The GENIUS Act, the most comprehensive attempt yet by the United States to create a federal-level regulatory framework for stablecoins, has recently cleared a major hurdle in the Senate. With a successful cloture vote on May 20, the bill now moves into full Senate debate and amendments, setting the stage for possible passage into law later this year.

While the bill still has to clear several procedural and political obstacles, its significance cannot be overstated. If passed, the GENIUS Act would mark a watershed moment in the regulation of digital assets in the U.S.—with implications reaching far beyond American borders. Here’s a detailed look at what lies ahead for the bill and what it means for the future of stablecoins.

The Road to Federal Stablecoin Legislation

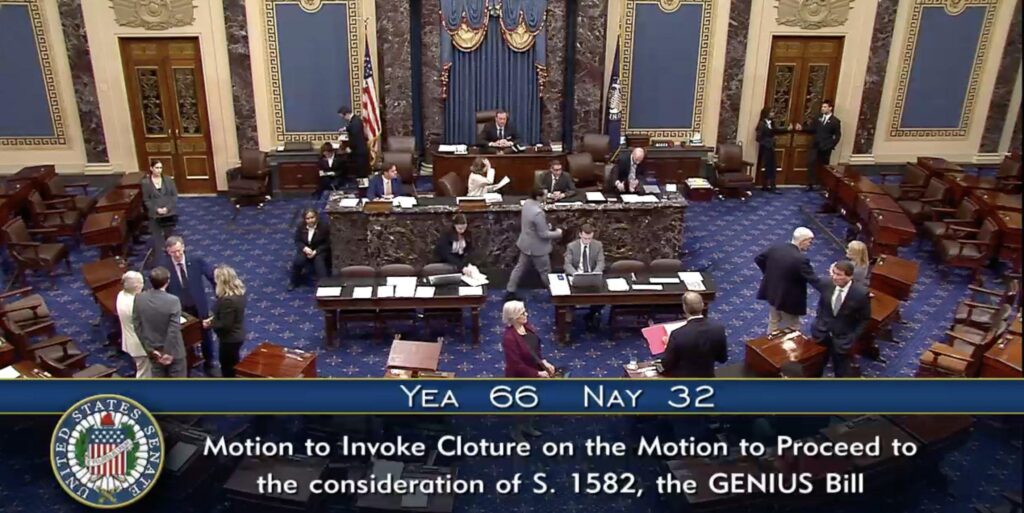

The GENIUS (Guaranteeing Emergency National Innovation in U.S. Stablecoins) Act was first introduced on February 4, 2025, by Senator Bill Hagerty. Since its introduction, the bill has undergone several revisions aimed at strengthening anti-money laundering (AML) measures, enhancing consumer protections, and clarifying federal oversight. The latest push culminated in the May 20 cloture vote in the Senate, where 66 senators voted in favour and 32 against—easily crossing the 60-vote threshold required to move the bill into full debate, and effectively ending the risk of a filibuster stalling its progress.

The cloture vote’s success follows an earlier setback: a failed vote on May 8, where the bill received only 48 votes in favour and 49 against. The reversal in fortune highlights the deep political negotiations and evolving sentiment around crypto regulation in Washington, particularly as the 2024 presidential election results continue to shape the legislative landscape.

Key Provisions of the GENIUS Act

The GENIUS Act is not merely symbolic. It introduces sweeping changes to how stablecoins, digital tokens pegged to fiat currencies like the US dollar are issued, backed, and regulated in the country. The bill’s provisions are designed to strike a balance between innovation and financial safety, and include the following key components:

1. Clear Definition and Reserve Requirements

The bill defines “payment stablecoins” as digital assets used primarily for payments or settlement, pegged to a fixed currency like the US dollar. These assets must be backed 1:1 with high-quality liquid assets, such as cash or short-term US Treasury bonds. Importantly, the reserves must be held separately from the issuer’s operating funds and must be certified on a monthly basis.

2. A Dual Regulatory Framework

The legislation introduces a flexible but structured approach to oversight. Issuers can choose to register either at the state or federal level. Those with a market cap exceeding $10 billion will be mandated to register federally, whereas smaller issuers may continue under state-level supervision—provided the state’s regulations align with new federal standards. A newly established “Stablecoin Certification Review Committee” will evaluate whether individual states meet those criteria.

3. Transparency and Consumer Protection

Stablecoin issuers will be required to publicly disclose reserve holdings, redemption policies, and ensure that users are paid first in the event of bankruptcy. These measures aim to restore trust in stablecoins after high-profile failures such as TerraUSD.

4. Anti-Money Laundering and Compliance

Issuers will be categorised as financial institutions under the Bank Secrecy Act. This subjects them to full AML obligations, including Know Your Customer (KYC) protocols, transaction monitoring, and suspicious activity reporting.

Technology Giants, Trump, and the Politics of Crypto

While the bill focuses heavily on consumer protection and financial safety, the political undertones surrounding its progression are impossible to ignore.

One of the most controversial elements has been the potential involvement of major tech companies—such as Meta and Google—in issuing their own stablecoins. The GENIUS Act explicitly prohibits non-financial entities from entering the stablecoin space unless they meet strict criteria: implementing financial risk controls, ensuring robust data privacy, and maintaining fair business practices.

