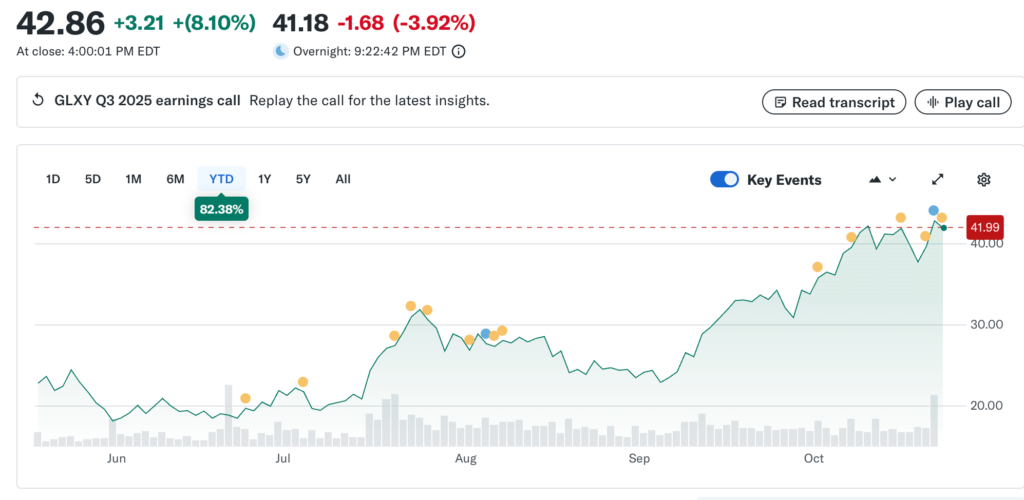

Galaxy Digital Holdings Ltd. (NasdaqGS: GLXY) has enjoyed a remarkable resurgence over the past month, with shares soaring more than 20% amid renewed confidence in the digital-asset sector. Year-to-date, the company’s stock is up nearly 120%, outperforming both the broader equity market and most crypto-linked firms.

This rally mirrors the rebound in digital-asset sentiment as investors return to risk-on positions, encouraged by stabilising macroeconomic conditions and improving institutional participation in the crypto space. Galaxy’s diversified presence across trading, asset management and infrastructure has positioned it as one of the sector’s prime beneficiaries of this renewed optimism.

However, despite its impressive performance, analysts are sounding a note of caution. Many argue that Galaxy Digital’s current valuation may already reflect much of its expected growth, leaving limited room for upside unless the company can demonstrate sustained profitability and operational scale.

Retail Expansion Marks Strategic Pivot

In a notable strategic shift, Galaxy Digital has ventured beyond its traditional institutional base to target retail investors through its newly launched platform, GalaxyOne. The initiative offers US consumers access to an integrated suite of services, including high-yield cash accounts, crypto trading and stock brokerage, a move aimed at broadening the firm’s revenue base.

The expansion reflects Galaxy’s ambition to become a one-stop shop for digital-asset financial services, appealing to a fast-growing segment of tech-savvy retail investors. Analysts see this as a natural progression for the firm, enabling it to tap into new demand streams and diversify away from the cyclical volatility of institutional crypto trading.

Yet, the retail push also introduces new challenges. Regulatory compliance remains a significant concern in the United States and operational execution will be critical. Entering a competitive market dominated by established players such as Coinbase and Robinhood, Galaxy’s ability to differentiate its offerings and maintain profitability will be closely scrutinised.

Valuation Metrics Show Signs of Strain

Despite its growth narrative, valuation indicators suggest that Galaxy’s recent rally may have outpaced its fundamentals. Independent research pegs the company’s fair value at around $37.78 per share, slightly below its current trading level, implying that the stock could be modestly overvalued.

From a price-to-sales (P/S) perspective, Galaxy trades at approximately 2.2×, lower than the crypto-sector average of 2.8× but still attracting a premium relative to historical levels. The broader US capital-markets benchmark, by comparison, stands at roughly 4.0×.

This valuation premium appears to reflect expectations of accelerating revenue growth and margin improvement, assumptions that may prove optimistic if the company’s retail operations or infrastructure projects encounter delays or cost overruns.

An analyst from Flood Capital noted, “It’s kind of crazy that Goldman was projecting Galaxy’s digital asset business to make around $183 million in net income by mid-2026. The firm just posted $505 million in one quarter.” The remark underscores growing belief that Galaxy’s earnings trajectory could be stronger than expected, though the sustainability of such profits remains uncertain.

Balancing Growth with Risk Exposure

Galaxy’s efforts to build long-term resilience through blockchain infrastructure, on-chain equity offerings and Web3 partnerships could pave the way for higher-margin, recurring revenue streams. These ventures, if executed effectively, may reduce the firm’s reliance on volatile trading revenues and enhance its overall valuation stability.

Nonetheless, several risks loom large. Galaxy remains heavily exposed to fluctuations in crypto-asset prices and trading volumes, both of which can impact its financial performance. The company’s dependence on large institutional clients also introduces concentration risks, while infrastructure expansion demands significant capital investment, factors that could constrain near-term returns.

As the company navigates its next phase, investor sentiment hinges on whether Galaxy can convert its strong momentum into durable, diversified growth. With the stock hovering near its estimated fair value, much will depend on its ability to deliver on its retail vision, maintain regulatory compliance and manage volatility across the digital-asset ecosystem.

Outlook: Sustainable Growth or Overextended Valuation?

Galaxy Digital’s remarkable rally highlights growing confidence in the broader crypto recovery, yet the sustainability of this momentum remains an open question. While the firm’s pivot toward retail services and infrastructure investment offers promising new avenues for expansion, execution risks and market volatility could test investor patience.

For now, the company stands at a critical juncture, straddling the line between transformative growth and valuation excess. Whether its current trajectory signals the start of a durable bull phase or a short-term overextension will likely depend on its ability to balance ambition with disciplined performance in the quarters ahead.

Leave a Reply