Grayscale Investments has quietly laid early groundwork that could signal future expansion of its crypto exchange traded product lineup. According to public records in Delaware, the asset manager has registered new statutory trusts linked to BNB and Hyperliquid’s HYPE token, a move that often comes before formal ETF or ETP filings in the United States but does not guarantee they will follow.

Delaware Trusts Signal Preliminary Planning

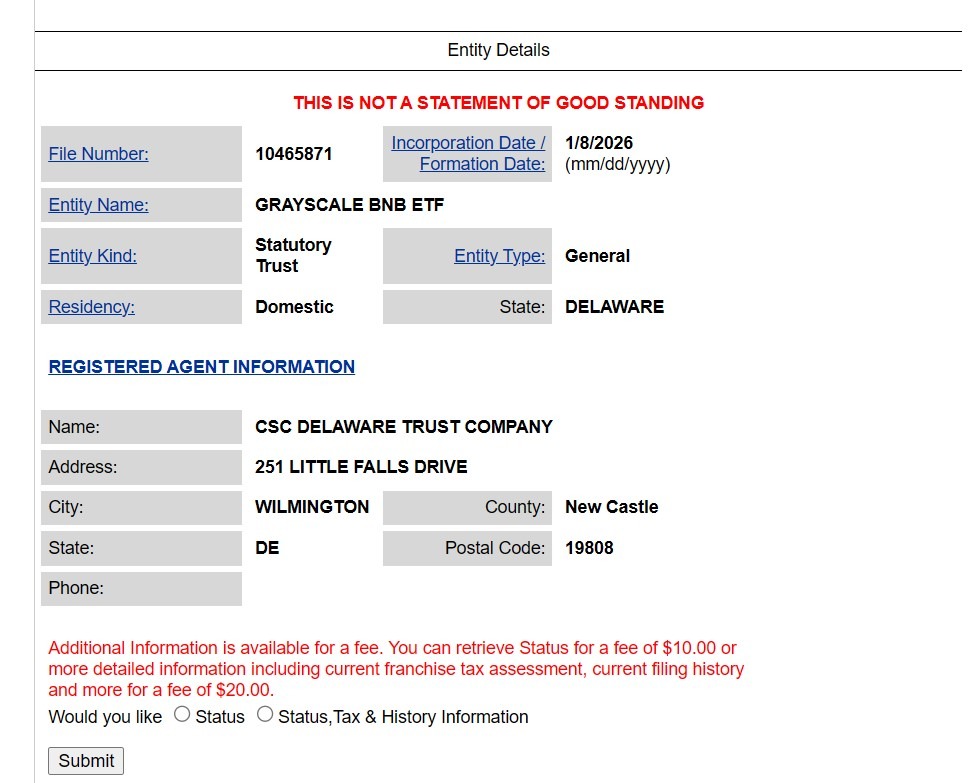

State records show that the trusts were registered on Thursday, with CSC Delaware Trust Company listed as the registered agent. Creating a Delaware statutory trust is a routine administrative step for asset managers preparing potential investment vehicles. These structures are commonly used as placeholders that can later be converted into exchange traded products if market conditions and regulatory approval align.

At this stage, the registrations do not indicate that Grayscale has filed any applications with the US Securities and Exchange Commission, nor do they suggest that approvals are imminent. Grayscale has also not publicly confirmed plans to launch BNB or HYPE related ETFs. The firm did not respond to requests for comment before publication.

Focus Shifts Beyond Bitcoin and Ether

The appearance of BNB and HYPE stands out in a US market still dominated by Bitcoin and Ether products. Most crypto ETFs listed in the country track BTC or ETH, with only limited exposure to alternative tokens. While a few altcoin linked funds have begun to emerge, the overall landscape remains heavily concentrated in the two largest assets by market capitalization.

BNB, the native token of the BNB Chain ecosystem, is among the largest crypto assets globally but has yet to see serious ETF momentum in the US. HYPE, by contrast, represents a newer and more niche exposure tied to Hyperliquid, a decentralized perpetuals trading platform that gained significant traction throughout 2025.

Administrative Step, Not a Regulatory Milestone

Industry observers generally view trust formation as an internal readiness measure rather than a signal of regulatory progress. Asset managers often set up these entities well in advance to ensure they can move quickly if sentiment, policy or demand shifts in their favor.

This approach allows firms like Grayscale to test interest and maintain flexibility without committing to a public filing. In past cases, some trusts have eventually turned into ETF applications, while others have remained dormant indefinitely.

Market Context and Grayscale’s Outlook

The timing of the registrations comes as Grayscale has struck an optimistic tone about the medium term outlook for crypto markets. Earlier this week, the firm published research arguing that recent ETF outflows were largely driven by tax considerations rather than a collapse in investor confidence.

Grayscale has pointed to 2026 as a potentially stronger year, citing expectations of clearer regulation and renewed institutional participation. That view contrasts with recent ETF flow data, which shows sustained redemptions from spot Bitcoin and Ether ETFs. More than one billion dollars has been withdrawn from these products in early January alone.

Despite the broader pullback, altcoin ETFs have shown comparatively modest but consistent inflows since their launches, suggesting selective appetite for diversified crypto exposure.

Why BNB and HYPE Matter

Including BNB and HYPE in Grayscale’s preparatory pipeline hints at a gradual broadening of institutional crypto offerings. BNB represents an established ecosystem with deep liquidity and widespread use, while HYPE reflects interest in emerging sectors such as decentralized derivatives trading.

Hyperliquid, the protocol behind HYPE, was a dominant force in perpetual futures trading for much of 2025 before competition began to intensify toward year end. Interest in such platforms highlights a shift among some investors toward infrastructure and trading focused tokens rather than just store of value assets.

For now, the Delaware registrations remain a quiet signal rather than a formal announcement. Whether they turn into ETF filings will likely depend on regulatory developments, market demand and Grayscale’s broader strategy in the year ahead.

Leave a Reply