Day trading in cryptocurrency is a fast-paced arena where opportunities can vanish within minutes. With 24/7 markets, sudden liquidity shifts and narrative-driven rallies, traders are under constant pressure to process information and act decisively. Google’s Gemini AI is emerging as a tool that can help traders cut through the noise, manage risk and maintain discipline.

The Role of Gemini AI in Day Trading

Gemini AI functions as a research and reasoning partner rather than an automated trading engine. It cannot execute trades or hold crypto keys directly, but it can support traders by summarising market data, comparing assets and structuring trading plans. The latest release, Gemini Flash 2.5, offers improved reasoning and coding abilities but still lacks access to live order books or real-time data. Traders must therefore cross-check AI insights against platforms such as TradingView, Glassnode or Nansen before taking positions.

Building a Trading Framework with Gemini

Traders can integrate Gemini into Google Workspace apps like Sheets and Docs to create a structured workflow. A typical trading notebook in Sheets might include tabs for watchlists, catalysts, support and resistance levels, order flow, trading plans and post-mortem reviews. This loop encourages discipline: watchlist, catalysts, levels, plan, order flow and post-mortem, then back to the watchlist.

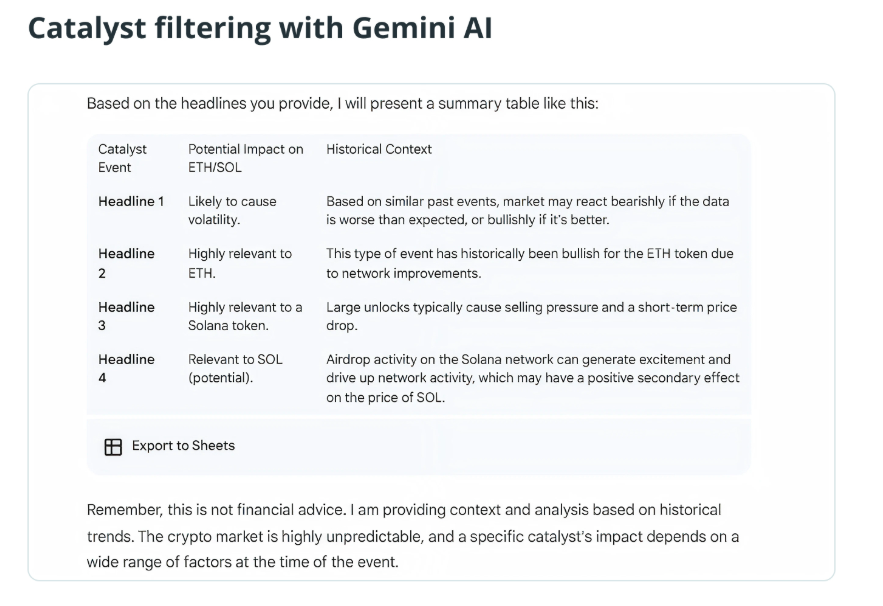

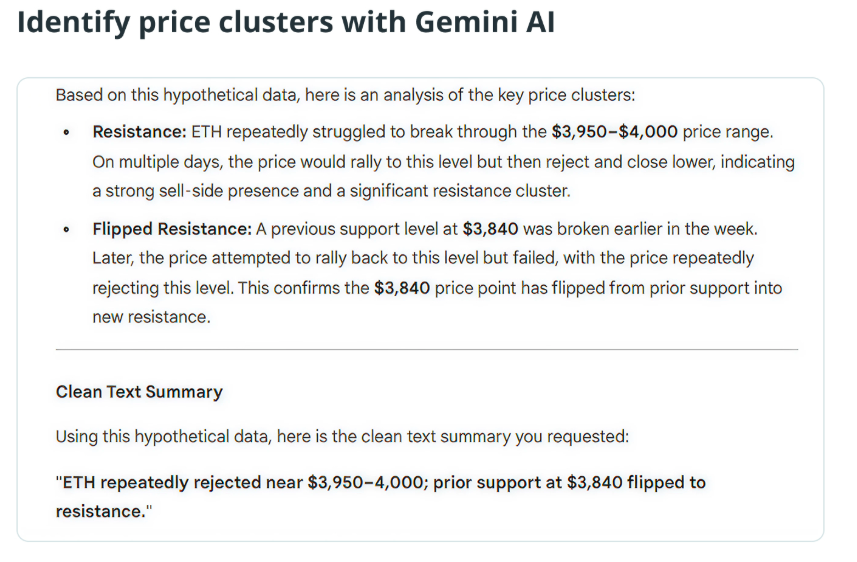

For example, Gemini can summarise which assets in a watchlist showed the largest 24-hour swings or highlight which news catalysts are most likely to influence ETH or SOL based on past reactions. It can also interpret OHLCV data to mark resistance clusters or turn complex futures positioning into clear summaries of whether sentiment is skewed long or short.

From Scenarios to Discipline

One of Gemini’s strengths lies in helping traders map scenarios. A prompt can generate intraday strategies with triggers and invalidations, such as a BTC rejection at a resistance level or a potential SOL drop after a token unlock. The AI can also review past trades to identify recurring mistakes, such as exiting winners too early or overtrading during volatility. This structured feedback loop prevents traders from chasing noise and promotes steady improvement.

Supporting Risk Management

Risk management remains the cornerstone of survival in day trading. Gemini AI can act as a discipline tool by calculating position sizes based on account size and risk tolerance, ranking trade setups by risk-to-reward ratio and identifying overexposure to certain assets. It can also produce scenario plans that include bullish, bearish and sideways outcomes, ensuring traders are prepared for multiple possibilities.

A Co-pilot Rather than a Replacement

Crypto markets are volatile, narrative-driven and open at all hours. While Gemini AI cannot replace human judgement or live data feeds, it provides a valuable edge by organising information, filtering signals and reinforcing trading rules. For traders willing to pair it with reliable data sources, Gemini offers a way to refine strategies, avoid impulsive trades and turn lessons into structured improvements.

Leave a Reply