Bitcoin traded steadily around the $100,000 mark over the weekend, but its subdued price action masked a remarkable rally among several altcoins. While the world’s largest cryptocurrency struggled to break out of a narrow range, select mid-cap tokens, particularly Filecoin (FIL) and Zcash (ZEC), captured traders’ attention with double-digit gains.

Data from on-chain analytics firm Santiment revealed that decentralized infrastructure and privacy-focused assets are driving fresh capital inflows. Tokens such as Filecoin, Internet Computer Protocol (ICP), Dash, and Zcash outperformed the broader market, signalling a growing appetite for fundamentally driven narratives amid Bitcoin’s consolidation.

Filecoin Leads the DePIN Sector Boom

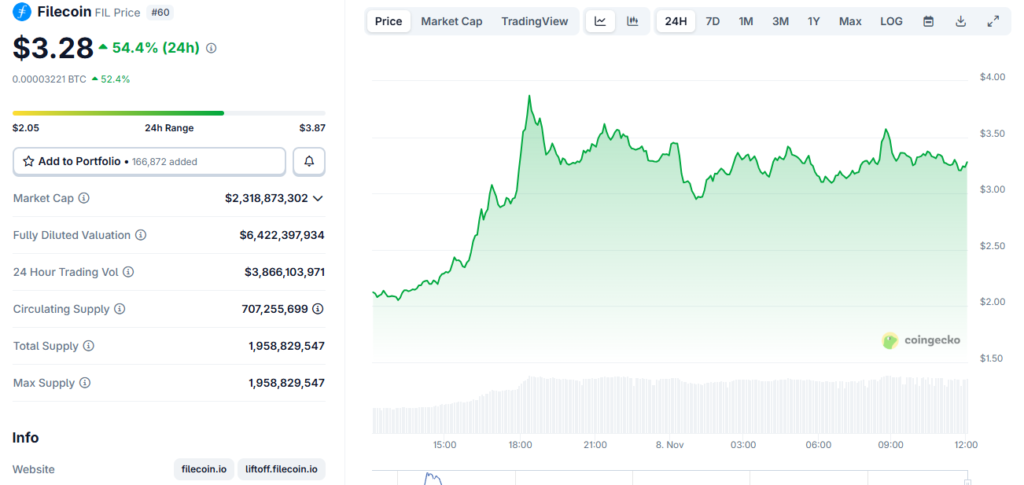

The standout performer in the recent rally was Filecoin (FIL), which soared more than 60% in the past 24 hours, reaching approximately $3.47, its highest price since February. This surge marked Filecoin’s best single-day performance in months and underscored renewed investor confidence in the decentralised physical infrastructure (DePIN) sector.

Filecoin has steadily evolved beyond its origins as an incentivised storage protocol. Now, it is positioning itself as a modular data layer for Web3 and AI applications. This shift is resonating with traders and developers alike, especially as decentralised infrastructure gains attention following high-profile disruptions in traditional cloud services.

In October, a multi-hour outage at Amazon Web Services (AWS) disrupted major platforms including Coinbase and Robinhood, exposing the vulnerabilities of centralised cloud networks. The event reignited debate around the importance of distributed infrastructure, giving Filecoin and other DePIN assets a significant narrative boost.

According to Messari, Filecoin recently marked its fifth anniversary with a surge in developer activity and fresh milestones. “Originally focused on incentivised cold storage, the network has expanded to support smart contract programmability through the Filecoin Virtual Machine (FVM), enabling applications in DeFi, data management, and decentralised autonomous organisations,” Messari noted.

This technological expansion has made Filecoin a strong candidate for investors seeking exposure to both decentralised storage and scalable data solutions for AI and blockchain ecosystems.

Privacy Tokens Make a Comeback

While DePIN tokens gained traction, privacy-focused cryptocurrencies also entered the spotlight. Zcash (ZEC) surged to a multi-year high of around $712 on November 7, before easing to the mid-$500 range. Despite the correction, the token remains one of the year’s strongest performers.

Interest in Zcash spiked further after Arthur Hayes, co-founder of BitMEX, revealed that ZEC had become the second-largest liquid position in his family office, Maelstrom. His endorsement reignited enthusiasm for privacy-oriented settlement and trading mechanisms, especially as global regulatory scrutiny increases over digital asset transparency.

The growing preference for privacy rails signals a renewed market segment that thrives outside compliance-heavy ecosystems. Investors appear increasingly interested in financial autonomy and confidential transactions, particularly as centralised exchanges and regulated platforms tighten oversight.

Similarly, Dash (DASH) followed the upward trajectory, climbing to multi-year highs above $100, buoyed by rising privacy transaction volumes and an uptick in developer engagement.

Capital Rotation Highlights Narrative-Driven Markets

Market analysts observing sector-wide flows note that capital is rotating decisively into narrative-rich assets, such as DePIN and privacy tokens. These categories offer clearer catalysts and distinct value propositions, contrasting with Bitcoin’s relatively stagnant movement.

The latest rally demonstrates that traders are positioning ahead of expected catalysts, not merely reacting to them, a pattern that often precedes broader “altseason” phases.

However, experts caution that whether this momentum translates into a sustained altcoin cycle remains uncertain. Much will depend on Bitcoin’s ability to break its consolidation range and broader macroeconomic factors influencing risk appetite.

Still, the sharp rotation into infrastructure and privacy assets underscores a notable shift in market psychology: investors are seeking utility, resilience, and narrative strength rather than speculative hype.

Outlook: Early Signs of an Altcoin Reawakening

While Bitcoin’s dominance remains intact, its stagnation has opened the door for select altcoins to outperform. The rallies in Filecoin and Zcash suggest that capital is increasingly flowing toward sectors underpinned by tangible use cases, decentralised storage, cloud resilience, and financial privacy.

If these trends persist, the market could be witnessing the early stages of a structural rotation, one where utility-based tokens lead the next phase of crypto growth.

For now, Bitcoin’s pause has created space for innovation-driven assets to take centre stage, hinting that the next wave of crypto leadership might emerge not from digital gold, but from the architects of the decentralised web.

Leave a Reply