Berlin, Germany – The German government missed out on over $2.3 billion in potential profit after selling nearly 50,000 Bitcoin (BTC) in mid-2024, a move that has since drawn criticism from crypto analysts and market observers. The sell-off, carried out during June and July, came just months before Bitcoin’s price surged by over 80%, highlighting what many now consider a poorly timed decision.

Massive Bitcoin Liquidation at $57,900

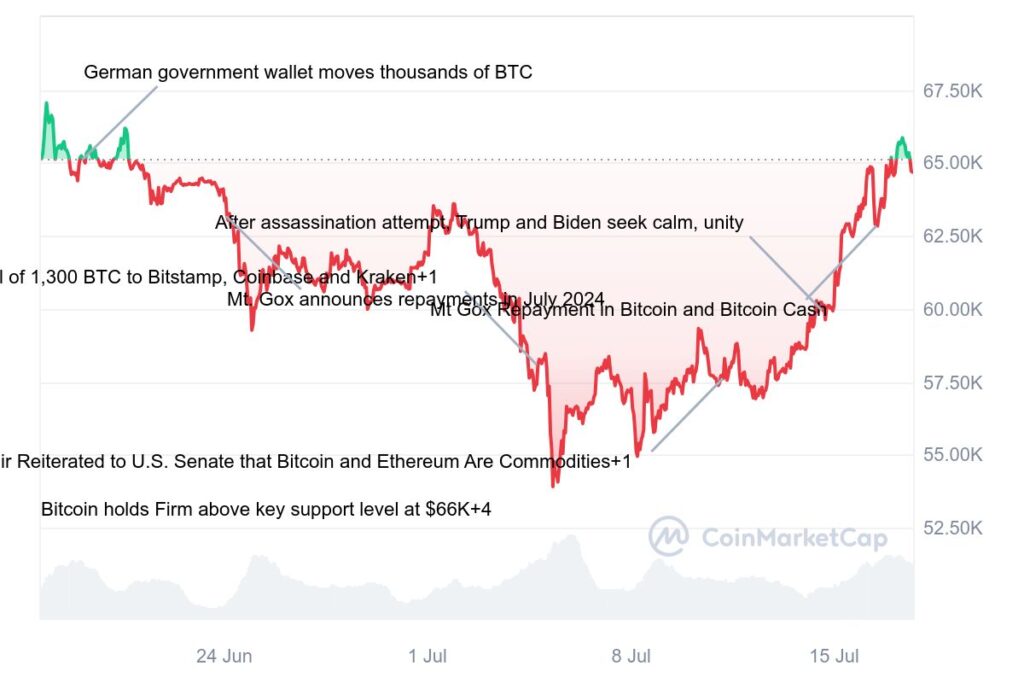

According to blockchain intelligence firm Arkham, a cryptocurrency wallet labelled “German Government (BKA)” sold a total of 49,858 BTC across multiple transactions at an average price of $57,900. The sale generated approximately $2.89 billion in proceeds.

At the time of writing, Bitcoin is trading above $104,700, meaning the holdings would now be worth around $5.24 billion—over $2.35 billion more than what the government received from the sales.

“If they had held it, their BTC would now be worth $5.24 billion,” Arkham stated in a post on X (formerly Twitter) on 19 May 2025.

Origins of the Bitcoin Holdings

The nearly 50,000 BTC sold by the German government were originally seized from the defunct piracy website Movie2k, which was involved in illegal film distribution. The authorities had stored the digital assets in a government-controlled wallet since the seizure.

Speculation about a potential sell-off first emerged on 19 June 2024 when the wallet executed a transfer of 6,500 BTC—valued at over $425 million at the time—sparking concern among investors and market watchers.

Rushed Transactions Raise Eyebrows

Crypto experts believe the selling strategy was hasty and lacked optimisation. Miguel Morel, founder of Arkham Intelligence, criticised the method used by the government, stating it pointed to a rush to gain liquidity rather than careful market strategy.

“The last thing I would have expected is that they would just go to five different exchanges and start market selling,” Morel said during an interview at EthCC 2024. “The fact that they’re going to so many different exchanges just reads like they’re just trying to get as much liquidity from each order book as possible.”

The decision to spread sales across various exchanges may have contributed to short-term downward pressure on Bitcoin, compounding the market’s reaction to the news rather than the volume of BTC itself.

Market Stabilises After Wallet Emptied

Bitcoin’s price dipped below the $60,000 mark during the liquidation period, driven in part by uncertainty about how much more Bitcoin the German government might offload. However, on 14 July 2024, a day after the BKA-labelled wallet was emptied, Bitcoin regained strength, climbing back above the $60,000 psychological threshold.

The end of the government’s selling spree helped restore market confidence, leading to a significant price recovery in the following months.

Critics Question Decision-Making

The German government’s decision has prompted debate over whether state actors handling digital assets need better financial guidance or strategic planning. While the aim may have been to quickly convert the seized assets into fiat currency, analysts argue that holding longer could have benefited the country’s economy significantly.

As of May 2025, with Bitcoin’s value soaring past the $100,000 mark, the missed opportunity remains a cautionary tale in crypto asset management.

Leave a Reply