The cryptocurrency world has once again been rocked by revelations of massive fund movements tied to a controversial exchange. Grinex, identified as the alleged successor to the sanctioned Russian platform Garantex, has reportedly facilitated over $1.66 billion in crypto transactions through various exchanges, raising fresh concerns about regulatory blind spots.

Grinex Emerges from Garantex’s Ashes

Garantex faced a significant crackdown in March when US, German, and Finnish authorities took down its infrastructure as part of a coordinated effort to disrupt illicit financial activities. The operation saw Tether freezing $27 million in stablecoins associated with Garantex, and European authorities seizing servers and domain names linked to the platform.

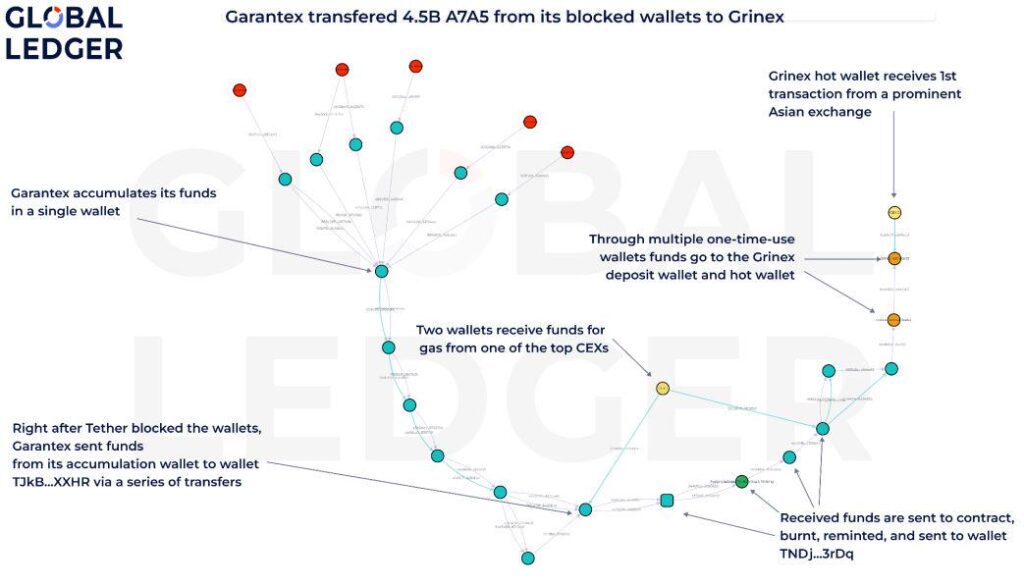

Despite these measures, blockchain analytics firm Global Ledger reports that Garantex has rebranded and resumed operations under the name Grinex. Investigations revealed that Garantex transferred over $60 million in Russian ruble-backed stablecoins to Grinex. Customers allegedly moved funds from Garantex to Grinex, further cementing its reputation as Garantex’s “full-fledged successor.”

Tron-Based USDt Transactions Raise Red Flags

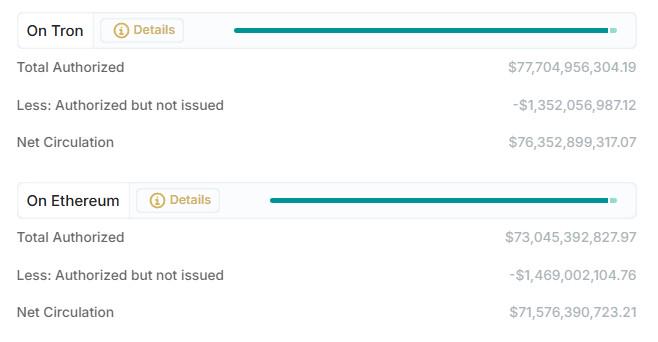

Grinex’s transactions have predominantly involved Tron-based Tether (USDt), a stablecoin that has become a favoured tool for illicit fund flows. Compliance company Bitrace reported that $649 billion in stablecoins were exposed to high-risk addresses in 2024, with over 70% of these transactions conducted on the Tron network.

