In a surprising twist amid a broader crypto market downturn, Jelly-My-Jelly (JELLYJELLY) has soared to a fresh all-time high of $0.589, defying bearish sentiment across digital assets. The memecoin’s meteoric rise has sparked excitement among retail traders, but also raised suspicions of market manipulation.

Since April 5, JELLYJELLY has traded within an ascending parallel channel, gradually gaining momentum before breaking out dramatically earlier this week. Despite a subsequent 50% correction, the token remains well above previous resistance levels, suggesting continued volatility and speculative fervour.

Technical Charts Reveal a Volatile Structure

Technical indicators paint a mixed picture for JELLYJELLY. The daily chart shows that the coin’s breakout from its ascending channel triggered a rapid price acceleration, but analysts warn that the rally could be unsustainable.

The Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) remain in bullish territory, implying that upward momentum still exists. However, the RSI has begun to display a bearish divergence, signalling that buying pressure may be weakening.

The six-hour chart further supports this caution. After completing an A–B–C corrective structure, the memecoin’s latest surge extended to the 4.61 Fibonacci retracement level, a region often associated with the exhaustion of a bullish phase.

If a retracement follows, technical analysts expect the $0.15 zone (formerly the channel’s resistance line) to act as the next strong support level.

On-Chain Activity Raises Red Flags

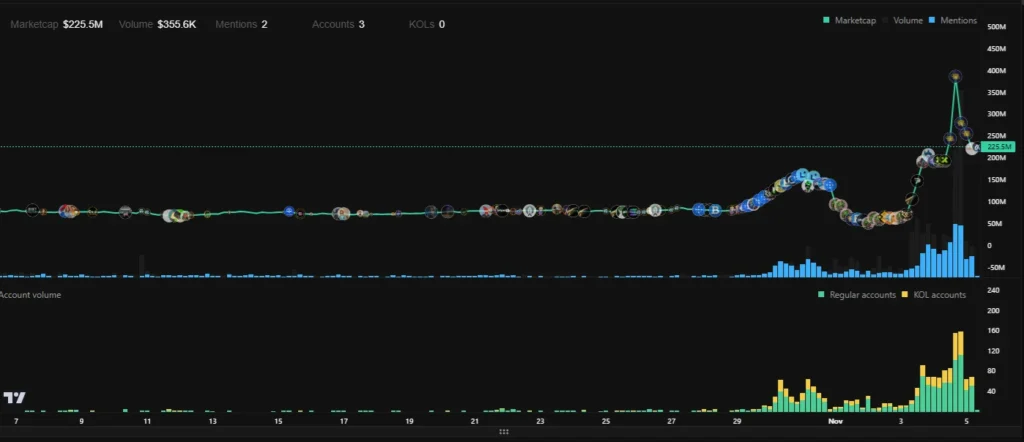

Behind the price action, on-chain data reveals unusual activity that’s fuelling suspicions of a coordinated price manipulation.

Three wallets currently control around 60% of JELLYJELLY’s total supply, with the largest holder owning a massive 44%. Such extreme supply concentration exposes the token to potential “whale-driven” volatility, where a few major holders can significantly move the market.

Adding to the intrigue, blockchain analytics show a series of large withdrawals from centralised exchanges (CEXs) over the past four days, right before the major pump. Analysts speculate this may have been a liquidity squeeze tactic, restricting available supply to drive prices upward.

Social Buzz and Retail Frenzy

As prices spiked, social media mentions of JELLYJELLY exploded, mirroring the coin’s sharp upward movement. Interestingly, most online activity originated from regular retail accounts rather than major influencers or “Key Opinion Leaders” (KOLs).

This could signal genuine community interest, but it also reflects how retail traders often chase high-risk memecoin trends during speculative manias.

However, not everyone is convinced. A well-known memecoin whale, famous for turning huge profits trading TRUMP, MELANIA, and PNUT tokens, reportedly exited a nine-month JELLYJELLY position, securing an estimated $1 million profit. The timing of the sale, immediately following the rally, has intensified doubts about the authenticity of the recent price surge.

Is JELLYJELLY Heading for a Correction?

The future of JELLYJELLY remains uncertain. While short-term momentum and retail enthusiasm are undeniable, the combination of bearish divergences, whale concentration, and potentially coordinated trading suggests a high-risk environment for new entrants.

For now, traders are closely watching the $0.15 support zone to see if the coin can stabilise above it. A breakdown below that could trigger further declines, while renewed social hype might push prices to retest previous highs.

Outlook: Thrill or Trap?

JELLYJELLY’s explosive rise highlights the ongoing fascination with memecoins, assets driven more by hype than fundamentals. Its surge against a backdrop of broader market weakness underscores both the irrational exuberance and high-stakes speculation characterising the sector.

In the coming days, the market will reveal whether JELLYJELLY’s rally marks the beginning of a new memecoin cycle or merely another fleeting pump-and-dump episode.

Either way, traders are reminded of one truth that never changes in crypto: the higher the hype, the harder the fall.

Leave a Reply