Japanese investment giant GATES has announced a bold move to tokenise over $200 billion worth of income-generating properties using the Oasys blockchain, marking one of the largest tokenisation initiatives to date. The project will kick off with $75 million in central Tokyo properties and aims to break down traditional barriers in Japan’s real estate market by offering fractionalised digital assets to global investors.

This development not only signals GATES’ entry into the real-world asset (RWA) tokenisation sector but also repositions Oasys, a blockchain platform previously focused on gaming into the broader digital asset economy.

From Tokyo to the World: Scaling Tokenised Real Estate

According to Wednesday’s announcement, the long-term goal is to bring approximately 1% of Japan’s entire real estate market, roughly valued at $20 trillion onto the blockchain. The tokenised properties will initially be offered through Web3-compatible wallets, enabling fractional investment and cross-border access for international buyers.

Both GATES and Oasys have made it clear that Japan is just the beginning. Their joint strategy includes global expansion into real estate markets across the United States, Europe, and other Asian countries. This international push highlights the growing appeal of blockchain-powered real estate solutions amid rising investor interest in borderless, efficient, and transparent asset ownership.

Lowering Entry Barriers for Global Investors

Real estate in Japan has traditionally been difficult to access for foreign investors, often requiring high legal fees, local legal representation, and navigation through complex regulatory frameworks. GATES and Oasys are aiming to disrupt this model by offering tokenised ownership through a user-friendly Web3 interface that doesn’t require deep legal or language expertise.

“Through this initiative, we will add firm value to Japan’s highly reliable real-estate assets by means of tokens that combine profitability and utility,” said Yuji Sekino, CEO of GATES. “We’re building next-generation investment infrastructure that allows global investors easy access to Japanese assets.”

Tokenised real estate offers several benefits, including increased liquidity, simplified transaction processes, and reduced investment thresholds, making prime real estate accessible to a broader pool of retail and institutional investors.

Tokenisation Trend Accelerates Globally

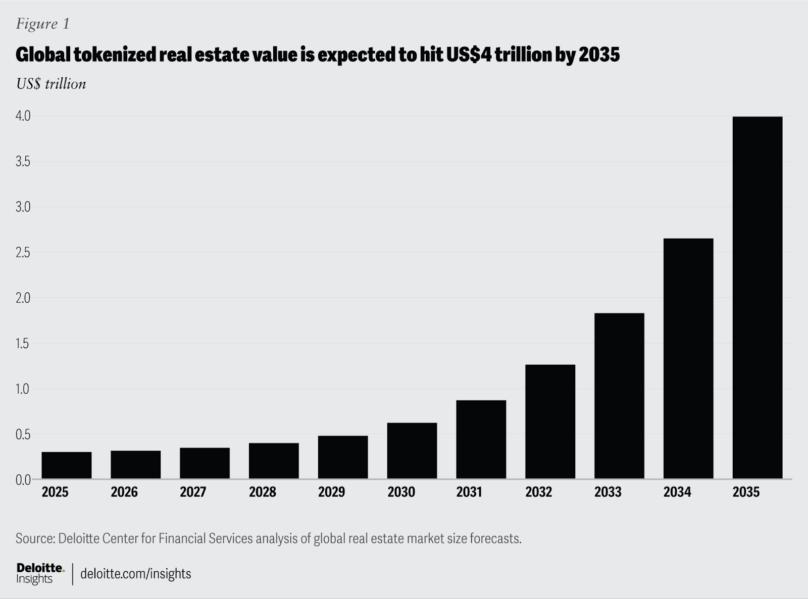

The GATES announcement is part of a broader trend that’s rapidly gaining momentum. According to an April 2025 report from Deloitte, the global tokenised real estate market is expected to balloon from $300 billion in 2024 to over $4 trillion by 2035, driven by improvements in blockchain infrastructure and regulatory clarity.

Dubai, a leader in tokenised property, reported $18 billion in such sales by May 2025, supported by regulatory innovations and strong public-private partnerships. Initiatives like the Dubai Land Department’s government-backed tokenisation platform, developed in collaboration with the Central Bank of the UAE and Dubai Future Foundation, are providing blueprints for other nations to follow.

In the same month, a $3 billion RWA agreement between MultiBank Group, real estate developer MAG, and blockchain firm Mavryk further highlighted the growing demand for tokenised investment solutions.

A New Era of Blockchain-Powered Property Investment

GATES’ $200 billion plan is not just a landmark moment for Japan’s real estate market, it’s a global signal that tokenised real estate is becoming a mainstream asset class. As blockchain adoption grows and investor appetite for fractionalised assets expands, traditional real estate markets may undergo a fundamental transformation.

With GATES and Oasys leading the charge in Asia, and regions like the UAE already reaping benefits, tokenisation is poised to redefine how real estate is bought, sold, and owned in the digital age.

Leave a Reply