Crypto prime broker FalconX has acquired 21Shares, the world’s largest issuer of crypto exchange-traded products (ETPs), marking its third major acquisition of 2025. The move strengthens FalconX’s push into regulated digital asset markets and signals a growing convergence between traditional finance and crypto infrastructure.

A Strategic Expansion for FalconX

The acquisition comes as FalconX seeks to deepen its role in the institutional digital asset ecosystem. The firm already serves more than 2,000 institutional clients and operates a trading infrastructure that has processed over $2 trillion in volume. Adding 21Shares to its portfolio gives FalconX a strong foothold in the fast-growing market for crypto ETPs—regulated investment products that mirror the performance of digital assets like Bitcoin and Ethereum.

FalconX CEO Raghu Yarlagadda said the acquisition aligns with the company’s mission to bridge traditional finance and digital assets. “21Shares has built one of the most trusted and innovative product platforms in digital assets,” Yarlagadda said in the company’s announcement. “We’re witnessing a powerful convergence between digital assets and traditional financial markets, as crypto ETPs open new channels for investor participation through regulated, familiar structures.”

Financial terms of the deal were not disclosed.

21Shares to Continue Operating Independently

Following the acquisition, 21Shares will maintain its existing leadership team and continue to operate independently under the FalconX umbrella. The company does not plan any immediate changes to its ETP or ETF offerings in Europe or the United States.

Russell Barlow, CEO of 21Shares, said the deal would enable the company to accelerate product innovation and expand its reach. “Together, we’ll pioneer solutions that will meet the evolving needs of digital asset investors worldwide,” he said.

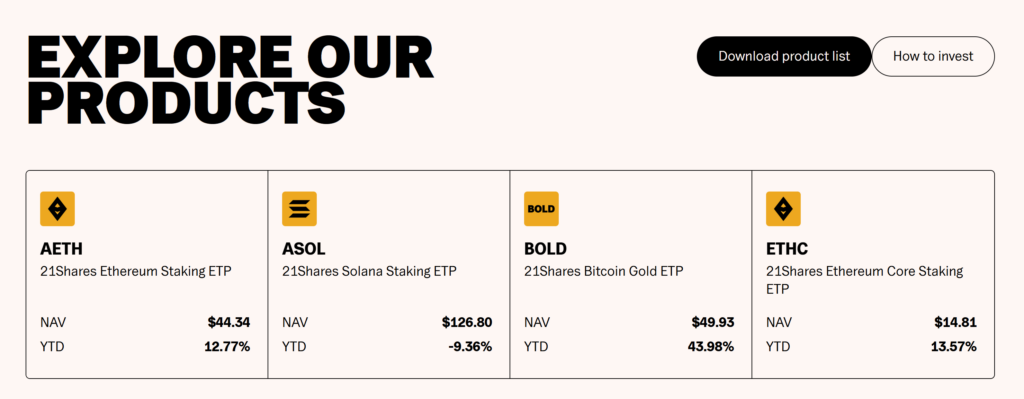

Founded in 2018 by Hany Rashwan and Ophelia Snyder, 21Shares has become a dominant player in the crypto ETP space. As of September 2025, it managed more than $11 billion in assets across 55 listed products globally. Its offerings provide investors exposure to digital assets through traditional stock exchanges, simplifying access to crypto within regulated environments.

Building a Comprehensive Digital Asset Platform

By combining forces, FalconX and 21Shares aim to create a broader suite of digital asset investment products designed to appeal to both institutional and retail investors. The partnership brings together FalconX’s deep liquidity network, risk management systems, and regulatory infrastructure with 21Shares’ product design and global distribution expertise.

The collaboration could also help expand investor participation in crypto markets through structured, compliant vehicles—an area that has drawn increasing interest from traditional asset managers and pension funds.

With regulatory frameworks for digital assets becoming clearer in major markets, demand for regulated crypto products is expected to rise. FalconX’s acquisition positions it to capitalize on this trend while providing its clients with new access points to crypto exposure.

Third Major Deal in 2025

The 21Shares acquisition is FalconX’s third major deal this year, underscoring its aggressive expansion strategy. In January, the company purchased crypto derivatives platform Arbelos Markets, followed by acquiring a majority stake in Monarq Asset Management’s parent company in June.

These moves reflect FalconX’s ambition to evolve from a prime brokerage into a full-spectrum digital asset financial services firm. The company is also working to streamline settlement and reduce counterparty risk across the industry.

Recently, FalconX joined Crypto.com, Galaxy, and Wintermute as a launch partner for Lynq, a new settlement platform developed with Arca Labs, Tassat Group, and tZERO. The platform aims to address longstanding challenges around regulatory compliance and risk management as institutional participation in digital assets continues to grow.

A Convergence of Finance and Technology

FalconX’s latest acquisition highlights how digital asset firms are increasingly adopting structures familiar to traditional markets to attract mainstream investors. By integrating ETPs and other regulated products into its offerings, FalconX is positioning itself at the intersection of finance and technology—a space where efficiency, transparency, and compliance are becoming essential.

The combination of FalconX’s institutional reach and 21Shares’ track record in product innovation could pave the way for a new generation of crypto investment vehicles. As regulatory clarity improves and investor demand widens, the partnership could accelerate the integration of digital assets into global financial markets.

While the size of the deal remains undisclosed, the strategic value is clear: FalconX is consolidating its role as a key intermediary between traditional capital and the emerging crypto economy—one regulated product at a time.

Leave a Reply