Google has taken another bold step into the crossover between artificial intelligence (AI) and crypto mining. The tech giant has secured a 5.4% stake in Bitcoin mining firm Cipher Mining by backstopping $1.4 billion of lease obligations in a $3 billion data centre deal with AI cloud infrastructure company Fluidstack.

The agreement highlights a growing trend where Bitcoin miners are pivoting towards high-performance computing (HPC) and AI hosting, a sector attracting major institutional investment.

Google, Cipher and Fluidstack: A Strategic Triangle

The deal centres on a 10-year hosting agreement between Cipher Mining and Fluidstack. Under the arrangement, Cipher will provide 168 megawatts (MW) of IT load capacity, backed by 244 MW of gross capacity, at its Barber Lake site in Colorado City, Texas. The development, one of Cipher’s flagship projects, has the potential to scale up to 500 MW and is supported by more than 580 acres of surrounding land.

Google’s involvement comes in the form of a $1.4 billion backstop of Fluidstack’s obligations under the contract. In return, the tech firm receives warrants to acquire about 24 million shares of Cipher stock, equivalent to roughly 5.4% pro forma equity. Cipher retains full ownership of the project while benefiting from Google’s financial backing and institutional credibility.

Cipher CEO Tyler Page hailed the transaction as transformative:

“We believe this transaction represents the first of several in the HPC space as we continue to scale our capabilities and strengthen our position in this rapidly growing sector.”

Echoes of Google’s TeraWulf Deal

This is not Google’s first foray into Bitcoin mining via Fluidstack. Just weeks earlier, the company became the largest shareholder in TeraWulf after acquiring a 14% stake under a similar arrangement. That deal also involved Google guaranteeing obligations from Fluidstack in exchange for equity.

The repetition of this structure suggests Google is positioning itself as a strategic backer of miners transitioning into AI and HPC services. By aligning with Fluidstack and miners like Cipher and TeraWulf, Google is indirectly expanding its footprint in both Bitcoin mining and the AI infrastructure market, without directly running mining operations itself.

Cipher’s Dual Expansion Plan

Alongside the Fluidstack contract, Cipher also unveiled plans for an $800 million private offering of convertible senior notes due in 2031. The notes will not bear interest but can be converted into shares, cash, or a combination under certain conditions. Purchasers are also expected to receive a 13-day option to buy up to an additional $120 million in notes.

Cipher intends to use the proceeds to finance its Barber Lake expansion, strengthen its 2.4-gigawatt HPC pipeline and fund development at other sites. This dual financing strategy underlines Cipher’s ambition to move beyond Bitcoin mining into diversified HPC and AI infrastructure hosting.

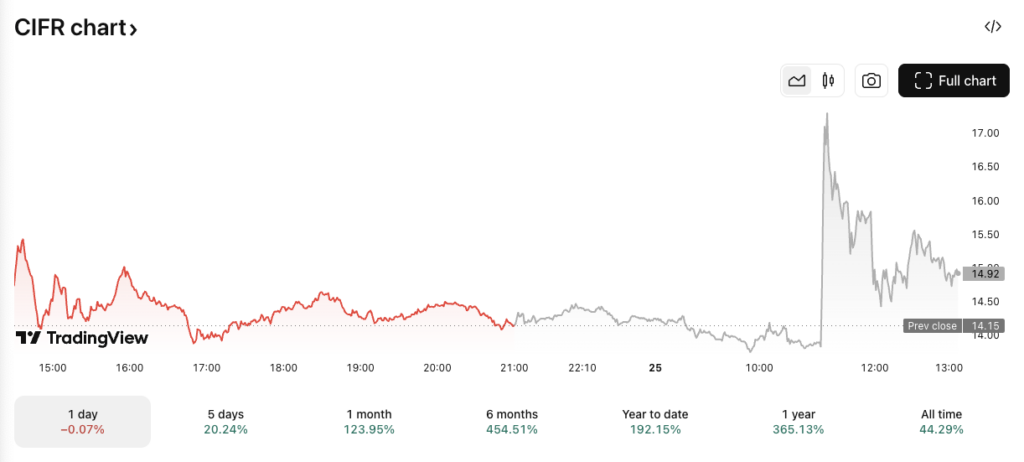

Following the announcement, Cipher’s shares surged 22.4% in pre-market trading before moderating to around $14.95, giving the firm a market capitalisation of $5.6 billion. Year-to-date, Cipher stock has gained nearly 192%, reflecting strong investor enthusiasm for its HPC shift.

AI and Mining: A Growing Convergence

The deal underscores a broader industry trend where miners are leveraging their existing infrastructure to serve AI demand. Crypto mining farms are naturally suited for high-performance computing because of their access to cheap energy, robust cooling systems and large-scale GPU capacity.

Other miners have already moved in this direction. CleanSpark recently announced a $100 million financing round partly earmarked for AI infrastructure, which boosted its stock price. Hive Digital also expanded into GPU and AI services earlier this year, reporting record earnings in its first fiscal quarter.

According to research by The Miner Mag, Bitcoin mining stocks have outpaced Bitcoin’s price recovery in recent months, largely because investors are rewarding firms that pursue AI and HPC strategies.

Cipher’s partnership with Fluidstack and Google places it firmly at the heart of this shift, positioning the miner not just as a Bitcoin operator but as a future heavyweight in AI data services.

Outlook: A Pivotal Deal for Cipher and Google

Google’s 5.4% stake in Cipher Mining signals more than a financial transaction. It represents a strategic bet on the convergence of AI and crypto mining. For Cipher, the $3 billion Fluidstack contract, backed by Google’s guarantees, provides both long-term revenue stability and institutional credibility.

As Cipher scales its Barber Lake site and pursues its multi-gigawatt HPC pipeline, the firm is well placed to capture demand from both crypto and AI markets. Meanwhile, Google strengthens its AI infrastructure ecosystem without direct exposure to the volatile mining business.

If this model proves successful, it could serve as a template for future partnerships between tech giants, AI firms and crypto miners. For now, Cipher’s latest deal cements its role as one of the leading players in the fast-evolving AI-mining crossover.

Leave a Reply