Google has taken a major step into the world of Bitcoin mining and AI infrastructure, securing a $3.2 billion agreement with US-based Bitcoin miner TeraWulf. The move not only makes Google the company’s largest shareholder but also highlights the growing shift of crypto mining firms into artificial intelligence and high-performance computing.

Google Steps in with $3.2 Billion Backstop

The centrepiece of the deal is a financial guarantee, known as a backstop, provided by Google. This backstop protects Fluidstack, a cloud infrastructure provider, in its 10-year lease with TeraWulf for data centre space at the Lake Mariner campus in New York.

If Fluidstack cannot meet its financial obligations, Google will step in with the guaranteed funds. In exchange for this financial safety net, Google secured warrants to purchase more than 73 million TeraWulf shares. This gives the tech giant a 14% stake in the company, making it TeraWulf’s largest shareholder.

Kerri Langlais, TeraWulf’s chief strategy officer, said the investment shows “powerful validation” of the firm’s zero-carbon data infrastructure from one of the world’s leading technology companies.

Expanding AI Infrastructure at Lake Mariner

The deal goes far beyond financial support. Fluidstack has already exercised an option to expand its operations at TeraWulf’s Lake Mariner facility by building a new purpose-built data centre known as CB-5.

This new site will add 160 megawatts (MW) of critical IT load capacity, with operations expected to start in the second half of 2026. The project strengthens TeraWulf’s position as both a Bitcoin miner and an emerging player in AI and high-performance computing (HPC).

TeraWulf CEO Paul Prager said the expansion shows the scale of the Lake Mariner campus, calling it a step that “deepens the strategic alignment with Google as a financial partner.”

The projected revenue from the Fluidstack lease stands at $6.7 billion, with the potential to reach $16 billion if extended. Importantly, the backstop applies only to AI and HPC lease revenues and does not cover TeraWulf’s Bitcoin mining business or corporate debt.

Shifting Strategy After the Bitcoin Halving

TeraWulf will continue its current Bitcoin mining operations but has no plans to expand them further. Instead, the company is shifting its focus towards AI and HPC workloads, which it sees as more profitable in the long term.

The decision reflects industry-wide changes following the April 2024 Bitcoin halving, which reduced mining rewards from 6.25 to 3.125 BTC per block. This has squeezed profit margins for mining companies worldwide.

While Bitcoin mining still provides TeraWulf with cash flow and grid stability through flexible energy use, the company believes AI and HPC represent a stronger growth path. Industry analysts agree, VanEck has estimated that miners shifting even 20% of their energy capacity to AI and HPC by 2027 could generate an additional $13.9 billion in profits over 13 years.

Market Reacts to Google Partnership

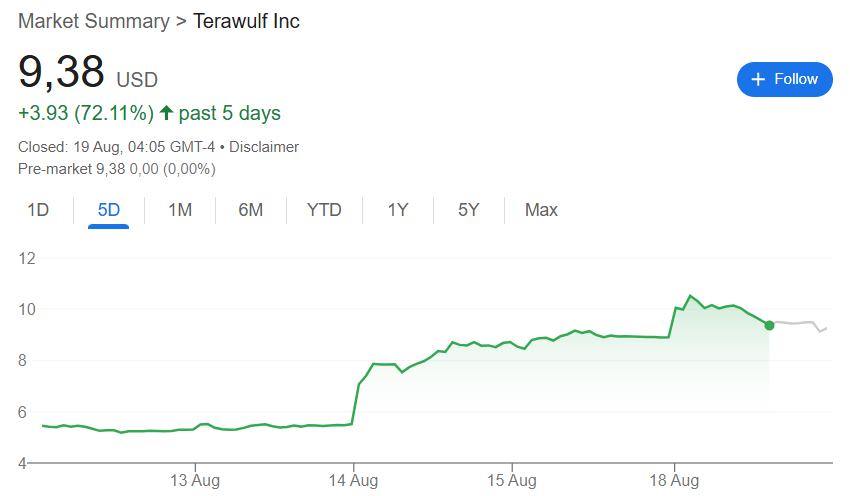

News of Google’s involvement sent TeraWulf shares surging. The stock jumped 17% during Monday trading to reach $10.57, up from a previous close of $8.97. Although it later settled at $9.38 and slipped a further 1.28% after hours, TeraWulf has still gained more than 72% over the last five trading days.

Investors view the deal as a turning point for TeraWulf, transforming it from a pure Bitcoin miner into a dual-purpose company with strong exposure to both cryptocurrency and AI. For Google, the investment signals its growing interest in securing access to sustainable infrastructure capable of supporting next-generation AI demands.

A New Phase for Mining and AI

The Google–TeraWulf partnership underscores a wider shift in the digital infrastructure sector. With Bitcoin mining profitability under pressure, companies are repurposing capacity for AI, machine learning, and other high-demand computing workloads.

TeraWulf’s zero-carbon data centres and Google’s backing create a powerful combination. If successful, the project could serve as a blueprint for how mining firms adapt in an era of tighter margins and rising energy costs.

As operations at the CB-5 facility come online in 2026, the partnership’s true value will be tested. For now, Google’s $3.2 billion commitment is being seen as a strong endorsement of TeraWulf’s strategy and a sign that the lines between crypto mining and AI infrastructure are becoming increasingly blurred.

Leave a Reply