Ethereum and the wider crypto market rallied sharply on Friday after US Federal Reserve Chair Jerome Powell hinted that interest rate cuts could arrive as early as September. While Powell stopped short of making firm commitments during his final keynote address at the annual Jackson Hole Symposium, his acknowledgement of labour market instability and shifting economic risks fuelled hopes that the central bank is finally softening its stance.

Ethereum responded with a surge of more than 7%, while speculative tokens and meme coins also enjoyed a strong rally. Analysts suggest Powell’s tone marked a shift that could prove bullish for risk assets, including cryptocurrencies.

Powell Opens the Door to Rate Cuts

In his remarks, Powell highlighted ongoing challenges facing the US economy, including weak employment data, persistent inflation pressures tied to tariffs, and concerns over a potential slowdown in growth.

“Our policy rate is now 100 basis points closer to neutral than it was a year ago,” Powell noted. “The instability of the labour market and our unemployment rate now allows us to proceed carefully as we consider changes to our policy stance. The shifting balance of risks may require us to change our policy stance.”

While careful to avoid making promises, the Fed Chair’s comments suggested an openness to easing, with the September meeting now seen by many as a potential turning point. Powell emphasised that protecting the labour market may now outweigh inflation risks, a shift that investors interpreted as dovish.

Ethereum Leads the Rally

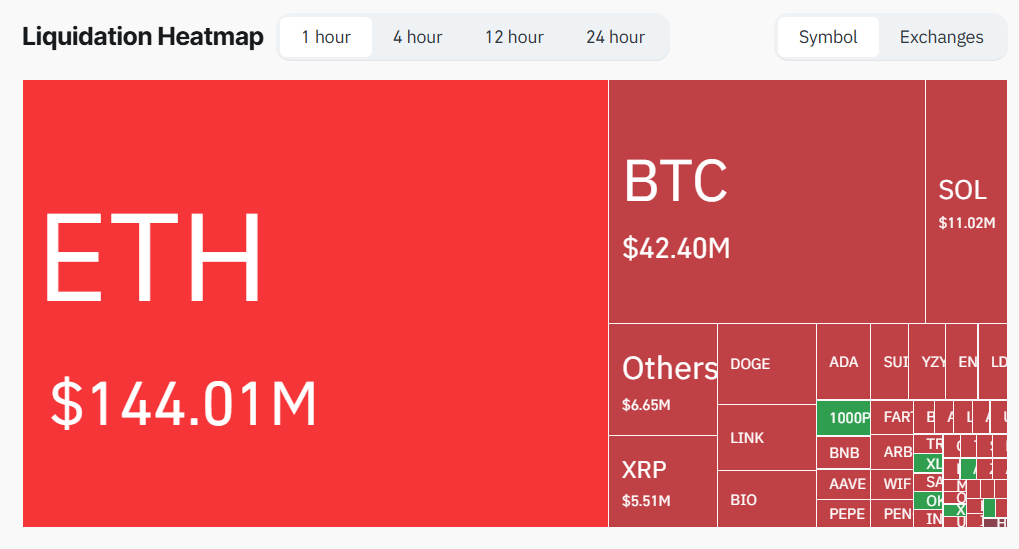

The crypto market reacted immediately. According to data from Coinglass, total liquidations across digital assets exceeded $200 million in just one hour following Powell’s speech, including $180 million in short positions. Ethereum dominated the move, with over $110 million in liquidations as traders piled into long positions.

ETH’s price surge of more than 7% underscored growing confidence that easier monetary policy could trigger a new leg higher for major cryptocurrencies. Traders now believe Ethereum could target an all-time high if the Fed follows through with cuts in the coming months.

Meme Coins and Speculative Tokens Jump

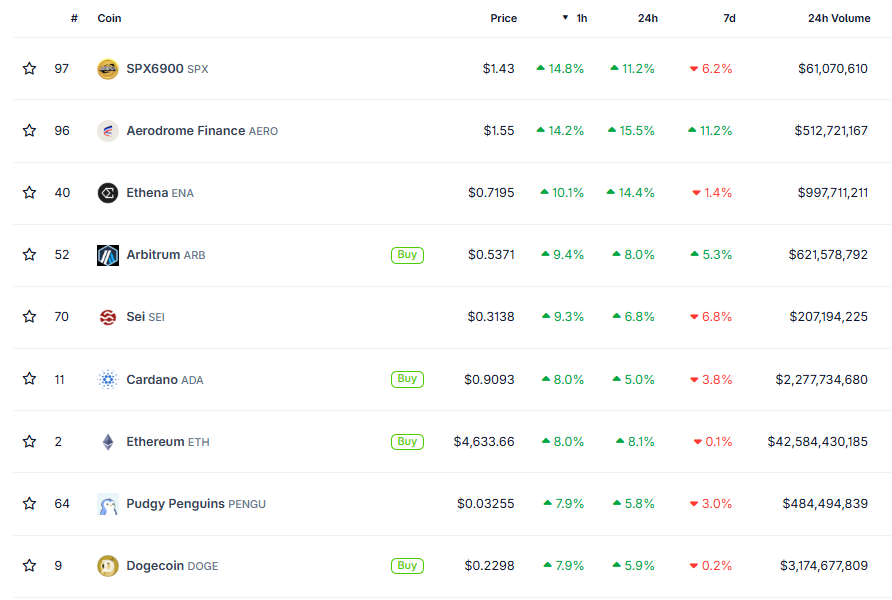

It wasn’t just Ethereum that benefited from Powell’s comments. Speculative tokens, often the first movers in times of excess liquidity, also posted strong gains. SPX, a meme coin, jumped 15%, while DOGE and PENGU each rallied around 8%.

Historically, previous cycles of Federal Reserve rate cuts have been followed by periods of heightened speculation and meme coin rallies. CoinMarketCap’s altcoin season index climbed to 44, reflecting increased optimism about broader market liquidity.

Analysts See Clearer Fed Bias

Market experts argue that Powell’s speech provided investors with greater clarity about the Fed’s priorities. Nic Puckrin, founder of Coin Bureau, noted:

“Powell’s Jackson Hole speech struck a positive tone for markets, with investors now largely pricing in a rate cut as soon as September. He signalled that the Fed’s focus is shifting toward the growing risks in the labour market, noting the unusual slowdown in both worker supply and demand, which raises the risk of sudden layoffs and higher unemployment. While tariff-related inflation remains a concern, Powell appeared more confident that these pressures will be temporary. His comments suggest that protecting the labour market now outweighs inflation risks, giving markets clarity on the Fed’s bias toward easing.”

Puckrin added that the sense of certainty has been welcomed by investors, sparking a bullish reaction across crypto markets.

No Guarantees Yet

Despite the optimism, Powell carefully avoided locking the Fed into a particular path. He described several hypothetical scenarios where rate cuts might become urgent but stopped short of saying that such a point had already arrived.

This leaves investors hopeful but still dependent on upcoming economic data to confirm the case for easing. Until September’s meeting, crypto markets may continue to trade on expectations rather than firm commitments.

Ethereum’s sharp rebound highlights how sensitive crypto markets remain to shifts in US monetary policy. With traders now betting on September cuts, the stage may be set for further gains if Powell and the Fed follow through.

For now, Powell’s words have injected renewed energy into the market, with Ethereum leading the charge and meme coins riding the wave. Whether this momentum can be sustained will depend on whether the Fed turns hints into action, but the Jackson Hole speech has already given crypto bulls plenty to cheer about.

Leave a Reply