This clause is viewed by many as an attempt to prevent tech conglomerates from gaining outsized influence in the digital finance sector, reminiscent of the backlash Meta faced over its abandoned Diem (formerly Libra) stablecoin project.

Another politically charged issue is the involvement of the Trump family in the stablecoin space. President Trump has openly supported the digital asset sector and is linked to USD1, a stablecoin issued by World Liberty Financial. Critics, including Senator Elizabeth Warren, argue that the bill could benefit Trump’s crypto interests without sufficient checks, potentially allowing the former president to profit massively. A previous draft of the bill included language aimed at curbing such conflicts of interest, but it has since been removed following bipartisan compromise.

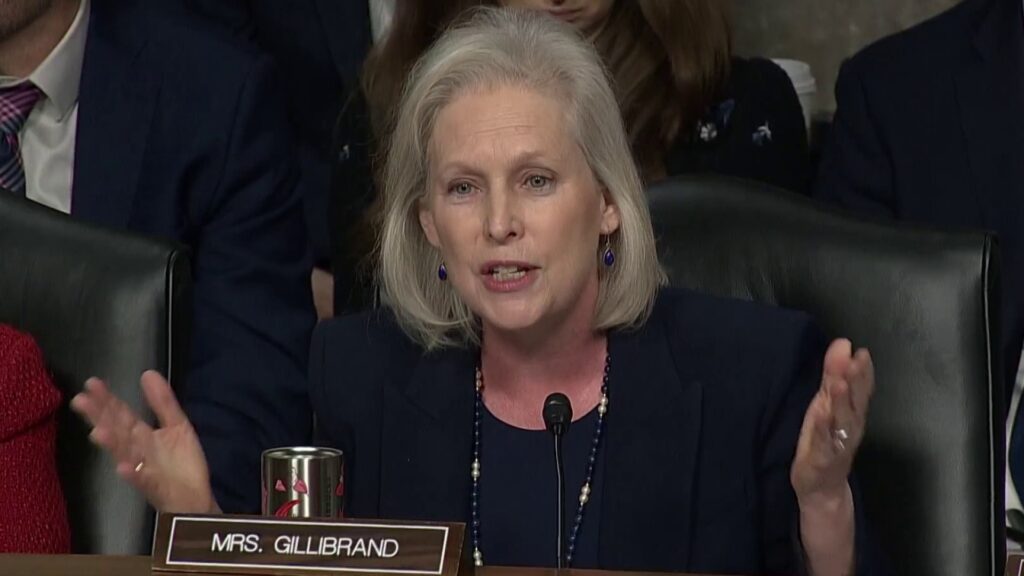

Democratic Senator Kirsten Gillibrand confirmed that the bill’s latest version removed direct references to Trump-related crypto projects in favour of a more neutral approach focusing strictly on regulatory standards. This move, though strategic, has drawn criticism for allegedly prioritising political pragmatism over accountability.

What’s Next: Legislative Hurdles and Presidential Approval

Now that the Senate has voted in favour of cloture, the GENIUS Act will enter the full debate and amendment stage in the Senate. If it passes this phase, it will proceed to the House of Representatives.

The good news for the bill’s supporters is that passage in the House is expected to be easier. With Republicans holding a narrow majority (220-215), and given that the GENIUS Act has Republican backing, analysts expect it to pass with a simple majority vote (218 votes required).

However, the bill must then be reconciled if the House and Senate versions differ. Once reconciled, both chambers must approve the final unified version. Only then will the bill be sent to the President’s desk for approval.

President Trump—should he choose to act promptly—can sign the bill into law, veto it, or ignore it. If Congress is in session and the President does not sign it within 10 days, it becomes law automatically. But if Congress is not in session, a pocket veto would prevent the bill from becoming law, with no opportunity for override.

The Potential Impact on the Crypto Market

If enacted, the GENIUS Act will represent a major milestone not only for stablecoin regulation, but for the broader crypto ecosystem in the United States. Here’s what to expect:

- Market Consolidation: Smaller issuers may struggle to comply with reserve and compliance requirements, possibly leading to mergers, acquisitions, or exits.

- Increased Institutional Trust: Enhanced AML compliance and financial transparency will make stablecoins more attractive to institutional players.

- Slower Tech Incursion: Stricter oversight of non-financial companies like Meta will reduce the speed at which tech firms can launch competing digital currencies.

- Enhanced Global Position: A unified U.S. regulatory approach may solidify the dollar’s position as the dominant global reserve currency in the digital era, countering the fragmentation risk posed by state-by-state frameworks.

However, the GENIUS Act stops short of directly regulating central bank digital currencies (CBDCs) or broader crypto markets like decentralised finance (DeFi). These areas remain open for future legislation.

A Defining Moment for US Crypto Policy

The GENIUS Act is far from becoming law, but the recent Senate vote marks a significant step forward. As the bill moves into full debate and then to the House of Representatives, lawmakers will continue to balance innovation, consumer protection, and political concerns.

Its eventual passage could transform the stablecoin industry, bolster investor confidence, and ensure the United States retains its leadership in digital financial infrastructure. But the path forward remains politically complex, particularly given the overlapping interests of tech giants, crypto startups, and politically exposed individuals like President Trump.

Leave a Reply