The cryptocurrency market often witnesses price fluctuations that test the patience of investors, and Hamster Kombat (HMSTR) is no exception. Following a sharp decline in recent days, HMSTR appears to be nearing oversold territory. However, the road to recovery remains clouded by unclear trends and waning momentum. Below, we dive into the latest developments, technical indicators, and potential outcomes for this intriguing altcoin.

Recent Performance: HMSTR Faces a Steep Decline

Hamster Kombat has recorded five consecutive daily bearish candlesticks since May 11, 2025, dragging its price down from a local high of $0.0029 to $0.0024. This represents a significant dip of nearly 17% in less than a week.

Despite nearing the oversold threshold—a zone that traditionally signals a potential bullish reversal—investors remain cautious. The absence of a clear recovery signal has left the altcoin’s trajectory uncertain, with key indicators pointing towards possible consolidation rather than an immediate rebound.

Technical Indicators Signal Weak Momentum

The RSI, a critical momentum indicator, has fallen sharply in recent days. On May 10, the RSI peaked at 65.78 as HMSTR reached $0.0028. By contrast, its current reading of 38.10 reflects waning buying pressure, indicating that the market sentiment has turned bearish.

Although an RSI below 30 signals an oversold asset, suggesting potential for a rebound, HMSTR has not yet reached this level. Instead, the cryptocurrency appears poised for a period of consolidation between $0.0023 (support) and $0.0028 (resistance).

IOMAP Data Reinforces Consolidation Expectations

The In/Out of Money Around Price (IOMAP) indicator provides a granular view of support and resistance levels by analysing unrealised profit and loss volumes. Current data reveals robust support at $0.0023, where nearly 7 billion HMSTR tokens are held in profit. Conversely, resistance is concentrated near $0.0028, with over 4 billion tokens at a loss.

This balance suggests limited room for dramatic price movements in the short term. Instead, HMSTR is likely to trade within this range until fresh buying momentum emerges or selling pressure intensifies.

Bearish Signals on the Chart: Key Indicators Flash Warnings

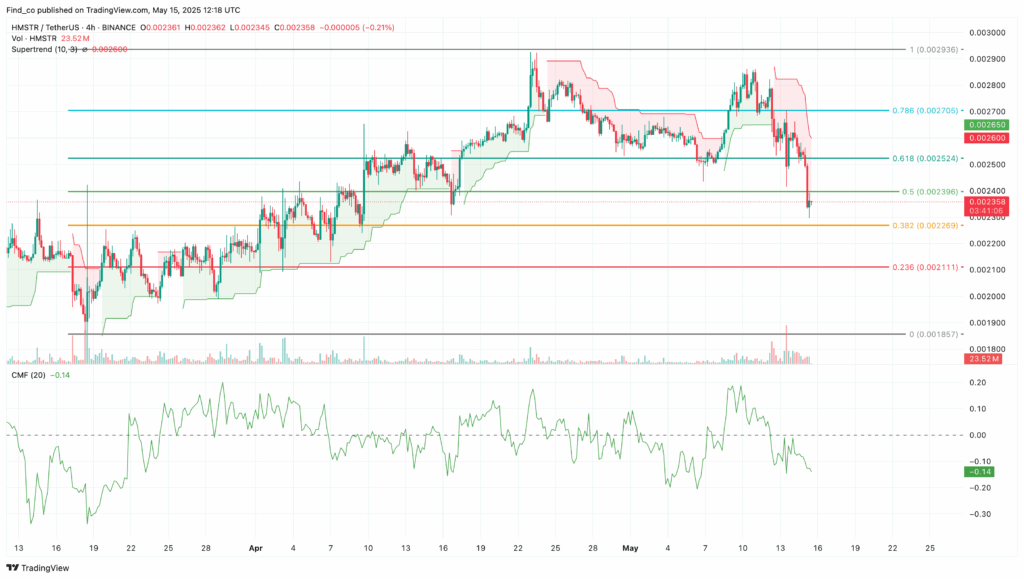

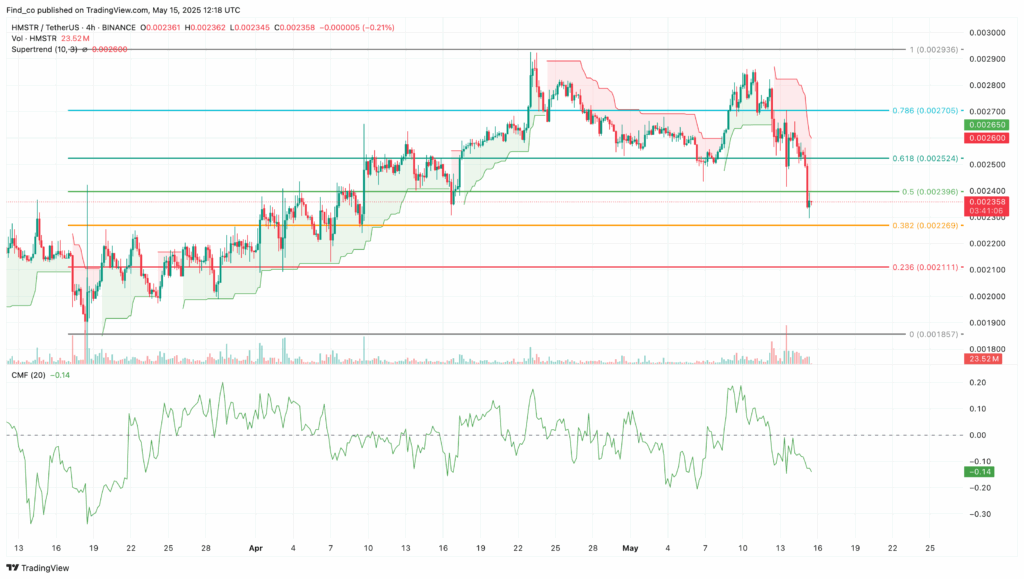

The 4-hour HMSTR/USDT chart shows the Supertrend indicator turning bearish, with the red line positioned above the current price. This signifies strong resistance, adding to the challenges of a potential upward breakout.

Chaikin Money Flow (CMF) Indicates Weak Buying Interest

The CMF, which measures capital flow into and out of an asset, has fallen below the zero line, underscoring that selling volume currently outpaces buying activity. This bearish signal suggests that downward pressure could persist unless a surge in demand reverses the trend.

If these indicators hold, HMSTR could test lower levels, potentially dropping to $0.0021 or even $0.0019 in a worst-case scenario. Conversely, a reversal in CMF momentum might enable the price to reclaim $0.0028 and aim for $0.0030.

Outlook: Consolidation Likely in the Short Term

The coming days will be critical for Hamster Kombat as it approaches the oversold zone. While this typically sparks a bullish reversal, a lack of strong buying signals suggests HMSTR is more likely to consolidate within the $0.0023–$0.0028 range.

To break free of this range and re-enter bullish territory, HMSTR needs a catalyst to reignite investor interest. Factors such as broader market sentiment, news announcements, or an influx of new buyers could drive such momentum.

For now, cautious optimism is the watchword, with traders advised to closely monitor key indicators such as RSI, CMF, and Supertrend for signs of a potential breakout.

Leave a Reply