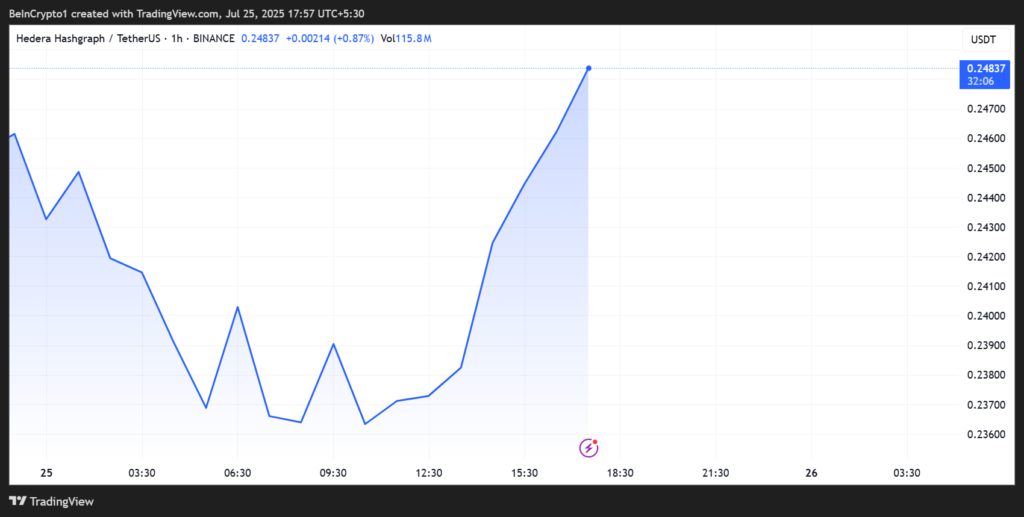

Hedera (HBAR) has emerged as the standout performer among the top 20 cryptocurrencies, recording near double-digit gains even as the broader altcoin market struggles. Robinhood, the popular US-based trading app, has officially listed HBAR on its platform.

While many altcoins continue to bleed in the current market environment, HBAR’s surge highlights the importance of strategic listings and the growing role of retail-driven platforms in shaping price action.

Robinhood Listing Opens New Retail Channels

The core catalyst behind the rally is Robinhood’s decision to list HBAR, granting the altcoin exposure to the platform’s over 20 million monthly active users. Known for its mobile-first approach and millennial-heavy user base, Robinhood has become a major force in retail trading across stocks and crypto.

Unlike traditional exchanges like Binance or Coinbase, Robinhood appeals to a newer class of retail traders who prefer simplicity and convenience. The listing gives HBAR access to this large and untapped pool of investors, many of whom may have previously never interacted with the token.

This trend has proven successful with other altcoins in recent months. Bithumb’s listing of Lista DAO (LISTA) and Merlin Chain (MERL) sparked double-digit price gains, while Coinbase’s hints of listing BNKR, JITOSOL, and MPLX led to surges in those tokens. HBAR is now seeing a similar influx of interest and price momentum.

Regulatory Tailwinds Boost Sentiment

Robinhood’s renewed confidence in expanding its crypto offerings comes at a time when the US regulatory environment appears to be softening. Following Donald Trump’s election victory in November, crypto firms in the US have seen increased operational flexibility. One example is the US SEC dropping its enforcement action against Robinhood related to crypto trading violations.

This shift has emboldened exchanges like Robinhood to expand listings, even adding meme coins to their portfolios, in an effort to capture more of the growing US crypto market. HBAR’s inclusion is a strategic step in this direction, reinforcing the perception of a friendlier regulatory climate under a pro-crypto administration.

ETF Hopes Add Fuel to HBAR Momentum

In addition to the Robinhood listing, HBAR’s bullish outlook is also being buoyed by ongoing discussions around the launch of a potential HBAR ETF (exchange-traded fund). Canary Capital was the first to file with the US SEC for an HBAR ETF back in November, with Grayscale also reportedly exploring similar offerings.

While the ETF has yet to be approved, even the filing alone has provided a confidence boost among investors, suggesting growing institutional interest in Hedera’s technology and long-term viability. ETFs are typically seen as a sign of maturity and credibility for a digital asset, further validating HBAR’s recent rise.

Short-Term Surge, Long-Term Potential?

HBAR’s recent rally is more than just hype, it reflects growing demand from new investor bases, regulatory shifts, and institutional curiosity. While short-term volatility may follow, especially as broader altcoin sentiment remains fragile, the Robinhood listing could mark the beginning of a more sustained period of visibility and adoption for Hedera.

With an HBAR ETF in the pipeline and more exchanges likely to follow Robinhood’s lead, the token appears well-positioned to build on its momentum in the coming months.

Leave a Reply