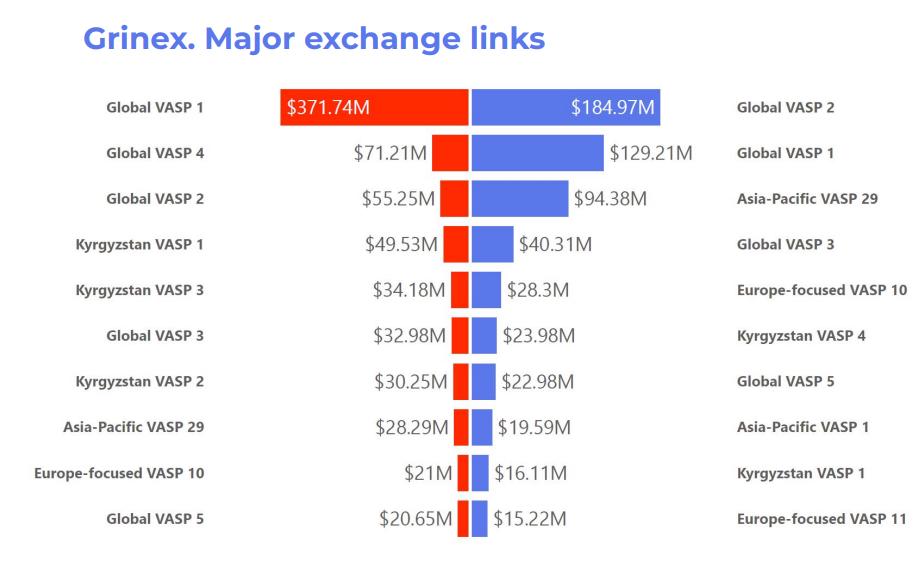

As of May 2025, Global Ledger estimates $2.41 billion in transactional exposure to various crypto services and wallets. Of this, $1.66 billion was directly moved in and out of 180 cryptocurrency exchanges. Alarmingly, these transactions often bypassed obfuscation techniques, directly linking Grinex wallets to exchanges.

Global Exchanges Scramble to Address Risks

Leading exchanges have begun taking measures to limit exposure to Grinex. Binance, one of the few platforms to respond to inquiries, stated that it actively monitors and blocks interactions with sanctioned entities. The exchange emphasized that while it cannot prevent incoming deposits, it takes steps to restrict further activity and prevent fund transfers to flagged addresses.

Despite some cooperation from exchanges, Global Ledger has noted limited responses to its risk notifications. Many platforms remain vulnerable due to gaps in compliance, particularly in regions where regulations are still evolving.

Challenges in Regulating Illicit Crypto Flows

The Grinex saga highlights the persistent challenges of regulating cryptocurrency. While the industry has matured significantly, with growing institutional interest and advanced tracking tools, regulatory arbitrage continues to be a major issue. Licensed exchanges in Europe, for instance, face strict scrutiny under the Markets in Crypto-Assets (MiCA) framework but remain exposed to activities in jurisdictions with looser regulations.

Experts warn that sanctioned platforms often rebrand to evade detection. Garantex’s evolution into Grinex is a stark reminder of this trend. Recent cases, such as the dismantling of no-KYC exchange eXch by German authorities, show that even when platforms are shut down, associated wallets often remain active.

A Call for Stronger Global Collaboration

Grinex’s continued operations underscore the urgent need for global collaboration to combat crypto-related financial crimes. While strides have been made in enhancing transparency and security, the rapid evolution of blockchain technology demands equally adaptive regulatory frameworks. Without concerted efforts, platforms like Grinex will continue to exploit vulnerabilities, undermining trust in the cryptocurrency ecosystem.

The battle against illicit crypto activities is far from over. As authorities and industry players step up their efforts, the Grinex case serves as a sobering reminder of the challenges ahead.

Leave a Reply