Hedera Hashgraph’s native cryptocurrency, HBAR, is showing signs of renewed bullish momentum after a month of largely sideways price action. Since the start of August, HBAR had been locked in a horizontal trading channel, with resistance at $0.2669 and support at $0.2357. This consolidation phase reflected market indecision, with neither bulls nor bears taking full control.

However, in the past 24 hours, HBAR has risen by 3%, breaking decisively above the upper resistance level. This move comes amid improving sentiment and stronger on-chain fundamentals, which suggest that this breakout could be more than a short-lived rally.

Capital Inflows Signal Renewed Confidence

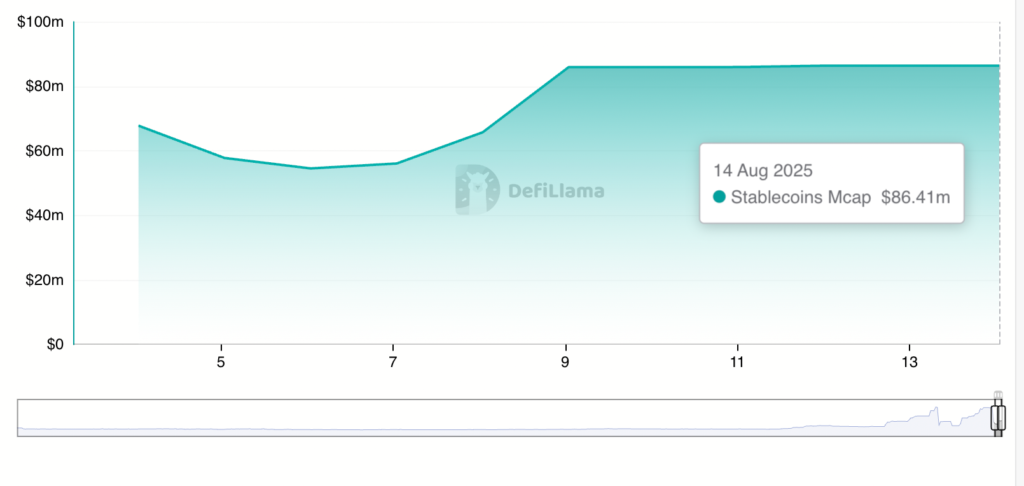

One of the clearest indicators supporting HBAR’s latest price push is a surge in stablecoin inflows to the Hedera network. According to data from DeFiLlama, the total market capitalisation of stablecoins on Hedera has increased by more than 54% in the past week, climbing to $86.41 million.

A growing stablecoin market cap is generally interpreted as a sign of fresh liquidity entering the ecosystem. Investors often move stablecoins into a network before deploying them into decentralised applications, staking, or purchasing native tokens. This inflow of capital can act as a catalyst for price growth, as it reflects rising confidence in the network’s prospects and the readiness of market participants to engage more deeply with its ecosystem.

TVL Jump Highlights Growing Network Engagement

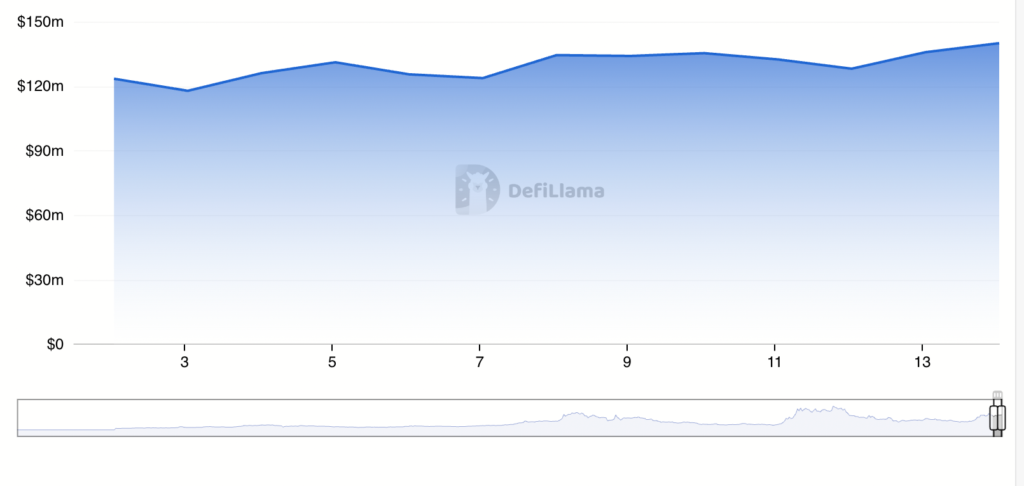

Alongside the surge in stablecoin inflows, Hedera Hashgraph has also recorded a substantial rise in its decentralised finance (DeFi) total value locked (TVL). As of the latest data, Hedera’s TVL stands at $140.06 million, marking a 20% increase since 3 August.

TVL represents the total amount of digital assets deposited into a blockchain’s DeFi protocols. A rising TVL suggests that more users are participating in staking, lending, liquidity provision, and other DeFi activities on the network. In Hedera’s case, the increase underscores growing user engagement and the attractiveness of its ecosystem for capital deployment.

Higher network activity typically strengthens the demand for a blockchain’s native token, in this case, HBAR. This is because HBAR is often required for transaction fees, staking, and interacting with decentralised applications, creating a direct link between network growth and token value.

Key Levels to Watch in the Short Term

The breakout above $0.2669 marks a significant technical development for HBAR. If bullish pressure continues, this level could flip from resistance into a strong support floor, providing a base for further upward movement. Should this scenario play out, analysts suggest HBAR could target the $0.3050 price level in the near term.

However, traders should remain cautious. If the price fails to hold above $0.2669, a retracement toward the previous support level at $0.2357 becomes likely. A break below this level could expose HBAR to a deeper correction, with $0.1963 as the next major support zone.

Momentum in Hedera’s Favour

With both capital inflows and network activity on the rise, Hedera Hashgraph appears to be entering a period of stronger market performance. The alignment of technical and on-chain indicators suggests that the recent breakout may be more than just a temporary spike.

If stablecoin inflows and TVL growth persist, HBAR could sustain its gains and potentially challenge higher resistance levels in the weeks ahead. While short-term volatility remains a risk, the underlying trends point towards a favourable outlook for the asset as the network continues to attract capital and user engagement.

Leave a Reply