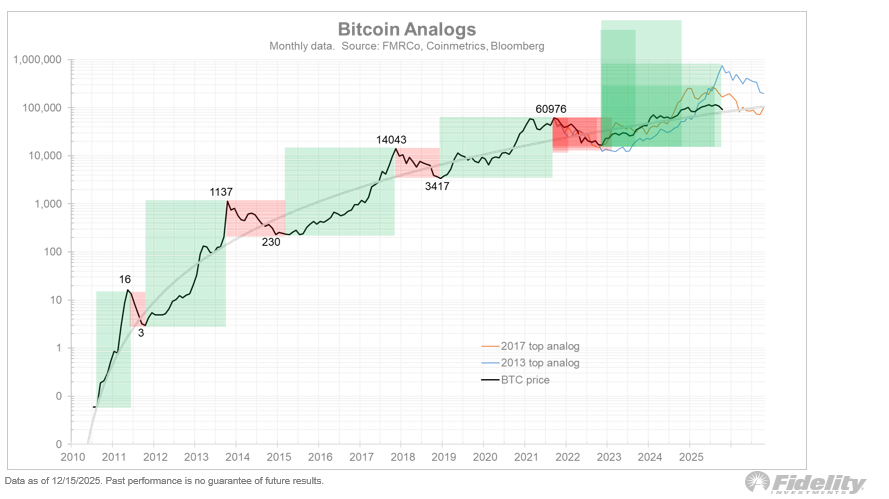

Fidelity’s director of global macro research Jurrien Timmer has warned that Bitcoin may be approaching the end of its traditional four year halving cycle. While maintaining a long term bullish view on the asset Timmer suggested the current market phase could give way to a period of downside lasting into 2026.

In a post shared on X Timmer said Bitcoin’s rally to a record high of around $125,000 in early October may have marked the peak of the present cycle both in terms of price and timing. He added that historical Bitcoin winters typically last around a year which could make 2026 a quieter period for the market.

According to Timmer Bitcoin could find long term support in the $65,000 to $75,000 range during that phase. He described himself as a secular bull but expressed concern that another halving driven cycle may have already concluded.

2026 could be a pause year for Bitcoin

Timmer’s outlook suggests that Bitcoin may experience a cooling off period rather than a continuation of the strong gains seen in recent years. His comments come at a time when many investors had expected the four year pattern to stretch further due to improving regulatory clarity and growing institutional involvement.

He argued that if Bitcoin has indeed followed its historical rhythm then the next major low could arrive in 2026 after a year of weaker performance. This would align with previous cycles where extended rallies were followed by prolonged consolidations.

Despite this cautious near term view Timmer emphasised that his broader conviction in Bitcoin remains intact. He sees the asset as a long term store of value but believes investors should be prepared for cyclical downturns.

Analysts remain divided on future highs

Not all market observers agree with Fidelity’s assessment. Several analysts continue to expect Bitcoin to reach new record highs in 2026 driven by structural progress in the crypto industry.

Tom Shaughnessy co founder of crypto research firm Delphi Digital said the market is still recovering from an unusually severe liquidation event that wiped out roughly $19 billion in value at the start of October. He described the episode as a one off shock that distorted prices and sentiment.

Shaughnessy believes that once the impact of that event fades Bitcoin could rebound strongly. He expects prices to reflect advances in adoption infrastructure and regulation which in his view could push the market to fresh all time highs in 2026.

Regulation and institutions seen as key drivers

Supporters of an extended bull case point to ongoing developments in regulation particularly in the United States. Policy experts anticipate that 2026 could be an important year for the practical rollout of crypto laws passed earlier.

Cathy Yoon general counsel at crypto research firm Temporal said the next phase of regulation will focus on implementation rather than legislation. She highlighted examinations disclosures and integration into payment systems as areas likely to attract institutional capital.

With stablecoin rules already in place Yoon expects clearer compliance frameworks to encourage broader use of digital assets across financial infrastructure. This could strengthen the fundamental case for Bitcoin and other cryptocurrencies over the medium term.

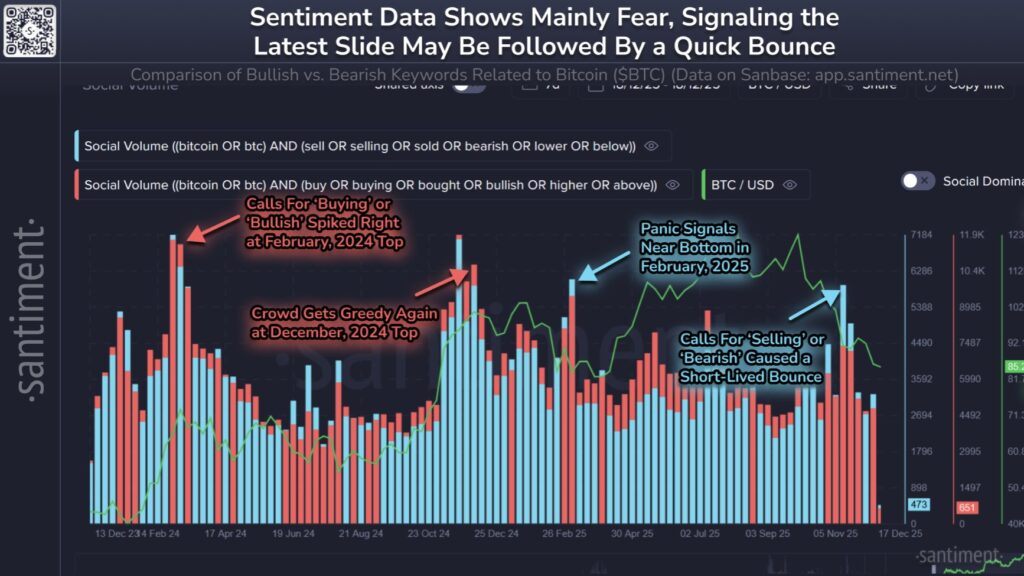

Market sentiment turns cautious amid price dip

In the short term sentiment has weakened following Bitcoin’s drop below $85,000 earlier this week. Data from market intelligence firm Santiment shows bearish commentary dominating platforms such as X Reddit and Telegram.

Blockchain analytics firm Nansen also reported that so called smart money traders are positioning defensively. These traders are collectively net short Bitcoin by around $123 million suggesting expectations of further downside.

At the same time the same group has taken net long positions in Ether worth roughly $475 million indicating selective optimism within the market. The mixed positioning reflects broader uncertainty as investors weigh cyclical risks against long term growth drivers.

Leave a Reply