Decentralized identity and IoT-focused blockchain project IoTeX has confirmed that it is probing suspicious activity involving one of its token safes, following alerts from onchain analysts about a possible security breach.

In a post shared on X on Saturday, the team said it is actively assessing the situation and working to contain any potential fallout. According to the project, early estimates suggest the losses are lower than figures circulating online. IoTeX added that it has coordinated with major cryptocurrency exchanges and security partners to track and freeze funds connected to the incident.

“The situation is under control. We will continue to monitor closely and provide timely updates to the community,” the team said in its statement.

Onchain Analysts Flag Possible Private Key Compromise

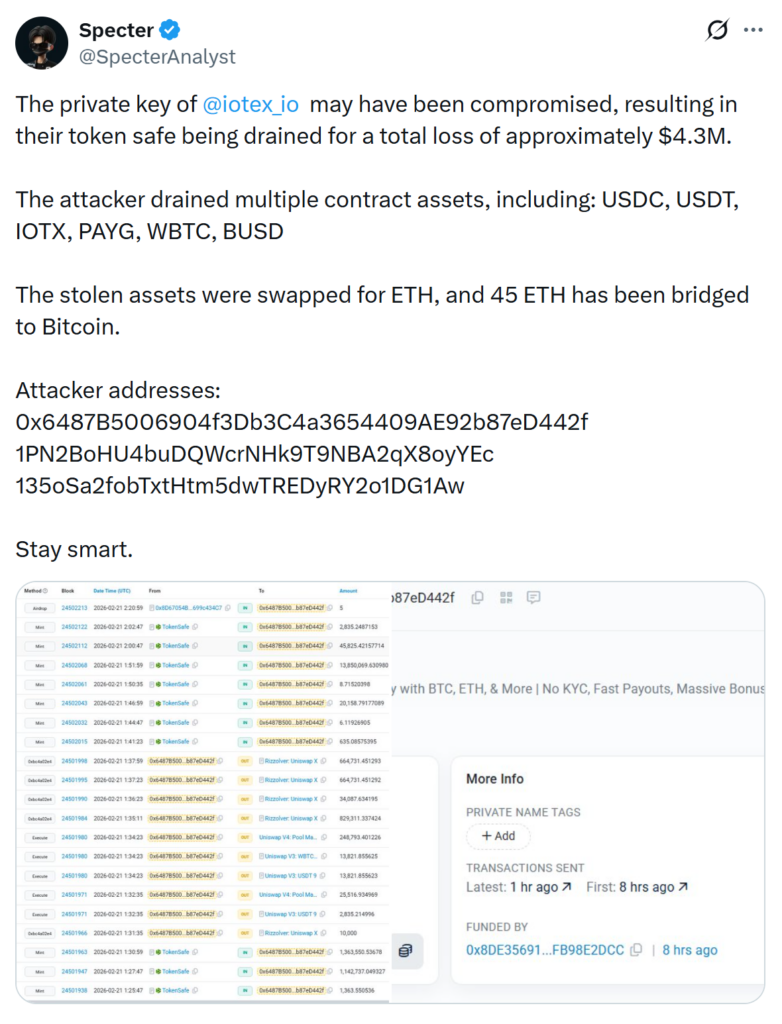

The investigation gained attention after onchain analyst Specter claimed that a private key tied to the affected token safe may have been compromised.

According to the analyst, the wallet was drained of multiple digital assets, including USDC, USDt, IoTeX’s native token IOTX, and wrapped Bitcoin. The estimated losses were placed at around $4.3 million.

Blockchain data shared by the analyst indicated that the stolen assets were quickly swapped into Ether. Approximately 45 Ether was later bridged to Bitcoin, a move that typically makes tracking and recovery more complicated. The transaction trail showed rapid activity across decentralized exchanges and token swaps, suggesting a deliberate attempt to convert and move funds across networks before any freeze could be enforced.

The analyst also published wallet addresses believed to be associated with the suspected attacker, along with transaction records highlighting swift and coordinated fund movements.

Token Price Slides After Incident

Following the reports, IOTX experienced a sharp price decline. Data from CoinMarketCap showed that the token fell more than 8 percent over a 24 hour period, trading at around $0.0049 at the time of reporting.

While price volatility is common in the crypto market, security incidents often amplify market reactions. Investors tend to respond quickly to any signs of risk, particularly when private key compromises are involved, as such breaches can raise concerns about operational controls and internal safeguards.

IoTeX, however, emphasized that the scale of the loss appears to be smaller than widely shared figures and that the core network and infrastructure remain unaffected.

Exchanges and Security Partners Brought In

To limit the impact, IoTeX said it has been working closely with major exchanges and blockchain security firms. In such cases, rapid coordination is critical. Exchanges can flag suspicious deposits and, in some instances, freeze assets before they are withdrawn or converted further.

Cross chain swaps and bridges, however, can make recovery difficult. Once funds are converted into widely used assets like Ether or bridged to Bitcoin, tracing them becomes more complex, especially if they pass through multiple wallets or mixing services.

The project did not specify whether any funds have been successfully frozen so far, but it reiterated that containment measures are in place and monitoring continues.

Crypto Projects Often Struggle After Major Hacks

The incident highlights a broader challenge within the digital asset industry. According to Web3 security leaders, nearly 80 percent of crypto projects hit by major hacks struggle to regain their footing.

Mitchell Amador, CEO of Immunefi, has previously said that many teams are unprepared for security breaches. Delayed responses and unclear communication during the first few hours of an incident often worsen the damage and erode user confidence.

Alex Katz, CEO of Kerberus, has noted that the financial hit is only part of the problem. Serious exploits frequently trigger large scale withdrawals by users, reduced liquidity, and long term reputational harm. Even after technical fixes are introduced, rebuilding trust can take months or even years.

For IoTeX, the coming days will likely be crucial. Transparent communication, swift containment, and visible cooperation with exchanges could help limit both financial and reputational damage.

As investigations continue, the project has assured its community that it will provide updates as more information becomes available.

Leave a Reply