The financial world is on edge after Federal Reserve Chair Jerome Powell refused to commit to policy easing, despite market turmoil triggered by Donald Trump’s latest tariff announcement. As stocks plunged, Bitcoin remained resilient, though uncertainty looms over the Fed’s next move.

Powell Stays Cautious, Markets Panic

Speaking at the Society for Advancing Business Editing and Writing Annual Conference, Powell made it clear that the Fed is in no rush to adjust monetary policy.

“We are well positioned to wait for greater clarity before considering any adjustments,” Powell stated, adding that it’s too early to predict future rate cuts. He acknowledged that the tariffs are “significantly larger” than expected but insisted the Fed’s role is to prevent temporary inflation spikes from becoming long-term problems.

Stocks Plunge, Bitcoin Holds Steady

Markets reacted violently to the uncertainty. The Nasdaq tumbled 6% on Thursday and fell another 4.2% on Friday, reflecting investor fears of prolonged economic strain.

Bitcoin (BTC) initially showed strength, bouncing higher before Powell’s speech, but later retreated below $83,000, ending the day roughly flat. Compared to equities, Bitcoin’s stability highlights its growing role as a hedge against macroeconomic risks.

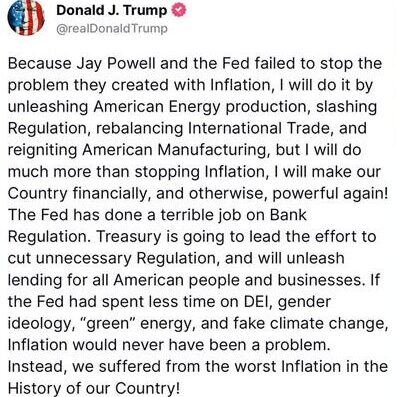

Trump Pressures Powell to Cut Rates

Just minutes before Powell’s speech, Trump took to Truth Social to demand immediate rate cuts, calling Powell “always late” in his policy decisions.

“This would be the perfect time for Fed Chairman Jerome Powell to cut interest rates,” Trump wrote. “He could now change his image, and quickly … Cut interest rates, Jerome, and stop playing politics.”

Trump’s aggressive stance adds political pressure to an already fragile situation, making the Fed’s next move even more critical.

What’s Next for Bitcoin and the Markets?

With no clear signals from the Fed, volatility is expected to persist. If inflation remains controlled and interest rates hold steady, Bitcoin could maintain its relative strength. However, if economic uncertainty deepens, BTC could face renewed selling pressure alongside traditional markets.

For now, all eyes remain on Powell, as investors wait for the next policy update. Will he hold firm, or will Trump’s demands push the Fed toward a rate cut? The coming weeks could define market direction for months to come.

Leave a Reply