Wallet Linked to Ex Staff Member, Says Co Founder

Decentralised perpetuals exchange Hyperliquid has responded to community allegations of insider trading involving its native HYPE token. The company said that a wallet accused of shorting HYPE belonged to a former employee who was dismissed in early 2024.

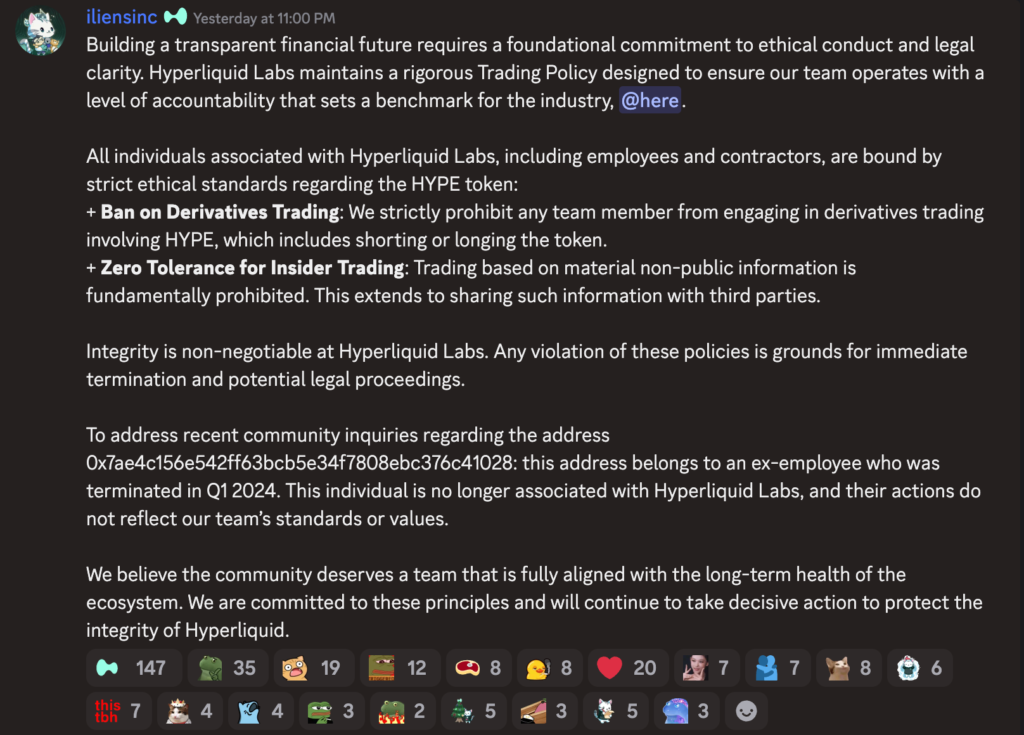

In a message shared on Hyperliquid’s Discord channel on Monday, co founder Iliensinc stated that the address identified by community members was controlled by an individual no longer associated with Hyperliquid Labs. He said the person was terminated during the first quarter of 2024.

“This individual is no longer associated with Hyperliquid Labs, and their actions do not reflect our team’s standards or values,” Iliensinc wrote, referring to the wallet address 0x7ae4…1028.

The clarification comes after weeks of speculation within the Hyperliquid community over alleged insider activity linked to large scale selling of HYPE tokens.

Community Raised Insider Trading Concerns

The issue first gained attention after a community member using the name cobe.hype claimed that the wallet belonged to a member of the Hyperliquid team. According to the claim, the address sold around 4,000 HYPE tokens in a single day in November, worth approximately $134,000 at the time.

These allegations triggered concern among token holders who questioned whether internal team members had access to privileged information or were engaging in prohibited trading activities. The wallet’s activity was widely discussed across social platforms and community channels.

Hyperliquid’s leadership remained silent initially, leading to further speculation before the official response was issued through Discord.

Strict Trading Rules for Staff

In his statement, Iliensinc emphasised that Hyperliquid Labs enforces a strict internal trading policy. He said the framework is designed to ensure accountability and transparency across the organisation.

“All individuals associated with Hyperliquid Labs, including employees and contractors, are bound by strict ethical standards regarding the HYPE token,” he said.

Hyperliquid explicitly prohibits employees and contractors from participating in derivatives trading involving HYPE. This restriction covers both short positions and long exposure to the token.

The company also bans trading based on material non public information. Iliensinc said this rule applies equally to sharing such information with third parties.

He described these principles as fundamental to maintaining trust within the ecosystem and protecting the integrity of the platform.

Hyperliquid’s Market Position Continues to Grow

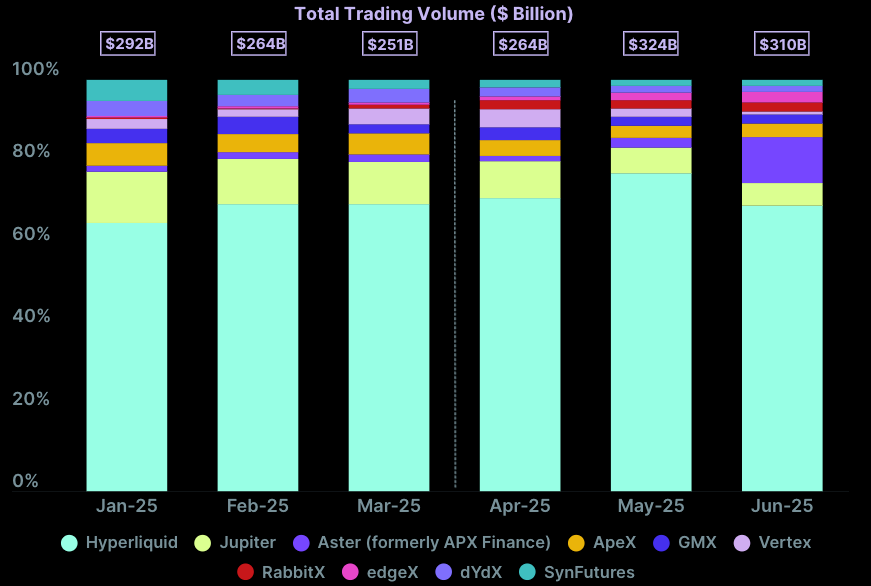

Founded in late 2022, Hyperliquid has become a dominant player in the decentralised perpetuals market. According to data from CoinGecko, the platform processed at least $653 billion in trading volume during the second quarter of 2025.

This figure represents roughly 73 percent of the total perpetual DEX market, highlighting Hyperliquid’s rapid growth and strong market presence.

The exchange has benefited from rising demand for on chain derivatives trading and a growing base of active users.

HYPE Volatility Persists Despite Industry Praise

Despite the controversy and recent price weakness, HYPE continues to attract attention from prominent figures in the crypto industry. Arthur Hayes, co founder of BitMEX, recently described Hyperliquid as the best story of the current market cycle.

Hayes noted that HYPE launched at around two or three dollars in November 2024 before surging to nearly $60. The token reached an all time high in mid September 2025 before facing a series of sell offs.

At the time of publication, HYPE was trading near $25.40. This places the token down about 24 percent over the past year but still up roughly 290 percent since launch, according to CoinGecko.

The clarification from Hyperliquid aims to reassure users as the platform continues to expand amid heightened scrutiny around governance and insider conduct.

Leave a Reply