A hacker who exploited decentralised finance (DeFi) protocol Radiant Capital in October 2024 has seen their stolen assets nearly double in value, thanks to Ether’s (ETH) sharp price surge over the past year.

From $58 Million Breach to $103 Million Windfall

Radiant Capital, a cross-chain lending platform, suffered a $58 million cybersecurity breach on BNB Chain and Arbitrum in mid-October 2024. Following the hack, the attacker converted much of the stolen funds into Ether. At the time, ETH was trading above $2,300, and the holdings were worth around $58 million.

Now, blockchain data from Lookonchain shows the exploiter holds 21,957 ETH valued at about $103 million, with Ether trading above $4,700 on Thursday. The windfall is a direct result of Ether’s price nearly doubling since the time of the exploit.

Security Move, Not Market Timing

Analysts suggest the hacker’s gains are more likely the by-product of operational security measures rather than a calculated investment. Blockchain forensics firm AMLBot noted that attackers often move stolen funds into Bitcoin or Ether to avoid token freezes and benefit from high liquidity.

“These assets are widely supported across exchanges and networks, making it easier to move them,” AMLBot’s team explained. “The holdings probably appreciated due to general market growth rather than a deliberate bet on ETH’s price.”

Ether’s Price Surge Drivers

Ether’s rise has been fuelled by several market and network developments. In late July 2024, Ether spot exchange-traded funds (ETFs) launched in the US, attracting $12.12 billion in net inflows within a year, according to CoinGlass data. This accumulation, along with record staking activity, has reduced ETH’s circulating supply.

Mid-June 2024 saw staked Ether reach an all-time high of over 35 million ETH, with Dune Analytics reporting the figure has since surpassed 36 million. Corporate ETH treasuries have also grown, exceeding $100 billion by late July.

The regulatory environment has shifted in Ether’s favour. In June 2024, the US Securities and Exchange Commission dropped its probe into whether ETH is a security, a move legal experts interpreted as a sign of weak grounds for a case.

Network Upgrades and Ecosystem Growth

Ethereum’s Dencun upgrade, rolled out earlier in 2024, introduced Ethereum Improvement Proposal 4844, enabling danksharding and proto-danksharding. These enhancements significantly boosted network scalability and layer-2 compatibility.

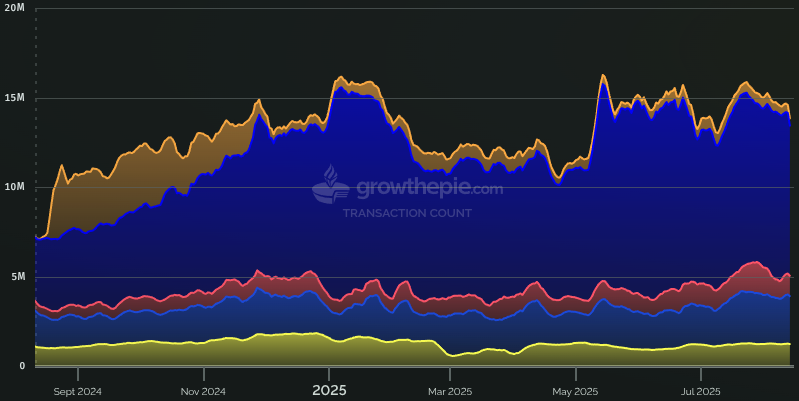

Ethereum’s layer-2 ecosystem has continued to expand, with daily transactions reaching 12.42 million on 12 August 2024 and nearly 13.88 million on a single day this week. Past peaks have topped 16 million daily transactions, reflecting growing adoption and activity.

A Fortunate Twist for the Attacker

While the Radiant Capital hack remains one of the largest DeFi breaches of 2024, the attacker’s decision to hold Ether has turned a stolen fortune into an even larger one. Analysts maintain, however, that the move likely came down to security and liquidity — and the rest was a matter of timing and market momentum.

Leave a Reply