially to the $3,354 low recorded in August.

Analysts divided on next move

While short-term sentiment leans bearish, some analysts argue that the current pullback could still be a “healthy correction” within a broader uptrend. FibonacciTrading believes a dip toward $3,300 would remain consistent with the ongoing bullish structure, provided that Ethereum’s weekly chart holds above the exponential moving average (EMA) cloud.

“It will be a real show of strength if bulls can defend support here and prepare for another attempt at resistance,” the analyst noted.

Similarly, pseudonymous trader Cactus maintains that Ethereum could still deliver a strong fourth quarter as long as the $3,800–$4,200 zone remains intact. Reclaiming $4,200—also the 50-day simple moving average—would signal renewed strength and set the stage for a retest of higher resistance levels near $4,500.

Bullish recovery hinges on reclaiming $4,000

For now, Ethereum’s technical picture hinges on whether it can quickly reclaim and hold the $4,000 mark. Doing so would restore confidence among traders and potentially invite new inflows into ETFs and futures. Failing that, a deeper correction to the mid-$3,000 range looks increasingly likely.

As the market digests mixed macro signals and thinning onchain activity, investors are weighing whether this consolidation phase marks a temporary pause before the next leg up—or the early signs of a more extended correction.

“Either this is a classic bear trap,” Pillows said, “or the crypto market is going way lower.”

Leave a Reply